Dashboard

Low ability to service debt as the company has a high Debt to EBITDA ratio of 3.83 times

- Poor long term growth as Net Sales has grown by an annual rate of 9.15% over the last 5 years

- Low ability to service debt as the company has a high Debt to EBITDA ratio of 3.83 times

- The company has been able to generate a Return on Equity (avg) of 0.32% signifying low profitability per unit of shareholders funds

Negative results in Sep 25

Underperformed the market in the last 1 year

Stock DNA

Pharmaceuticals & Biotechnology

INR 22,936 Cr (Small Cap)

NA (Loss Making)

34

0.06%

0.51

-0.55%

2.87

Total Returns (Price + Dividend)

Latest dividend: 0.1 per share ex-dividend date: Jul-16-2025

Risk Adjusted Returns v/s

Returns Beta

News

Piramal Pharma Ltd is Rated Strong Sell

Piramal Pharma Ltd is rated Strong Sell by MarketsMOJO. This rating was last updated on 03 Dec 2025. However, the analysis and financial metrics discussed here reflect the stock’s current position as of 28 December 2025, providing investors with the latest insights into the company’s performance and outlook.

Read More

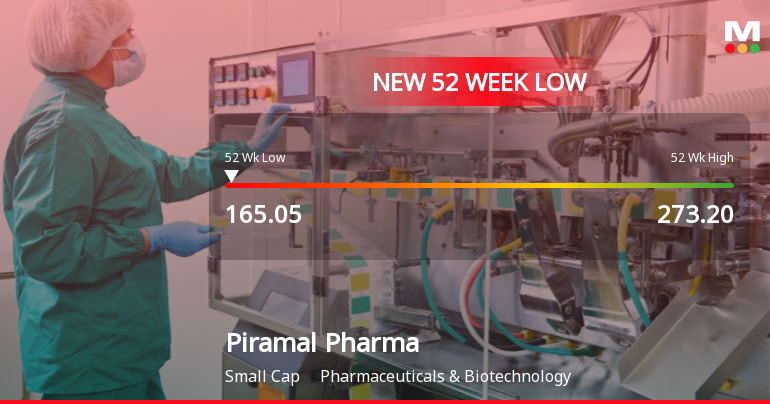

Piramal Pharma Stock Falls to 52-Week Low of Rs.165.05 Amidst Continued Downtrend

Piramal Pharma's shares reached a new 52-week low of Rs.165.05 today, marking a significant decline as the stock continues to trade below all key moving averages. This latest low reflects ongoing pressures on the company’s financial performance and market valuation within the Pharmaceuticals & Biotechnology sector.

Read More

Piramal Pharma Stock Falls to 52-Week Low of Rs.165.05 Amidst Prolonged Downtrend

Piramal Pharma’s shares touched a fresh 52-week low of Rs.165.05 today, marking a continuation of the stock’s downward trajectory over recent sessions. The pharmaceutical company’s stock has declined over the past four trading days, reflecting a cumulative return of -5.27% during this period, underperforming its sector by 0.76% today.

Read More Announcements

Announcement under Regulation 30 (LODR)-Newspaper Publication

18-Dec-2025 | Source : BSESubmission of copy of newspaper advertisement for Postal Ballot

Shareholder Meeting / Postal Ballot-Notice of Postal Ballot

17-Dec-2025 | Source : BSEPlease find enclosed Postal Ballot Notice intimation.

Shareholder Meeting / Postal Ballot-Notice of Postal Ballot

17-Dec-2025 | Source : BSEPlease find enclosed Postal Ballot Notice intimation.

Corporate Actions

No Upcoming Board Meetings

Piramal Pharma Ltd has declared 1% dividend, ex-date: 16 Jul 25

No Splits history available

No Bonus history available

Piramal Pharma Ltd has announced 5:46 rights issue, ex-date: 02 Aug 23

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Promoters

None

Held by 29 Schemes (13.11%)

Held by 179 FIIs (30.27%)

The Sri Krishna Trust Through Its Trustee Mr. Ajay G Piramal And Dr. (mrs.) Swati A Piramal (26.55%)

Ca Alchemy Investments (17.95%)

14.12%

Quarterly Results Snapshot (Consolidated) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is 5.69% vs -29.79% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is -21.44% vs -153.22% in Jun 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is -5.14% vs 14.55% in Sep 2024

Growth in half year ended Sep 2025 is -173.91% vs 29.40% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is 13.85% vs 14.25% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 25.26% vs 64.73% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 11.99% vs 15.39% in Mar 2024

YoY Growth in year ended Mar 2025 is 411.39% vs 109.56% in Mar 2024