Dashboard

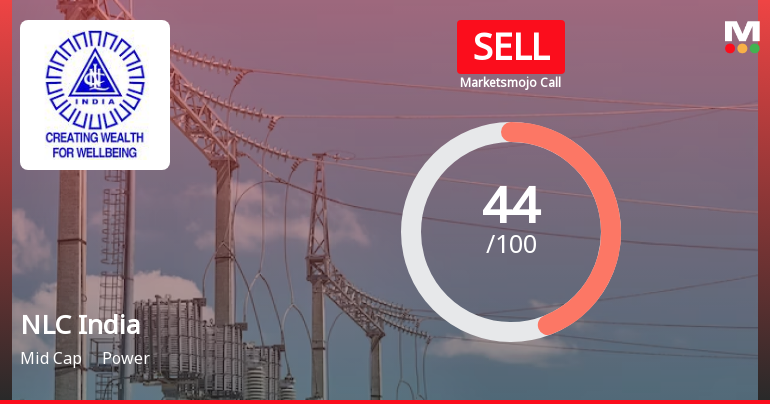

Weak Long Term Fundamental Strength with an average Return on Capital Employed (ROCE) of 6.66%

- Poor long term growth as Net Sales has grown by an annual rate of 8.92% and Operating profit at 6.33% over the last 5 years

- Low ability to service debt as the company has a high Debt to EBITDA ratio of 5.01 times

Flat results in Sep 25

Total Returns (Price + Dividend)

Latest dividend: 1.5 per share ex-dividend date: Sep-19-2025

Risk Adjusted Returns v/s

Returns Beta

News

NLC India Technical Momentum Shifts Amid Mixed Indicator Signals

NLC India’s stock price momentum has shifted from a sideways trend to a mildly bullish stance, reflecting nuanced changes in key technical indicators. Despite some bearish signals on longer-term charts, recent daily moving averages and price action suggest a cautious optimism in the power sector stock’s near-term outlook.

Read More

NLC India Technical Momentum Shifts Amid Mixed Market Signals

NLC India’s recent technical evaluation reveals a nuanced shift in price momentum, with key indicators signalling a transition from mildly bullish trends to a more sideways movement. This development comes amid a backdrop of mixed signals from momentum oscillators and moving averages, reflecting a complex market environment for the power sector stock.

Read More

NLC India Sees Shift in Market Assessment Amid Mixed Financial and Technical Signals

NLC India, a key player in the power generation sector, has experienced a notable shift in market assessment driven by evolving technical indicators and a complex financial backdrop. While the stock price has shown resilience in recent weeks, underlying fundamentals and valuation metrics present a nuanced picture for investors navigating the power sector landscape.

Read More Announcements

Closure of Trading Window

22-Dec-2025 | Source : BSETrading Window Closure for the Un-Audited Financial Results for the Company for the Quarter ending 31st December2025.

Intimation Under Regulation 30 & 51 Of SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015 For Commencement Of Initial Operations Of Pachwara South Open Cast Project Mining On 19Th December 2025.

19-Dec-2025 | Source : BSEPlease refer attachment

Announcement under Regulation 30 (LODR)-Press Release / Media Release

16-Dec-2025 | Source : BSEPlease refer attachment.

Corporate Actions

No Upcoming Board Meetings

NLC India Ltd. has declared 15% dividend, ex-date: 19 Sep 25

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Promoters

None

Held by 22 Schemes (9.79%)

Held by 128 FIIs (3.24%)

President Of India (72.2%)

Nippon Life India Trustee Ltd (under Different Sub Accounts) (6.35%)

5.3%

Quarterly Results Snapshot (Consolidated) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is 9.22% vs -0.27% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is -16.61% vs 65.49% in Jun 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 13.80% vs 11.75% in Sep 2024

Growth in half year ended Sep 2025 is -0.58% vs -1.22% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is 21.00% vs -14.26% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 22.96% vs 207.39% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 17.55% vs -19.57% in Mar 2024

YoY Growth in year ended Mar 2025 is 41.38% vs 32.84% in Mar 2024