Stock DNA

Auto Components & Equipments

INR 224 Cr (Micro Cap)

13.00

32

0.00%

0.65

7.15%

0.88

Total Returns (Price + Dividend)

Latest dividend: 0.1 per share ex-dividend date: Sep-20-2019

Risk Adjusted Returns v/s

Returns Beta

News

Pritika Auto Industries Ltd is Rated Sell

Pritika Auto Industries Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 29 September 2025. However, the analysis and financial metrics discussed below reflect the stock's current position as of 24 December 2025, providing investors with the latest insights into the company’s performance and outlook.

Read More

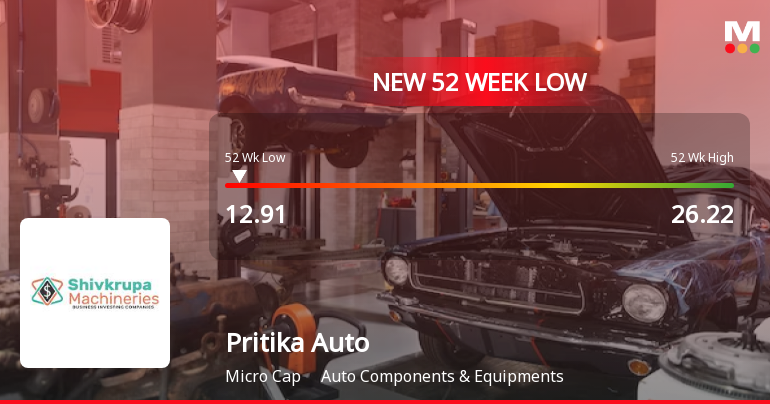

Pritika Auto Industries Falls to 52-Week Low of Rs.12.91 Amid Market Underperformance

Pritika Auto Industries has reached a new 52-week low of Rs.12.91, reflecting a continued downward trend in its stock price despite a broadly positive market environment. The stock's performance contrasts sharply with the broader indices and sector benchmarks, highlighting ongoing challenges within the company’s valuation and market positioning.

Read More Announcements

Announcement under Regulation 30 (LODR)-Public Announcement-Delisting

26-Dec-2025 | Source : BSEVoluntary Delisting of the Equity Shares of the Company from The Calcutta Stock Exchange Limited Further to our letter dated 12 February 2025 we write to inform that The Calcutta Stock Exchange Limited (CSE) vide letter dated 24th December 2025 (copy enclosed) has granted its approval for voluntary delisting of the Equity Shares of the Company from CSE with effect from today i.e. 26th December 2025. It may be noted that the Equity Shares of the Company will continue to remain listed on the National Stock Exchange of India Limited (NSE) and BSE Limited (BSE).

Closure of Trading Window

25-Dec-2025 | Source : BSEPritika Auto Industries Limited has informed the Exchange regarding the Trading Window closure pursuant to SEBI (Prohibition of Insider Trading) Regulations 2015 for the quarter ending 31st December2025

Disclosures under Reg. 29(2) of SEBI (SAST) Regulations 2011

24-Dec-2025 | Source : BSEThe Exchange has received the disclosure under Regulation 29(2) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for Pritika Industries Ltd

Corporate Actions

No Upcoming Board Meetings

Pritika Auto Industries Ltd has declared 5% dividend, ex-date: 20 Sep 19

Pritika Auto Industries Ltd has announced 2:10 stock split, ex-date: 09 Apr 21

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 3 FIIs (3.04%)

Harpreet Singh Nibber (41.78%)

Enforcement Directorate Raipur (3.71%)

29.06%

Quarterly Results Snapshot (Consolidated) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is 1.61% vs 12.74% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is 8.18% vs 75.16% in Jun 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 32.36% vs -7.35% in Sep 2024

Growth in half year ended Sep 2025 is -19.93% vs 91.18% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is -1.55% vs -5.34% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 66.79% vs -19.55% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 4.33% vs -5.51% in Mar 2024

YoY Growth in year ended Mar 2025 is 76.85% vs -15.18% in Mar 2024