Dashboard

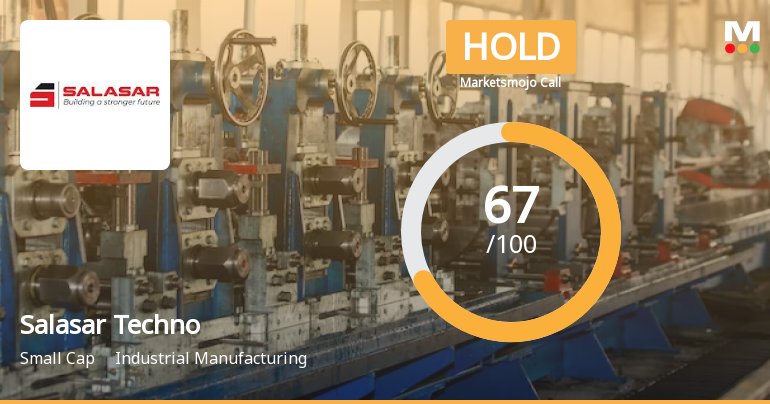

Healthy long term growth as Net Sales has grown by an annual rate of 30.42%

The company has declared positive results in Sep'2025 after 2 consecutive negative quarters

With ROCE of 9.9, it has a Very Attractive valuation with a 1.7 Enterprise value to Capital Employed

Reducing Promoter Confidence

Below par performance in long term as well as near term

Stock DNA

Industrial Manufacturing

INR 1,627 Cr (Small Cap)

43.00

33

0.00%

0.38

4.63%

2.02

Total Returns (Price + Dividend)

Latest dividend: 0.1 per share ex-dividend date: Sep-15-2023

Risk Adjusted Returns v/s

Returns Beta

News

Salasar Techno Engineering Shows Mixed Technical Signals Amid Price Momentum Shift

Salasar Techno Engineering, a player in the industrial manufacturing sector, has exhibited a notable shift in price momentum and technical indicators, reflecting a complex market assessment. Recent trading data and technical signals reveal a nuanced picture of the stock’s near-term trajectory amid broader market conditions.

Read More

Salasar Techno Engineering Sees Shift in Technical Momentum Amid Mixed Market Signals

Salasar Techno Engineering, a key player in the industrial manufacturing sector, has experienced a notable shift in its technical momentum, reflecting a complex interplay of market forces and technical indicators. Recent data reveals a transition from a mildly bullish trend to a sideways movement, underscoring a period of consolidation for the stock amid broader market fluctuations.

Read More

Salasar Techno Sees Revision in Market Evaluation Amid Mixed Financial Signals

Salasar Techno, a small-cap player in the Industrial Manufacturing sector, has experienced a notable revision in its market evaluation metrics, reflecting a shift in analytical perspective driven by recent financial and technical developments. This adjustment comes amid a backdrop of mixed performance indicators and evolving market sentiment.

Read More Announcements

Award Of Contract Valued At INR 695.18 Crores By Rail Vikas Nigam Limited (RVNL)

26-Nov-2025 | Source : BSEPlease find enclosed intimation under regulation 30 of SEBI (LODR) Reg 2015 for award of a contract at INR 695.18 Crores by Rail Vikas Nigam Limited (RVNL)

Announcement under Regulation 30 (LODR)-Newspaper Publication

15-Nov-2025 | Source : BSEPlease find enclosed herewith copy of newspaper publication of financial results for the quarter & six months ended 30.09.2025.

Board Meeting Outcome for Consideration And Approval Of Unaudited Financial Results (Standalone & Consolidated) For Quarter And Six Months Ended 30.09.2025

14-Nov-2025 | Source : BSEPlease find enclosed outcome of the Board meeting Held On November 14 2025 for Consideration & Approval Of unaudited Financial Results (Standalone & Consolidated) For The Quarter and six months Ended 30th September 2025.

Corporate Actions

No Upcoming Board Meetings

Salasar Techno Engineering Ltd has declared 10% dividend, ex-date: 15 Sep 23

Salasar Techno Engineering Ltd has announced 1:10 stock split, ex-date: 27 Jun 22

Salasar Techno Engineering Ltd has announced 4:1 bonus issue, ex-date: 01 Feb 24

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Non Institution

4.8223

Held by 1 Schemes (0.0%)

Held by 27 FIIs (3.55%)

Hill View Infrabuild Limited (16.65%)

Eminence Global Fund Pcc- Eubilia Capital Partners Fund I (1.6%)

42.33%

Quarterly Results Snapshot (Consolidated) - Sep'25 - YoY

YoY Growth in quarter ended Sep 2025 is 51.75% vs 2.23% in Sep 2024

YoY Growth in quarter ended Sep 2025 is 64.38% vs 5.96% in Sep 2024

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 26.39% vs 7.13% in Sep 2024

Growth in half year ended Sep 2025 is 20.91% vs 4.64% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is 13.03% vs 18.43% in Dec 2023

YoY Growth in nine months ended Dec 2024 is -10.60% vs 41.02% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 19.78% vs 20.25% in Mar 2024

YoY Growth in year ended Mar 2025 is -63.91% vs 31.76% in Mar 2024