Dashboard

High Management Efficiency with a high ROCE of 31.42%

Strong ability to service debt as the company has a low Debt to EBITDA ratio of 1.20 times

Healthy long term growth as Net Sales has grown by an annual rate of 15.00% and Operating profit at 19.45%

The company has declared Positive results for the last 6 consecutive quarters

With ROCE of 31.5, it has a Very Attractive valuation with a 2.9 Enterprise value to Capital Employed

Company is among the highest 1% of companies rated by MarketsMojo across all 4,000 stocks

Stock DNA

Non - Ferrous Metals

INR 239,374 Cr (Large Cap)

17.00

23

3.83%

1.57

33.55%

5.86

Total Returns (Price + Dividend)

Latest dividend: 16 per share ex-dividend date: Aug-26-2025

Risk Adjusted Returns v/s

Returns Beta

News

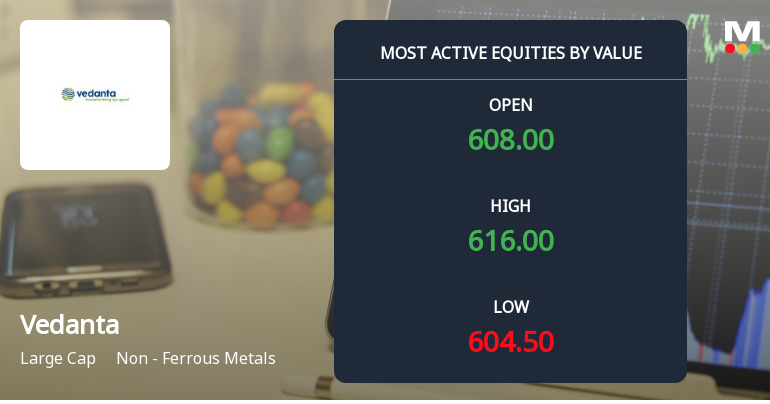

Vedanta Ltd. Sees Robust Trading Activity Amidst Sector Gains

Vedanta Ltd., a prominent player in the non-ferrous metals sector, has recorded significant trading volumes and value turnover, reflecting heightened market interest and active participation from institutional investors. The stock’s recent price movements and sector dynamics offer insights into its current market standing and liquidity profile.

Read More

Vedanta Sees Heavy Put Option Activity Amidst Strong Price Momentum

Vedanta Ltd., a major player in the Non-Ferrous Metals sector, has attracted significant attention in the options market with a surge in put option trading ahead of the 30 December 2025 expiry. Despite the stock's recent upward trajectory, the volume and open interest in put contracts suggest a complex positioning by investors, reflecting a blend of hedging strategies and cautious sentiment.

Read More

Vedanta Ltd Sees Robust Call Option Activity Amidst Steady Price Gains

Vedanta Ltd, a prominent player in the Non-Ferrous Metals sector, has attracted significant attention in the derivatives market with heavy call option trading ahead of the 30 December 2025 expiry. The stock’s recent price movements and option market activity suggest a notable bullish positioning among investors, reflecting confidence in the company’s near-term prospects.

Read More Announcements

Disclosure Under Regulation 30 Of Securities And Exchange Board Of India (Listing Obligations And Disclosure Requirements) Regulations 2015 (SEBI Listing Regulations) As Amended

27-Dec-2025 | Source : BSEPlease refer the enclosed intimation.

Disclosure Under Regulation 30 Of Securities And Exchange Board Of India (SEBI) (Listing Obligations And Disclosure Requirements) Regulations 2015 (Listing Regulations) As Amended - Declaration Of Successful Bidder For Depo Graphite - Vanadium Block Under

26-Dec-2025 | Source : BSEPlease refer the enclosed file.

Closure of Trading Window

26-Dec-2025 | Source : BSEPlease refer the enclosed file.

Corporate Actions

No Upcoming Board Meetings

Vedanta Ltd. has declared 1600% dividend, ex-date: 26 Aug 25

Vedanta Ltd. has announced 1:10 stock split, ex-date: 08 Aug 08

Vedanta Ltd. has announced 1:1 bonus issue, ex-date: 08 Aug 08

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Promoters

99.9935

Held by 40 Schemes (8.83%)

Held by 710 FIIs (11.08%)

Twin Star Holdings Ltd (40.02%)

Life Insurance Corporation Of India (5.7%)

11.84%

Quarterly Results Snapshot (Consolidated) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is 5.40% vs -6.50% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is -43.55% vs -8.56% in Jun 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 5.85% vs 0.99% in Sep 2024

Growth in half year ended Sep 2025 is -37.38% vs 828.59% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is 3.97% vs -1.06% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 300.87% vs -66.98% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 6.43% vs -2.43% in Mar 2024

YoY Growth in year ended Mar 2025 is 253.57% vs -59.91% in Mar 2024