Dashboard

With a Operating Losses, the company has a Weak Long Term Fundamental Strength

- Low ability to service debt as the company has a high Debt to EBITDA ratio of 12.63 times

- The company has been able to generate a Return on Equity (avg) of 2.99% signifying low profitability per unit of shareholders funds

With a fall in Net Sales of -90.69%, the company declared Very Negative results in Sep 25

Risky - Negative Operating Profits

Below par performance in long term as well as near term

Stock DNA

Telecom - Equipment & Accessories

INR 7,976 Cr (Small Cap)

NA (Loss Making)

33

0.55%

1.17

-12.26%

2.42

Total Returns (Price + Dividend)

Latest dividend: 2.5 per share ex-dividend date: Jun-19-2025

Risk Adjusted Returns v/s

Returns Beta

News

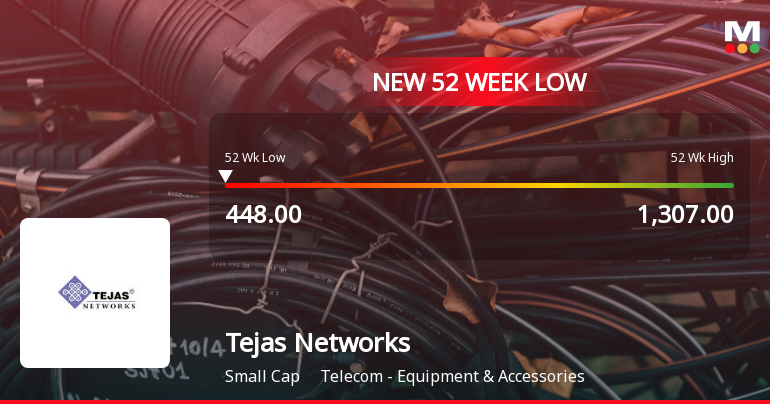

Tejas Networks Falls to 52-Week Low of Rs.442.2 Amidst Continued Downtrend

Tejas Networks has reached a new 52-week low of Rs.442.2 today, marking a significant decline in its stock price amid a sustained downward trend over the past week. The stock has underperformed its sector and broader market indices, reflecting ongoing pressures within the company’s financial and operational landscape.

Read More

Tejas Networks Stock Falls to 52-Week Low of Rs.448 Amidst Prolonged Downtrend

Tejas Networks has reached a new 52-week low of Rs.448, marking a significant decline amid a sustained downward trend over recent sessions. The stock has recorded a four-day consecutive fall, reflecting ongoing pressures within the telecom equipment sector.

Read More

Tejas Networks Falls to 52-Week Low of Rs.448 Amidst Prolonged Downtrend

Tejas Networks has reached a new 52-week low of Rs.448, marking a significant decline amid a sustained downward trend over recent sessions. The stock has recorded a four-day consecutive fall, reflecting ongoing pressures within the telecom equipment sector.

Read More Announcements

Closure of Trading Window

15-Dec-2025 | Source : BSEClosure of Trading Widow for Q3 FY 26

Announcement under Regulation 30 (LODR)-Press Release / Media Release

11-Dec-2025 | Source : BSEPress Release

Announcement under Regulation 30 (LODR)-Allotment

01-Dec-2025 | Source : BSEAllotment of shares pursuant to ESOP / RSU

Corporate Actions

No Upcoming Board Meetings

Tejas Networks Ltd has declared 25% dividend, ex-date: 19 Jun 25

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Promoters

None

Held by 15 Schemes (3.95%)

Held by 95 FIIs (6.24%)

Panatone Finvest Limited (53.66%)

Nippon Life India Trustee Ltd-a/c Nippon India Small Cap Fund (3.64%)

27.04%

Quarterly Results Snapshot (Consolidated) - Sep'25 - YoY

YoY Growth in quarter ended Sep 2025 is -90.69% vs 610.00% in Sep 2024

YoY Growth in quarter ended Sep 2025 is -211.61% vs 2,277.06% in Sep 2024

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is -89.40% vs 648.88% in Sep 2024

Growth in half year ended Sep 2025 is -242.06% vs 1,005.88% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is 513.29% vs 84.45% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 718.53% vs -409.42% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 261.13% vs 168.70% in Mar 2024

YoY Growth in year ended Mar 2025 is 609.00% vs 272.97% in Mar 2024