Dashboard

Company has a low Debt to Equity ratio (avg) at 0.02 times

Healthy long term growth as Net Sales has grown by an annual rate of 15.03%

Positive results in Sep 25

With ROE of 9.5, it has a Expensive valuation with a 3.3 Price to Book Value

High Institutional Holdings at 30.65%

With its market cap of Rs 64,209 cr, it is the biggest company in the sector and constitutes 36.28% of the entire sector

Stock DNA

Tyres & Rubber Products

INR 64,306 Cr (Mid Cap)

34.00

32

0.16%

-0.05

9.53%

3.30

Total Returns (Price + Dividend)

Latest dividend: 3 per share ex-dividend date: Nov-21-2025

Risk Adjusted Returns v/s

Returns Beta

News

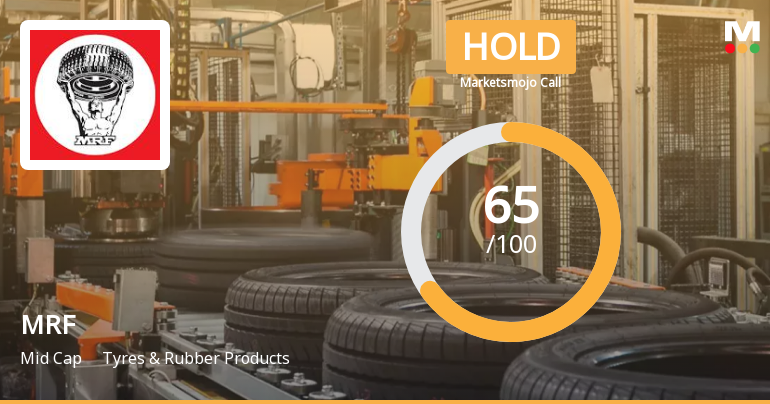

MRF Ltd. is Rated Hold by MarketsMOJO

MRF Ltd. is rated 'Hold' by MarketsMOJO, with this rating last updated on 20 Nov 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 25 December 2025, providing investors with the latest insights into its performance and outlook.

Read More

MRF’s Evaluation Revised Amid Mixed Financial and Market Signals

MRF, a leading player in the Tyres & Rubber Products sector, has experienced a revision in its market evaluation reflecting a nuanced view of its financial health, valuation, and technical outlook. This adjustment comes amid a backdrop of steady long-term growth and premium valuation metrics, prompting investors to reassess the stock’s positioning within its sector and the broader market.

Read More

MRF Stock Analysis: Technical Momentum Shifts Amid Mixed Indicator Signals

MRF, a leading player in the Tyres & Rubber Products sector, has experienced a subtle shift in its technical momentum, reflecting a nuanced market assessment. Recent evaluation adjustments reveal a transition from a bullish to a mildly bullish trend, with key technical indicators presenting a complex picture for investors analysing price movements and momentum.

Read More Announcements

Closure of Trading Window

23-Dec-2025 | Source : BSETrading Window Closure Intimation

Re-Lodgement Of Transfer Requests Of Physical Shares

05-Dec-2025 | Source : BSEDetails Attached

Announcement under Regulation 30 (LODR)-Press Release / Media Release

14-Nov-2025 | Source : BSEPress Release attached

Corporate Actions

No Upcoming Board Meetings

MRF Ltd. has declared 30% dividend, ex-date: 21 Nov 25

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Non Institution

None

Held by 92 Schemes (8.27%)

Held by 563 FIIs (18.27%)

Comprehensive Investment And Finance Company Pvt. Ltd. (10.42%)

Mowi Foundation (11.98%)

12.07%

Quarterly Results Snapshot (Consolidated) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is -3.87% vs 8.49% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is 5.03% vs -2.27% in Jun 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 6.94% vs 11.22% in Sep 2024

Growth in half year ended Sep 2025 is -1.50% vs -11.37% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is 12.00% vs 9.63% in Dec 2023

YoY Growth in nine months ended Dec 2024 is -19.46% vs 293.45% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 11.86% vs 9.39% in Mar 2024

YoY Growth in year ended Mar 2025 is -10.18% vs 170.66% in Mar 2024