Dashboard

Healthy long term growth as Operating profit has grown by an annual rate 43.26%

- ROCE(HY) Highest at 13.29%

- DPS(Y) Highest at Rs 3.50

- NET SALES(Q) Highest at Rs 1,270.37 cr

With ROCE of 10.1, it has a Attractive valuation with a 2 Enterprise value to Capital Employed

Majority shareholders : Promoters

Market Beating performance in long term as well as near term

Stock DNA

Auto Components & Equipments

INR 3,279 Cr (Small Cap)

19.00

39

0.64%

0.75

14.00%

2.69

Total Returns (Price + Dividend)

Latest dividend: 3.5 per share ex-dividend date: Sep-12-2025

Risk Adjusted Returns v/s

Returns Beta

News

Sandhar Technologies Limited: Technical Momentum Shift Signals Mixed Market Sentiment

Sandhar Technologies Limited, a key player in the Auto Components & Equipments sector, has experienced a notable shift in its technical momentum, reflecting a nuanced market assessment. Recent evaluation adjustments highlight a blend of bullish and bearish signals across multiple technical indicators, suggesting a complex trading environment for investors.

Read More

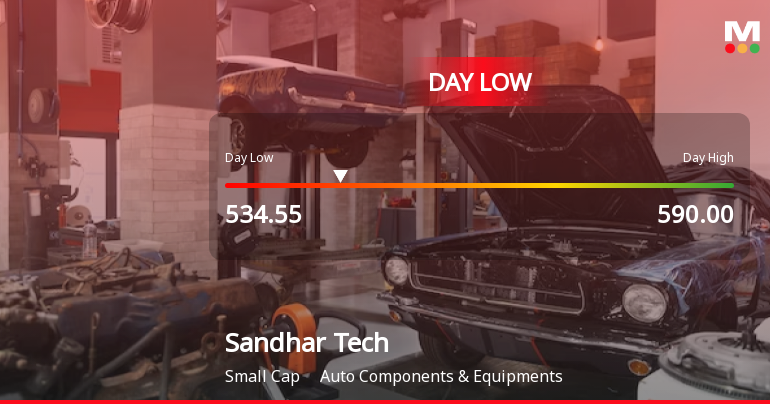

Sandhar Technologies Limited Hits Intraday Low Amid Price Pressure

Sandhar Technologies Limited experienced a notable decline today, touching an intraday low of Rs 534.55, reflecting a price pressure of 8.02% during the session. This movement contrasts with the broader market's modest gains, highlighting immediate pressures on the stock within the auto components sector.

Read More

Sandhar Technologies Limited Shows Bullish Momentum Amid Technical Shifts

Sandhar Technologies Limited, a key player in the Auto Components & Equipments sector, has exhibited a notable shift in its technical momentum, reflecting a more bullish stance across multiple timeframes. Recent market data and technical indicators suggest evolving investor sentiment and price dynamics that warrant close attention.

Read More Announcements

Closure of Trading Window

24-Dec-2025 | Source : BSETrading Window closure for the quarter ended on December 31 2025

Announcement under Regulation 30 (LODR)-Earnings Call Transcript

20-Nov-2025 | Source : BSEEarning Call Transcript of Call held on 17th November 2025

Newspaper Publication For The Shares To Be Transferred To IEPF Authority

19-Nov-2025 | Source : BSENewspaper publication for the shares to be transferred to IEPF Authority

Corporate Actions

No Upcoming Board Meetings

Sandhar Technologies Limited has declared 35% dividend, ex-date: 12 Sep 25

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Promoters

None

Held by 8 Schemes (15.85%)

Held by 38 FIIs (0.66%)

Jayant Davar (50.56%)

Dsp Small Cap Fund (4.32%)

11.23%

Quarterly Results Snapshot (Consolidated) - Sep'25 - YoY

YoY Growth in quarter ended Sep 2025 is 29.08% vs 11.22% in Sep 2024

YoY Growth in quarter ended Sep 2025 is 83.36% vs 46.59% in Sep 2024

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 24.45% vs 10.68% in Sep 2024

Growth in half year ended Sep 2025 is 46.77% vs 41.88% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is 10.26% vs 21.42% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 33.97% vs 51.94% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 10.32% vs 21.05% in Mar 2024

YoY Growth in year ended Mar 2025 is 29.02% vs 50.45% in Mar 2024