Dashboard

With ROE of 16.5, it has a Expensive valuation with a 3.4 Price to Book Value

- The stock is trading at a discount compared to its peers' average historical valuations

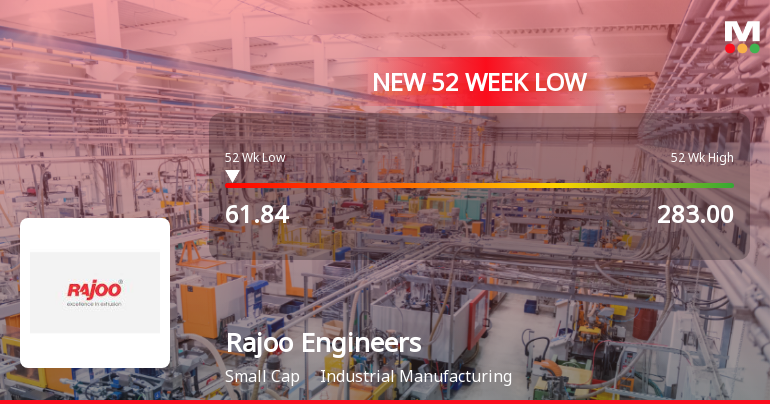

- Over the past year, while the stock has generated a return of -75.86%, its profits have risen by 102.9% ; the PEG ratio of the company is 0.5

Falling Participation by Institutional Investors

Underperformed the market in the last 1 year

Stock DNA

Industrial Manufacturing

INR 1,130 Cr (Small Cap)

21.00

37

0.24%

-0.35

16.47%

3.48

Total Returns (Price + Dividend)

Latest dividend: 0.15 per share ex-dividend date: Sep-19-2025

Risk Adjusted Returns v/s

Returns Beta

News

Rajoo Engineers Sees Revision in Market Evaluation Amid Mixed Financial Signals

Rajoo Engineers has experienced a revision in its market evaluation, reflecting a shift in analytical perspective driven by a combination of financial trends, valuation considerations, and technical indicators. Despite a notably positive financial trajectory, other factors have influenced the overall assessment of this small-cap player in the industrial manufacturing sector.

Read More

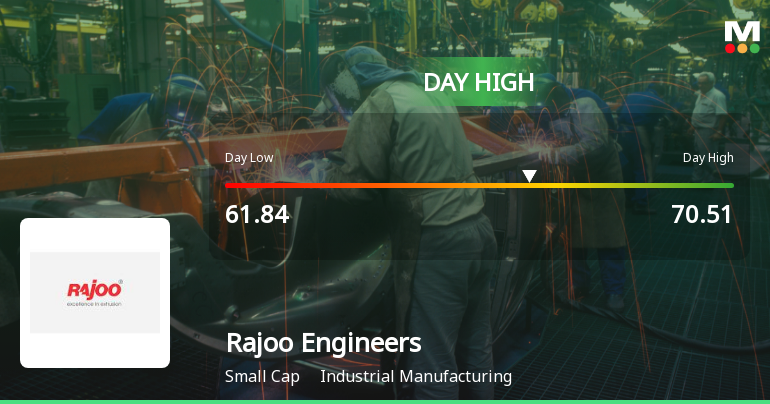

Rajoo Engineers Hits Intraday High with Strong Trading Momentum

Rajoo Engineers demonstrated robust intraday performance today, surging to an intraday high of Rs 70.51, marking an 11.06% rise from the previous close. The stock outpaced its sector and broader market indices amid heightened volatility and active trading.

Read More

Rajoo Engineers Stock Falls to 52-Week Low of Rs.61.84 Amid Market Pressure

Rajoo Engineers has reached a new 52-week low of Rs.61.84, marking a significant decline in its share price amid broader market fluctuations and sectoral underperformance. The stock has been trading below all key moving averages, reflecting sustained downward momentum over recent sessions.

Read More Announcements

Announcement under Regulation 30 (LODR)-Change in Management

20-Dec-2025 | Source : BSEAppointment of Ms. Lakshmi Ramakrishnan as Independent Director

Shareholder Meeting / Postal Ballot-Scrutinizers Report

20-Dec-2025 | Source : BSESubmission of Voting Results and Scrutinizers Report dated December 19 2025

Announcement under Regulation 30 (LODR)-Press Release / Media Release

28-Nov-2025 | Source : BSEPress Release - Rajoo Engineers Ltd. introduces flexible working practices to boost workplace wellbeing and uninterrupted 24x7 customer support

Corporate Actions

No Upcoming Board Meetings

Rajoo Engineers Ltd has declared 15% dividend, ex-date: 19 Sep 25

Rajoo Engineers Ltd has announced 1:10 stock split, ex-date: 17 Sep 09

Rajoo Engineers Ltd has announced 1:3 bonus issue, ex-date: 02 Dec 24

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Promoters

None

Held by 1 Schemes (0.0%)

Held by 13 FIIs (2.25%)

Rajesh Nanalal Doshi (11.12%)

None

30.17%

Quarterly Results Snapshot (Consolidated) - Sep'25 - YoY

YoY Growth in quarter ended Sep 2025 is 62.38% vs 6.13% in Sep 2024

YoY Growth in quarter ended Sep 2025 is 78.81% vs 47.67% in Sep 2024

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 64.68% vs 27.07% in Sep 2024

Growth in half year ended Sep 2025 is 118.27% vs 71.48% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is 13.08% vs 63.77% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 63.98% vs 131.06% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 28.53% vs 23.51% in Mar 2024

YoY Growth in year ended Mar 2025 is 81.44% vs 82.85% in Mar 2024