Dashboard

Strong lending practices with low Gross NPA ratio of 2.93%

Strong Long Term Fundamental Strength with a 70.72% CAGR growth in Net Profits

Healthy long term growth as Net profit has grown by an annual rate of 70.72%

With ROA of 1, it has a Fair valuation with a 1 Price to Book Value

High Institutional Holdings at 29.83%

Market Beating performance in long term as well as near term

Total Returns (Price + Dividend)

Latest dividend: 0.4 per share ex-dividend date: Aug-13-2025

Risk Adjusted Returns v/s

Returns Beta

News

South Indian Bank Sees Exceptional Trading Volume Amid Positive Momentum

South Indian Bank has emerged as one of the most actively traded stocks recently, registering a remarkable surge in trading volume and demonstrating sustained price momentum. The private sector bank's shares have attracted significant market attention, reflecting a combination of strong liquidity, positive price action, and notable accumulation signals.

Read More

South Indian Bank Sees Elevated Trading Volumes Amid Market Volatility

South Indian Bank has emerged as one of the most actively traded stocks by volume on 9 December 2025, reflecting heightened investor interest amid a broader market downturn. Despite a modest decline in price, the surge in traded shares and delivery volumes signals notable market activity and potential accumulation patterns within the private sector banking space.

Read More

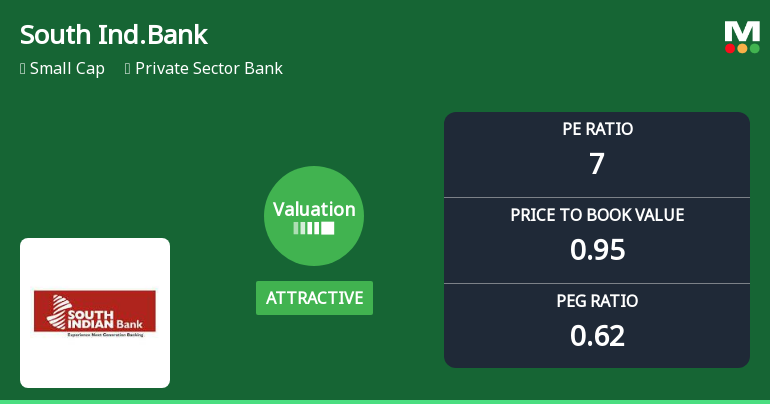

South Indian Bank Valuation Shifts Highlight Price Attractiveness Amid Market Dynamics

South Indian Bank’s recent valuation parameters indicate a notable shift in price attractiveness, reflecting changes in key financial metrics such as the price-to-earnings (P/E) and price-to-book value (P/BV) ratios. This development comes amid a broader market context where the bank’s returns have outpaced benchmark indices over multiple time horizons, prompting a fresh analytical perspective on its market positioning and investment appeal.

Read More Announcements

Announcement under Regulation 30 (LODR)-Allotment of ESOP / ESPS

25-Nov-2025 | Source : BSEIntimation under Regulation 30 of SEBI (LODR) Regulations 2015-Allotment of Equity Shares under SIB ESOS Scheme-2008

Announcement under Regulation 30 (LODR)-Newspaper Publication

19-Nov-2025 | Source : BSENewspaper Advertisement regarding opening of Special Window for Re-lodgement of transfer requests of physical shares

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

18-Nov-2025 | Source : BSEIntimation under Regulation 30 of SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015 - Participation in the Investor Conference - November 18 2025

Corporate Actions

No Upcoming Board Meetings

South Indian Bank Ltd has declared 40% dividend, ex-date: 13 Aug 25

South Indian Bank Ltd has announced 1:10 stock split, ex-date: 23 Sep 10

South Indian Bank Ltd has announced 1:4 bonus issue, ex-date: 16 Oct 08

South Indian Bank Ltd has announced 1:4 rights issue, ex-date: 27 Feb 24

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Non Institution

None

Held by 10 Schemes (10.01%)

Held by 166 FIIs (17.91%)

None

Bandhan Small Cap Fund (4.93%)

55.85%

Quarterly Results Snapshot (Standalone) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is 1.89% vs -0.46% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is 9.14% vs -5.91% in Jun 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is 2.15% vs 12.4% in Sep 2024

Growth in half year ended Sep 2025 is 8.81% vs 29.69% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'24

YoY Growth in nine months ended Dec 2024 is 11.07% vs 20.49% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 22.77% vs 77.36% in Dec 2023

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is 9.29% vs 19.07% in Mar 2024

YoY Growth in year ended Mar 2025 is 21.76% vs 38.06% in Mar 2024