Dashboard

With a Negative Book Value, the company has a Weak Long Term Fundamental Strength

- Poor long term growth as Net Sales has grown by an annual rate of -17.98% and Operating profit at 0% over the last 5 years

- High Debt Company with a Debt to Equity ratio (avg) at 0 times

Negative results in Sep 25

Risky - Negative EBITDA

Consistent Underperformance against the benchmark over the last 3 years

Stock DNA

Telecom - Services

INR 310 Cr (Micro Cap)

NA (Loss Making)

39

0.00%

-0.48

0.22%

0.00

Total Returns (Price + Dividend)

Latest dividend: 0.25 per share ex-dividend date: Aug-14-2013

Risk Adjusted Returns v/s

Returns Beta

News

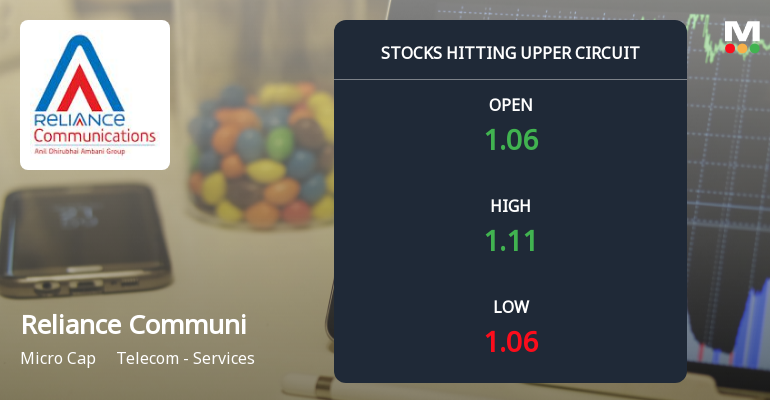

Reliance Communications Hits Upper Circuit Amid Strong Buying Pressure

Reliance Communications Ltd witnessed a significant surge in trading activity on 26 Dec 2025, hitting its upper circuit limit with a daily gain of 4.72%. The telecom services stock outperformed its sector and benchmark indices, reflecting robust buying interest and a notable shift in investor sentiment.

Read More

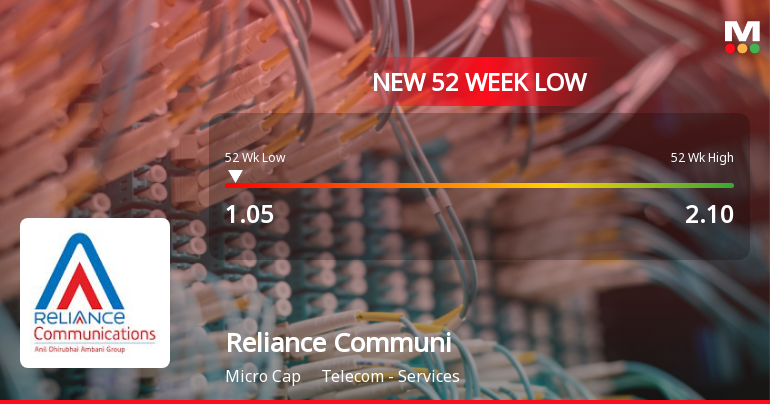

Reliance Communications Falls to 52-Week Low of Rs.1.05 Amid Continued Downtrend

Reliance Communications has reached a new 52-week low of Rs.1.05 today, marking a significant milestone in its ongoing price decline. The stock has experienced a three-day consecutive fall, accumulating a loss of 7.76% over this period, underperforming its sector and broader market indices.

Read More

Reliance Communi Sees Revision in Market Assessment Amidst Challenging Financials

Reliance Communi has experienced a revision in its market assessment reflecting a more cautious outlook based on recent financial and technical indicators. The telecom services micro-cap continues to face significant headwinds, with evaluation metrics signalling increased risk and subdued performance trends.

Read More Announcements

Frauds-Initial Disclosure

23-Dec-2025 | Source : BSELetter received from Central Bank of India in respect of Reliance Telecom Limited a subsidiary of Reliance Communications Limited

Corporate Insolvency Resolution Process (CIRP)-Updates - Corporate Insolvency Resolution Process (CIRP)

16-Dec-2025 | Source : BSENotice of re-schedule of Committee of Creditors (CoC) meeting on Friday December 19 2025 from Tuesday December 16 2025.

Corporate Insolvency Resolution Process (CIRP)-Intimation of meeting of Committee of Creditors

14-Dec-2025 | Source : BSEIntimation regarding the 68th CoC (Committee of Creditors) to be held on December 16 2025.

Corporate Actions

No Upcoming Board Meetings

Reliance Communications Ltd has declared 5% dividend, ex-date: 14 Aug 13

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Non Institution

None

Held by 27 Schemes (0.01%)

Held by 71 FIIs (0.07%)

Rwtipl Industries Private Limited (0.31%)

Lici Gratuity Plus Non Unit Fund (4.13%)

85.22%

Quarterly Results Snapshot (Consolidated) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is 4.82% vs -4.60% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is -5.51% vs -2.32% in Jun 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is -8.11% vs -6.09% in Sep 2024

Growth in half year ended Sep 2025 is -16.78% vs -48.96% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is -6.53% vs -20.92% in Dec 2023

YoY Growth in nine months ended Dec 2024 is -35.40% vs 59.70% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is -6.53% vs -20.04% in Mar 2024

YoY Growth in year ended Mar 2025 is -30.19% vs 50.26% in Mar 2024