Dashboard

Company has a low Debt to Equity ratio (avg) at 0.02 times

Poor long term growth as Operating profit has grown by an annual rate 10.53% of over the last 5 years

With ROE of 11, it has a Very Expensive valuation with a 5.2 Price to Book Value

High Institutional Holdings at 63.6%

Underperformed the market in the last 1 year

With its market cap of Rs 30,091 cr, it is the second biggest company in the sector (behind Bharat Forge)and constitutes 20.95% of the entire sector

Stock DNA

Auto Components & Equipments

INR 30,188 Cr (Mid Cap)

48.00

35

0.66%

-0.06

10.98%

5.27

Total Returns (Price + Dividend)

Latest dividend: 1.6 per share ex-dividend date: Jul-04-2025

Risk Adjusted Returns v/s

Returns Beta

News

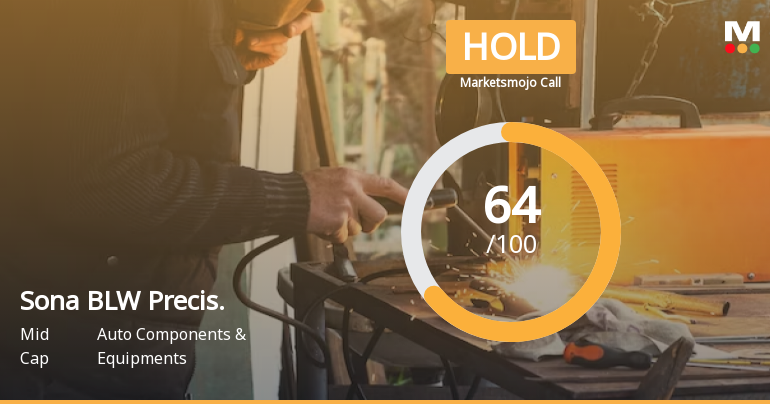

Sona BLW Precision Forgings Ltd is Rated Hold

Sona BLW Precision Forgings Ltd is rated 'Hold' by MarketsMOJO, with this rating last updated on 12 December 2025. While the rating change occurred on that date, the analysis and financial metrics presented here reflect the stock's current position as of 26 December 2025, providing investors with an up-to-date view of the company’s fundamentals, valuation, financial trends, and technical outlook.

Read More

Sona BLW Precision Forgings Sees Notable Surge in Derivatives Open Interest Amid Market Volatility

Sona BLW Precision Forgings Ltd has experienced a significant rise in open interest within its derivatives segment, signalling heightened market activity and evolving investor positioning. This development comes amid a backdrop of subdued price movement and declining delivery volumes, offering insights into potential directional bets and market sentiment within the auto components sector.

Read More

Sona BLW Precision Forgings Sees Notable Surge in Derivatives Open Interest Amid Market Volatility

Sona BLW Precision Forgings Ltd, a key player in the Auto Components & Equipments sector, has witnessed a significant rise in open interest within its derivatives segment, signalling heightened market activity and evolving investor positioning. This development comes amid a backdrop of subdued price performance and shifting volume dynamics, prompting a closer examination of the underlying market sentiment and potential directional bets.

Read More Announcements

Shareholder Meeting / Postal Ballot-Scrutinizers Report

20-Dec-2025 | Source : BSEScrutinizer Report

Closure of Trading Window

15-Dec-2025 | Source : BSEClosure of Trading window for Q3 financial results.

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

10-Dec-2025 | Source : BSEIntimation of Investor Meeting

Corporate Actions

No Upcoming Board Meetings

Sona BLW Precision Forgings Ltd has declared 16% dividend, ex-date: 04 Jul 25

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Mutual Funds

None

Held by 32 Schemes (33.02%)

Held by 248 FIIs (23.46%)

Aureus Investment Private Limited (28.02%)

Sbi Esg Exclusionary Strategy Fund (8.24%)

7.12%

Quarterly Results Snapshot (Consolidated) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is 33.30% vs -1.25% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is 38.54% vs -24.01% in Jun 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 9.86% vs 19.39% in Sep 2024

Growth in half year ended Sep 2025 is 4.05% vs 21.21% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is 16.54% vs 20.30% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 18.58% vs 33.79% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 11.34% vs 19.95% in Mar 2024

YoY Growth in year ended Mar 2025 is 16.23% vs 30.86% in Mar 2024