Stock DNA

Cement & Cement Products

INR 3,500 Cr (Small Cap)

11.00

36

0.29%

0.03

14.87%

1.70

Total Returns (Price + Dividend)

Latest dividend: 0.5 per share ex-dividend date: Jul-25-2025

Risk Adjusted Returns v/s

Returns Beta

News

Orient Cement Ltd. is Rated Sell

Orient Cement Ltd. is rated 'Sell' by MarketsMOJO, with this rating last updated on 11 Nov 2025. However, the analysis and financial metrics presented here reflect the stock's current position as of 24 December 2025, providing investors with an up-to-date view of its fundamentals, returns, and market standing.

Read More

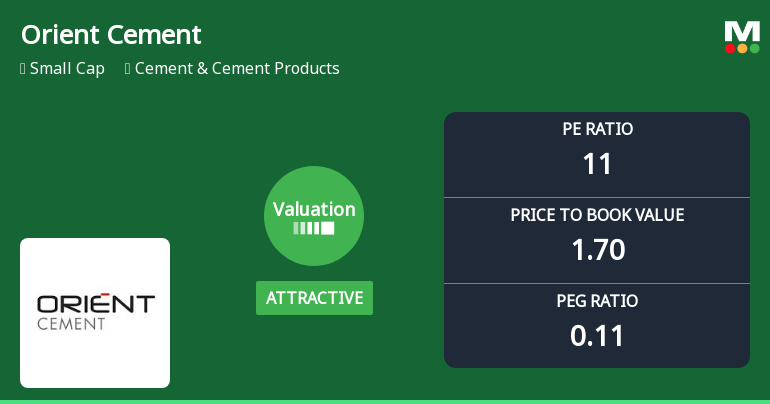

Orient Cement Valuation Shifts Highlight Price Attractiveness Amid Sector Dynamics

Orient Cement's recent valuation parameters reveal a notable shift in price attractiveness, reflecting changes in market assessment within the cement sector. With key metrics such as the price-to-earnings (P/E) ratio and price-to-book value (P/BV) adjusting against historical and peer averages, investors are presented with a nuanced view of the company's current standing amid broader industry trends.

Read More

Orient Cement Opens with Strong Gap Up, Reflecting Positive Market Sentiment

Orient Cement Ltd. commenced trading with a notable gap up, opening 7.48% higher than its previous close, signalling a robust start amid positive market sentiment. The stock outperformed its sector and broader market indices, maintaining momentum through the trading session.

Read More Announcements

Closure of Trading Window

27-Dec-2025 | Source : BSEIntimation of Closure of Trading Window.

Announcement under Regulation 30 (LODR)-Scheme of Arrangement

22-Dec-2025 | Source : BSEApproval of the Scheme of Amalgamation of Orient Cement Limited with Ambuja Cements Limited.

Announcement under Regulation 30 (LODR)-Scheme of Arrangement

22-Dec-2025 | Source : BSEApproval of Scheme of Amalgamation of Orient Cement Limited with Ambuja Cements Limited.

Corporate Actions

No Upcoming Board Meetings

Orient Cement Ltd. has declared 50% dividend, ex-date: 25 Jul 25

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Promoters

None

Held by 6 Schemes (0.09%)

Held by 109 FIIs (5.92%)

Ambuja Cements Limited (72.66%)

Birla Institute Of Technology And Science (1.71%)

12.93%

Quarterly Results Snapshot (Standalone) - Sep'25 - YoY

YoY Growth in quarter ended Sep 2025 is 18.25% vs -24.50% in Sep 2024

YoY Growth in quarter ended Sep 2025 is 2,015.95% vs -90.58% in Sep 2024

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is 21.73% vs -19.76% in Sep 2024

Growth in half year ended Sep 2025 is 551.79% vs -36.69% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'24

YoY Growth in nine months ended Dec 2024 is -18.00% vs 11.43% in Dec 2023

YoY Growth in nine months ended Dec 2024 is -53.89% vs 92.37% in Dec 2023

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is -14.95% vs 8.43% in Mar 2024

YoY Growth in year ended Mar 2025 is -47.81% vs 42.36% in Mar 2024