Dashboard

Poor long term growth as Net Sales has grown by an annual rate of 6.49% and Operating profit at 8.96% over the last 5 years

Flat results in Sep 25

With ROE of 88.8, it has a Very Expensive valuation with a 45.2 Price to Book Value

Consistent Underperformance against the benchmark over the last 3 years

Total Returns (Price + Dividend)

Latest dividend: 65 per share ex-dividend date: Aug-28-2025

Risk Adjusted Returns v/s

Returns Beta

News

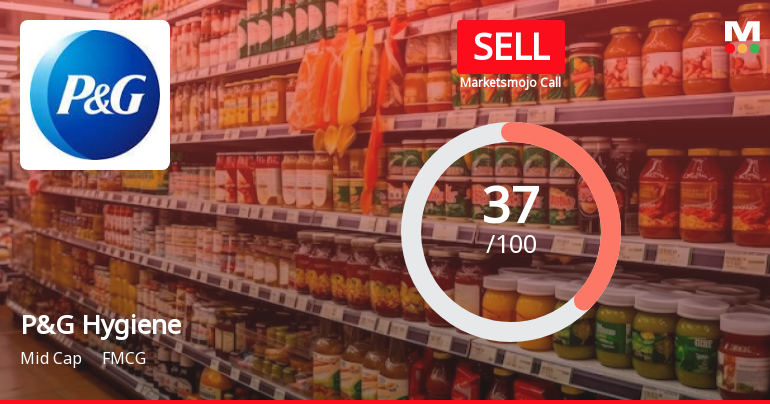

Procter & Gamble Hygiene & Health Care Ltd. is Rated Sell

Procter & Gamble Hygiene & Health Care Ltd. is rated 'Sell' by MarketsMOJO, with this rating last updated on 07 Oct 2024. However, the analysis and financial metrics discussed here reflect the stock's current position as of 28 December 2025, providing investors with an up-to-date view of the company’s fundamentals, valuation, financial trends, and technical outlook.

Read More

P&G Hygiene Sees Revision in Market Evaluation Amidst Challenging FMCG Landscape

P&G Hygiene’s market evaluation has undergone a revision reflecting shifts in its fundamental and technical outlook. The company, positioned within the FMCG sector as a midcap entity, faces a complex environment marked by valuation concerns and subdued financial momentum, influencing its recent assessment.

Read More

P&G Hygiene Sees Revision in Market Evaluation Amidst Challenging Performance

P&G Hygiene's market evaluation has undergone a revision reflecting shifts in its fundamental and technical outlook. The changes come amid subdued financial trends and valuation concerns, impacting investor sentiment in the midcap FMCG sector.

Read More Announcements

Closure of Trading Window

26-Dec-2025 | Source : BSEThe Company has informed the Exchange about the closure of trading window for the quarter ending December 31 2025

Board Meeting Intimation for Consideration And Approval Of Unaudited Financial Results For The Quarter Ended December 31 2025

26-Dec-2025 | Source : BSEProcter & Gamble Hygiene And Health Care Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 30/01/2026 inter alia to consider and approve Unaudited Financial Results for the quarter ended December 31 2025

Announcement under Regulation 30 (LODR)-Change in Management

08-Dec-2025 | Source : BSEChange in Senior Management Personnel of the Company

Corporate Actions

No Upcoming Board Meetings

Procter & Gamble Hygiene & Health Care Ltd. has declared 650% dividend, ex-date: 28 Aug 25

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Promoters

None

Held by 25 Schemes (8.8%)

Held by 96 FIIs (1.11%)

Procter And Gamble Overseas India B.v. (68.73%)

Sbi Focused Fund (4.97%)

9.65%

Quarterly Results Snapshot (Standalone) - Sep'25 - YoY

YoY Growth in quarter ended Sep 2025 is 1.42% vs -0.21% in Sep 2024

YoY Growth in quarter ended Sep 2025 is -0.96% vs 0.57% in Sep 2024

Half Yearly Results Snapshot (Standalone) - Sep'25

Not Applicable: The company has declared_date for only one period

Not Applicable: The company has declared_date for only one period

Nine Monthly Results Snapshot (Standalone) - Dec'24

YoY Growth in nine months ended Dec 2024 is 1.29% vs 6.79% in Mar 2024

YoY Growth in nine months ended Dec 2024 is -5.46% vs 12.73% in Mar 2024

Annual Results Snapshot (Standalone) - Jun'24

YoY Growth in year ended Jun 2024 is 7.33% vs 2.97% in Jun 2023

YoY Growth in year ended Jun 2024 is -0.46% vs 17.78% in Jun 2023