Dashboard

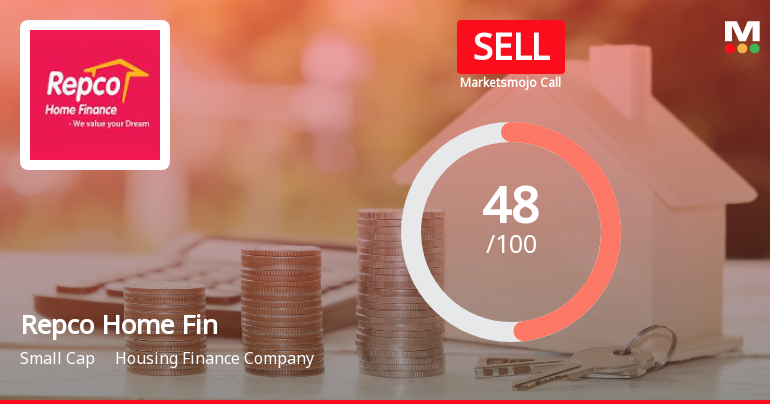

Strong Long Term Fundamental Strength with an average Return on Equity (ROE) of 12.16%

Poor long term growth as Net Sales has grown by an annual rate of 4.92% and Operating profit at 5.62%

Flat results in Sep 25

With ROE of 12.7, it has a Attractive valuation with a 0.7 Price to Book Value

High Institutional Holdings at 34.61%

Stock DNA

Housing Finance Company

INR 2,507 Cr (Small Cap)

6.00

13

1.59%

3.18

12.70%

0.71

Total Returns (Price + Dividend)

Latest dividend: 2.5 per share ex-dividend date: Aug-25-2025

Risk Adjusted Returns v/s

Returns Beta

News

Repco Home Finance Technical Momentum Shifts Amid Mixed Market Signals

Repco Home Finance has experienced a notable shift in its technical momentum, moving from a sideways trend to a mildly bullish stance on shorter timeframes, while longer-term indicators present a more nuanced picture. This article analyses the recent technical signals, price movements, and comparative returns to provide a comprehensive overview of the stock’s current market position.

Read More

Repco Home Finance Technical Momentum Shifts Amid Mixed Market Signals

Repco Home Finance has experienced a notable shift in its technical momentum, reflecting a complex interplay of market forces and indicator signals. Recent evaluation adjustments reveal a transition from a mildly bullish trend to a sideways movement, underscoring a period of consolidation for the housing finance company amid broader sector dynamics.

Read More

Repco Home Finance: Analytical Review Highlights Shift in Market Assessment

Repco Home Finance has experienced a notable revision in its market evaluation, reflecting changes across key parameters including quality, valuation, financial trends, and technical indicators. This comprehensive review offers investors a detailed understanding of the factors influencing the company’s current standing within the housing finance sector.

Read More Announcements

Announcement under Regulation 30 (LODR)-Change in Management

19-Dec-2025 | Source : BSEAppointment of Mr. Paiyur Kuppuraman Vaidyanathan as Additional Director in the capacity of Wholetime Director

Announcement under Regulation 30 (LODR)-Newspaper Publication

15-Dec-2025 | Source : BSENewspaper publication and social media communication regarding special window for re-lodgement of transfer request of physical shares

Intimation Of Provisional Ratings Assigned To Securitisation Notes (Sns)

12-Dec-2025 | Source : BSEIntimation of provisional ratings assigned to Securitisation notes by M/s. ICRA Limited

Corporate Actions

No Upcoming Board Meetings

Repco Home Finance Ltd has declared 25% dividend, ex-date: 25 Aug 25

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Promoters

None

Held by 7 Schemes (21.36%)

Held by 82 FIIs (11.91%)

Repatriates Co Operative Finance & Development Bank Ltd (37.13%)

Hdfc Small Cap Fund (6.98%)

22.42%

Quarterly Results Snapshot (Consolidated) - Sep'25 - YoY

YoY Growth in quarter ended Sep 2025 is 4.39% vs 11.20% in Sep 2024

YoY Growth in quarter ended Sep 2025 is -4.75% vs 15.14% in Sep 2024

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 5.14% vs 12.59% in Sep 2024

Growth in half year ended Sep 2025 is -1.26% vs 16.50% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is 12.58% vs 19.98% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 13.83% vs 32.24% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 12.68% vs 18.76% in Mar 2024

YoY Growth in year ended Mar 2025 is 11.70% vs 30.63% in Mar 2024