Recent Price Movement and Market Performance

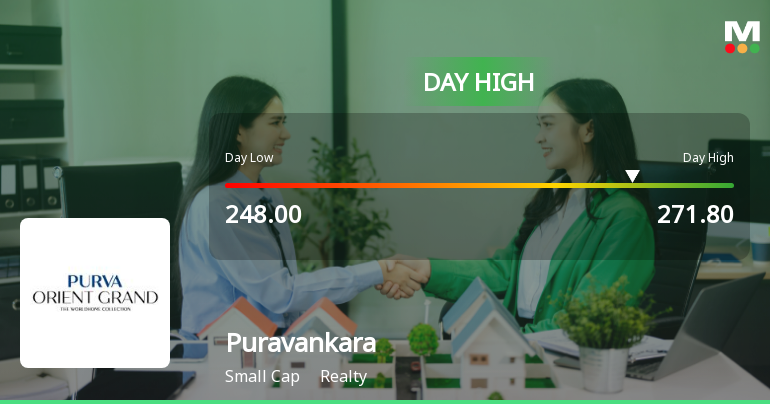

Puravankara’s stock has been on an upward trajectory over the past week, delivering a 7.09% gain compared to the Sensex’s modest 1.00% rise. Over the last month, the stock similarly outpaced the benchmark with a 6.78% increase against the Sensex’s 0.34%. This recent momentum is underscored by the stock’s three consecutive days of gains, accumulating a 10.21% return in that period. On 23-Dec, the stock opened with a gap up of 3.47% and reached an intraday high of ₹288.65, representing a 20% spike from its low point during the day. However, the trading session was marked by high volatility, with an intraday price range of ₹40.65 and a volatility measure of 5.69% based on the weighted average price.

Despite this short-term stre...

Read More