Dashboard

Poor long term growth as Operating profit has grown by an annual rate -5.87% of over the last 5 years

With a fall in Net Sales of -4.66%, the company declared Very Negative results in Sep 25

With ROE of 3.6, it has a Very Expensive valuation with a 1.5 Price to Book Value

Consistent Underperformance against the benchmark over the last 3 years

Stock DNA

Specialty Chemicals

INR 2,600 Cr (Small Cap)

42.00

40

1.28%

-0.16

3.56%

1.47

Total Returns (Price + Dividend)

Latest dividend: 2 per share ex-dividend date: Jul-30-2025

Risk Adjusted Returns v/s

Returns Beta

News

Nocil's Evaluation Metrics Revised Amid Challenging Financial and Market Conditions

Nocil, a small-cap player in the Specialty Chemicals sector, has experienced a revision in its evaluation metrics reflecting a more cautious market assessment. This shift follows a series of financial and technical developments that have influenced the company's overall outlook.

Read More

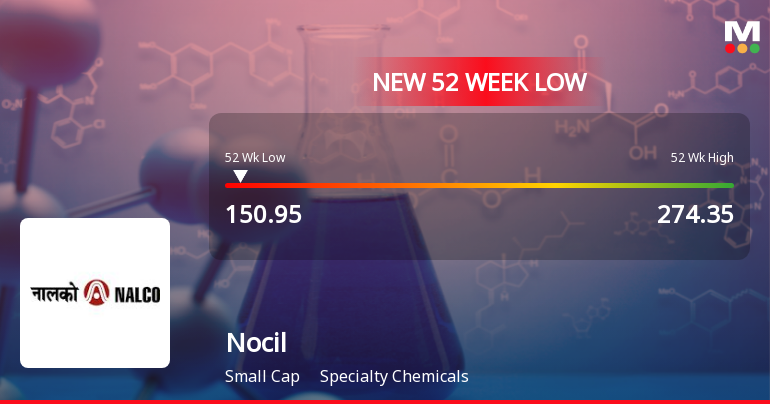

Nocil . Stock Falls to 52-Week Low of Rs.150.95 Amidst Prolonged Downtrend

Shares of Nocil . touched a fresh 52-week low of Rs.150.95 today, marking a significant decline amid a sustained downward trajectory over recent sessions. The stock has recorded a four-day consecutive fall, accumulating a loss of approximately 5% during this period, underperforming its sector peers and broader market indices.

Read More

Nocil . Stock Falls to 52-Week Low of Rs.150.95 Amidst Prolonged Downtrend

Shares of Nocil . touched a fresh 52-week low of Rs.150.95 today, marking a significant milestone in the stock’s ongoing decline. This new low comes after a series of consecutive sessions with negative returns, reflecting persistent pressures on the specialty chemicals company’s market valuation.

Read More Announcements

Closure of Trading Window

23-Dec-2025 | Source : BSEIt is intimated that the Trading Window of NOCIL Ltd. (the Company) would be closed from the close of business hours from Wednesday 31st December 2025 for the designated and connected persons till the conclusion of 48 hours after the declaration of Unaudited Financial Results for the quarter and nine months period ending on 31st December 2025 as approved by the Board of Directors.

Announcement under Regulation 30 (LODR)-Newspaper Publication

15-Dec-2025 | Source : BSENewspaper Publication- Special Window for Re-Lodgement of Transfer requests of Physical Shares.

Disclosures under Reg. 31(1) and 31(2) of SEBI (SAST) Regulations 2011.

02-Dec-2025 | Source : BSEThe Exchange has received Disclosure under Regulation 31(1) and 31(2) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 on December 01 2025 for Hrishikesh Arvind Mafatlal as a Trustee of (Gurukripa Trust)

Corporate Actions

No Upcoming Board Meetings

Nocil Ltd. has declared 20% dividend, ex-date: 30 Jul 25

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Non Institution

13.166

Held by 9 Schemes (5.55%)

Held by 73 FIIs (5.15%)

Hrishikesh Arvind Mafatlal(as A Trustee Of Gurukripa Trust) (18.16%)

Icici Prudential Smallcap Fund (3.55%)

44.0%

Quarterly Results Snapshot (Consolidated) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is -4.66% vs -1.02% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is -29.78% vs -16.98% in Jun 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is -10.63% vs -1.70% in Sep 2024

Growth in half year ended Sep 2025 is -57.54% vs 12.58% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is -3.23% vs -11.09% in Dec 2023

YoY Growth in nine months ended Dec 2024 is -10.24% vs -24.31% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is -3.60% vs -10.63% in Mar 2024

YoY Growth in year ended Mar 2025 is -22.66% vs -10.83% in Mar 2024