Dashboard

Weak Long Term Fundamental Strength with a -6.89% CAGR growth in Operating Profits over the last 5 years

- Company's ability to service its debt is weak with a poor EBIT to Interest (avg) ratio of -0.01

- The company has been able to generate a Return on Equity (avg) of 3.34% signifying low profitability per unit of shareholders funds

Risky - Negative EBITDA

Below par performance in long term as well as near term

Total Returns (Price + Dividend)

Sarda Proteins for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

Sarda Proteins Ltd is Rated Strong Sell

Sarda Proteins Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 12 Nov 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 29 December 2025, providing investors with an up-to-date view of the company's fundamentals, valuation, financial trend, and technical outlook.

Read More

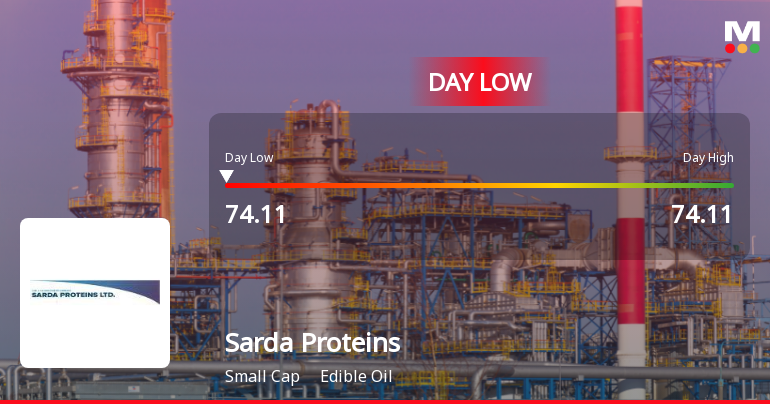

Sarda Proteins Hits Intraday Low Amid Price Pressure and Market Headwinds

Sarda Proteins experienced a significant intraday decline, touching a low of Rs 74.11, reflecting a price pressure of 9.74% during today’s trading session. The stock’s performance contrasted sharply with broader market trends, highlighting immediate pressures within the edible oil sector.

Read More

Sarda Proteins Opens with Sharp Gap Down Amid Market Concerns

Sarda Proteins witnessed a significant gap down at the opening of trading today, with the stock price declining by 9.74% to open at Rs 74.11. This sharp drop reflects heightened market concerns within the edible oil sector, as the stock underperformed both its sector peers and the broader Sensex index.

Read More Announcements

Closure of Trading Window

27-Dec-2025 | Source : BSEIntimation of Trading Window Closure

Board Meeting Outcome for Outcome Of Board Meeting Held On Monday 08-12-2025

08-Dec-2025 | Source : BSEOutcome of Board Meeting held on 08-12-2025

Announcement under Regulation 30 (LODR)-Change in Management

08-Dec-2025 | Source : BSEIntimation of appointment of additional directors of the Company

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2024

Shareholding Compare (%holding)

Non Institution

None

Held by 0 Schemes

Held by 0 FIIs

Ritika Vegetable Oil Private Limited (0.0%)

Uday R Shah (huf) (4.26%)

89.2%

Quarterly Results Snapshot (Standalone) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is -60.73% vs 0.00% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is 181.63% vs -345.45% in Jun 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is 10,800.00% vs -41.67% in Sep 2024

Growth in half year ended Sep 2025 is -400.00% vs 400.00% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Mar'25

YoY Growth in nine months ended Mar 2025 is -88.71% vs -75.49% in Dec 2023

YoY Growth in nine months ended Mar 2025 is 0.00% vs 0.00% in Dec 2023

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is 1,760.77% vs -77.59% in Mar 2024

YoY Growth in year ended Mar 2025 is -50.00% vs 166.67% in Mar 2024