Dashboard

With ROE of 40.4, it has a Very Expensive valuation with a 9.2 Price to Book Value

- The stock is trading at a discount compared to its peers' average historical valuations

- Over the past year, while the stock has generated a return of -19.36%, its profits have risen by 221.6% ; the PEG ratio of the company is 0.1

Underperformed the market in the last 1 year

Stock DNA

Heavy Electrical Equipment

INR 72,050 Cr (Mid Cap)

23.00

36

0.00%

-0.06

40.37%

9.01

Total Returns (Price + Dividend)

Latest dividend: 1 per share ex-dividend date: Jul-17-2008

Risk Adjusted Returns v/s

Returns Beta

News

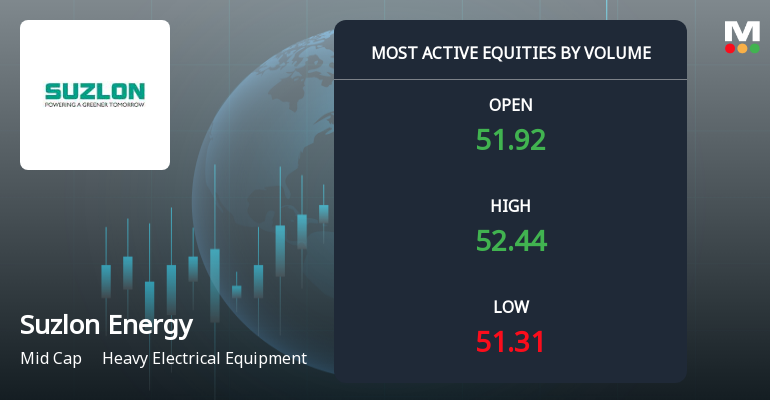

Suzlon Energy Sees Exceptional Trading Volume Amid Market Activity

Suzlon Energy Ltd has emerged as one of the most actively traded stocks in the Heavy Electrical Equipment sector, registering a significant surge in trading volume and value on 12 December 2025. This heightened activity reflects notable investor interest and market dynamics influencing the stock’s performance.

Read More

Suzlon Energy Sees High Volume Trading Amidst Sector-Aligned Price Movement

Suzlon Energy Ltd has emerged as one of the most actively traded stocks by volume on 11 Dec 2025, with over 83.6 lakh shares exchanging hands. Despite this heightened activity, the stock's price movement remains largely in line with its sector peers, reflecting a nuanced market response amid ongoing investor interest.

Read More

Suzlon Energy Sees Exceptional Trading Volume Amid Sector-Aligned Gains

Suzlon Energy Ltd emerged as one of the most actively traded stocks on 10 Dec 2025, registering a total traded volume exceeding 1.06 crore shares and a traded value surpassing ₹56 crores. The stock’s price movements aligned closely with its sector trends, reflecting a steady performance within the Heavy Electrical Equipment industry.

Read More Announcements

Proceedings And Voting Results Of The Meeting Of The Unsecured Creditors Of Suzlon Energy Limited Held On Friday 12Th December 2025

12-Dec-2025 | Source : BSEProceedings and Voting Results of the meeting of the Unsecured Creditors of Suzlon Energy Limited

Shareholder Meeting / Postal Ballot-Outcome of Court Convened Meeting

12-Dec-2025 | Source : BSEProceedings and Voting Results of the Meeting of the Equity Shareholders of Suzlon Energy Limited

Update Regarding Penalty

11-Dec-2025 | Source : BSEUpdate regarding Penalty

Corporate Actions

No Upcoming Board Meetings

Suzlon Energy Ltd has declared 50% dividend, ex-date: 17 Jul 08

Suzlon Energy Ltd has announced 2:10 stock split, ex-date: 21 Jan 08

No Bonus history available

Suzlon Energy Ltd has announced 5:21 rights issue, ex-date: 03 Oct 22

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Non Institution

None

Held by 32 Schemes (4.91%)

Held by 662 FIIs (22.7%)

Tanti Holdings Private Limited (4.64%)

Belgrave Investment Fund . (1.87%)

39.17%

Quarterly Results Snapshot (Consolidated) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is 23.60% vs -17.37% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is 294.50% vs -72.57% in Jun 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 69.76% vs 48.79% in Sep 2024

Growth in half year ended Sep 2025 is 219.16% vs 147.30% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is 63.86% vs 1.32% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 118.94% vs -84.19% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 66.79% vs 9.36% in Mar 2024

YoY Growth in year ended Mar 2025 is 213.72% vs -76.82% in Mar 2024