Stock DNA

E-Retail/ E-Commerce

INR 108,411 Cr (Mid Cap)

NA (Loss Making)

29

0.00%

-0.32

-42.59%

11.28

Total Returns (Price + Dividend)

Swiggy for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

Swiggy Ltd is Rated Strong Sell

Swiggy Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 04 Dec 2025. However, the analysis and financial metrics discussed here reflect the company’s current position as of 25 December 2025, providing investors with the latest insights into its performance and outlook.

Read More

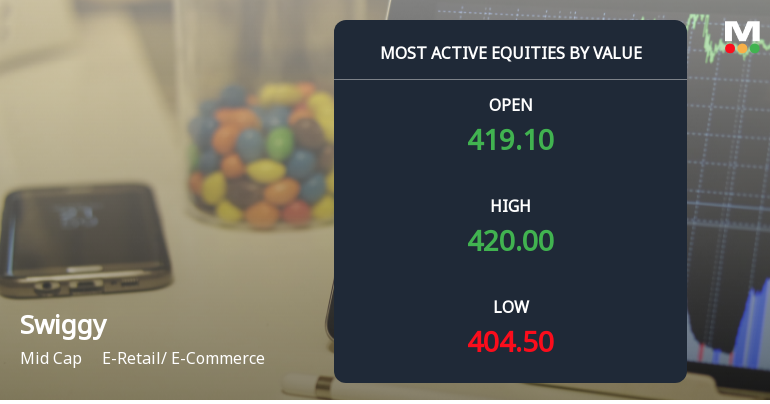

Swiggy Sees High Value Trading Amidst Mixed Market Signals

Swiggy Ltd, a prominent player in the E-Retail and E-Commerce sector, recorded one of the highest value turnovers on 19 Dec 2025, with significant trading volumes and active investor participation. Despite a slight dip in its share price, the stock remains a focal point for market watchers due to its liquidity and trading activity.

Read More

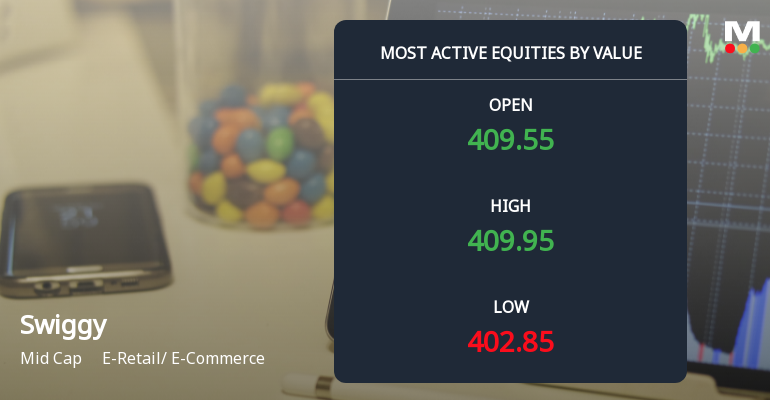

Swiggy Sees High Value Trading Amidst Market Volatility

Swiggy Ltd, a prominent player in the E-Retail and E-Commerce sector, has emerged as one of the most actively traded stocks by value on 16 Dec 2025, reflecting significant market interest despite recent price fluctuations. The stock’s trading activity, institutional participation, and price movements provide a nuanced picture of investor sentiment in a challenging market environment.

Read More Announcements

Announcement under Regulation 30 (LODR)-Allotment

13-Dec-2025 | Source : BSEOutcome of the Investment & Allotment Committee Meeting - Allotment of 266666663 Equity Shares pursuant to Qualified Institutional Placement

Announcement under Regulation 30 (LODR)-Press Release / Media Release

13-Dec-2025 | Source : BSESwiggy successfully completes INR 10000 Crore Qualified Institutions Placement

Announcement under Regulation 30 (LODR)-Qualified Institutional Placement

12-Dec-2025 | Source : BSEOutcome of the Investment & Allotment Committee Meeting - Qualified Institutional Placement: (a). Issue Closure; (b). Issue Price; and (c). Approval of Placement Document

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Non Institution

None

Held by 35 Schemes (18.85%)

Held by 540 FIIs (12.68%)

None

Mih India Food Holdings Bv (21.06%)

8.75%

Quarterly Results Snapshot (Consolidated) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is 12.09% vs 12.49% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is 8.77% vs -10.73% in Jun 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 54.19% vs 32.42% in Sep 2024

Growth in half year ended Sep 2025 is -85.04% vs -1.30% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'24

Not Applicable: The company has declared_date for only one period

Not Applicable: The company has declared_date for only one period

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 35.38% vs 36.09% in Mar 2024

YoY Growth in year ended Mar 2025 is -32.62% vs 43.76% in Mar 2024