Dashboard

Healthy long term growth as Net Sales has grown by an annual rate of 33.17% and Operating profit at 31.33%

Flat results in Sep 25

With ROCE of 31.4, it has a Expensive valuation with a 8.5 Enterprise value to Capital Employed

Rising Promoter Confidence

Market Beating performance in long term as well as near term

Stock DNA

Automobiles

INR 5,301 Cr (Small Cap)

38.00

32

0.48%

0.48

31.88%

12.11

Total Returns (Price + Dividend)

Latest dividend: 18 per share ex-dividend date: Jul-09-2025

Risk Adjusted Returns v/s

Returns Beta

News

SML Mahindra’s Evaluation Metrics Revised Amid Strong Market Performance

SML Mahindra has experienced a revision in its evaluation metrics, reflecting a shift in market assessment driven by its recent financial and technical developments. The company’s performance across key parameters such as quality, valuation, financial trends, and technical indicators has influenced this change, positioning it differently within the competitive landscape of the automobile sector.

Read More

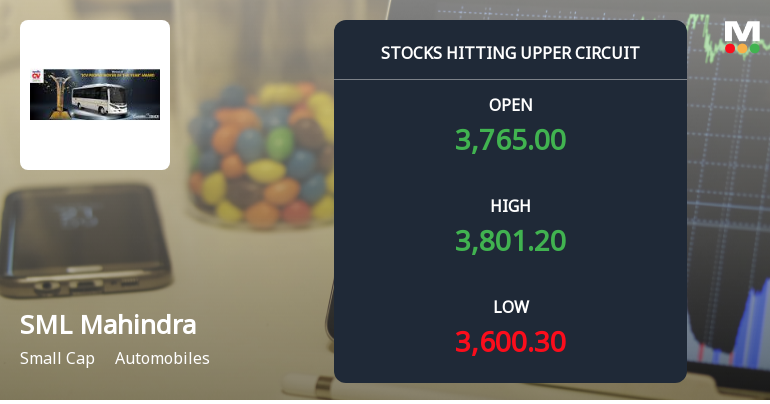

SML Mahindra Hits Upper Circuit Amid Strong Buying Pressure

SML Mahindra Ltd, a notable player in the Indian automobile sector, witnessed its stock price hit the upper circuit limit on 19 Dec 2025, reflecting robust buying interest and a maximum daily gain of 4.98%. This surge underscores heightened investor enthusiasm despite a backdrop of falling delivery volumes and regulatory trading freezes.

Read More

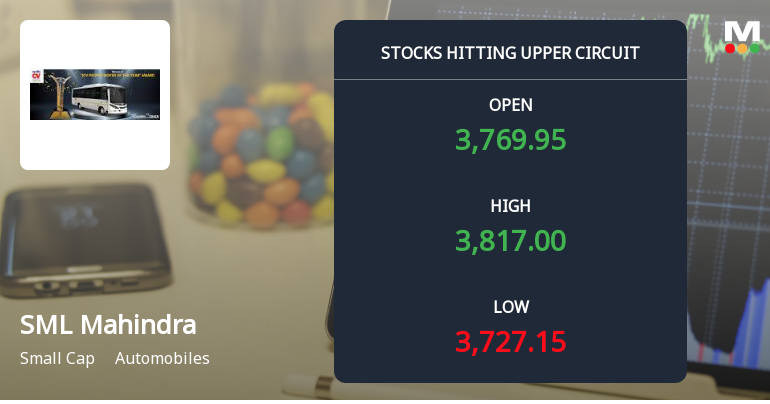

SML Mahindra Hits Upper Circuit Amid Strong Buying Pressure and Market Optimism

SML Mahindra Ltd, a key player in the automobile sector, witnessed robust buying interest on 10 Dec 2025, hitting its upper circuit limit with a maximum daily gain of 3.87%. The stock’s performance outpaced its sector and broader market indices, reflecting heightened investor enthusiasm despite a decline in delivery volumes.

Read More Announcements

Disclosures under Reg. 29(2) of SEBI (SAST) Regulations 2011

22-Dec-2025 | Source : BSEThe Exchange has received the disclosure under Regulation 29(2) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for Navodya Enterprises

Disclosure Under Regulation 30(2) Of The SEBI LODR Regulations 2015

17-Dec-2025 | Source : BSEDisclosure under Regulation 30(2) of the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations 2015 read with Clause 20 of Para A of Part A of Schedule III

Disclosure Under Regulation 30(2) Of The SEBI LODR Regulations 2015

10-Dec-2025 | Source : BSEDisclosure under Regulation 30(2) of the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations 2015 read with Clause 20 of Para A of Part A of Schedule III

Corporate Actions

No Upcoming Board Meetings

SML Mahindra Ltd has declared 180% dividend, ex-date: 09 Jul 25

No Splits history available

No Bonus history available

SML Mahindra Ltd has announced 19:50 rights issue, ex-date: 09 Feb 10

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Promoters

None

Held by 2 Schemes (0.18%)

Held by 41 FIIs (1.8%)

Mahindra & Mahindra Limited (58.97%)

Sachin Bansal (partner Of Navodaya Enterprises) (7.51%)

33.21%

Quarterly Results Snapshot (Standalone) - Sep'25 - YoY

YoY Growth in quarter ended Sep 2025 is 0.98% vs 10.25% in Sep 2024

YoY Growth in quarter ended Sep 2025 is -3.44% vs 3.37% in Sep 2024

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is 8.12% vs 14.65% in Sep 2024

Growth in half year ended Sep 2025 is 29.07% vs 28.95% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'24

YoY Growth in nine months ended Dec 2024 is 7.34% vs 22.45% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 23.69% vs 898.28% in Dec 2023

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is 9.25% vs 20.55% in Mar 2024

YoY Growth in year ended Mar 2025 is 12.78% vs 444.02% in Mar 2024