Dashboard

With a Operating Losses, the company has a Weak Long Term Fundamental Strength

- Company's ability to service its debt is weak with a poor EBIT to Interest (avg) ratio of -0.80

- The company has been able to generate a Return on Equity (avg) of 8.47% signifying low profitability per unit of shareholders funds

Flat results in Sep 25

Risky - Negative EBITDA

Despite the size of the company, domestic mutual funds hold only 0.53% of the company

Stock DNA

Trading & Distributors

INR 9,374 Cr (Small Cap)

137.00

30

0.00%

-0.92

3.66%

4.49

Total Returns (Price + Dividend)

Latest dividend: 0.3 per share ex-dividend date: Sep-19-2019

Risk Adjusted Returns v/s

Returns Beta

News

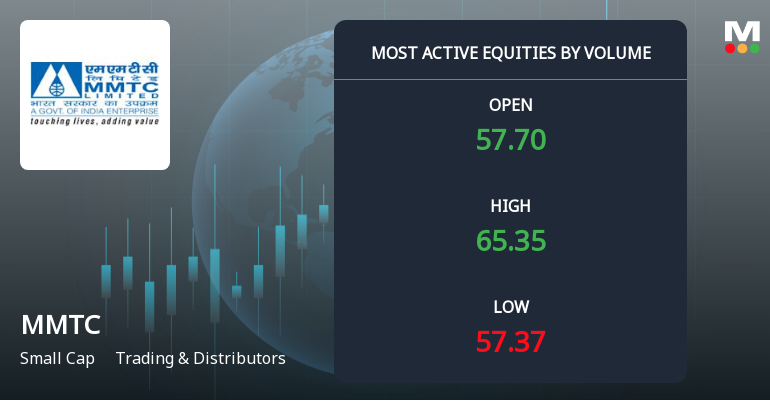

MMTC Sees Exceptional Trading Volume Amidst Broad Market Rally

MMTC Ltd, a key player in the Trading & Distributors sector, has emerged as one of the most actively traded stocks by volume on 26 December 2025, with a total traded volume exceeding 2 crore shares. The stock’s performance has notably outpaced its sector and the broader market, reflecting heightened investor interest and significant price movement within a single trading session.

Read More

MMTC Hits Intraday High with Strong 8.75% Surge Amid Volatile Trading

MMTC recorded a robust intraday performance on 26 Dec 2025, touching a day’s high of Rs 62.54, reflecting an 8.75% rise amid heightened volatility. The stock outpaced its sector and broader market indices, marking a notable session for the Trading & Distributors company.

Read More

MMTC Technical Momentum Shifts Signal Bearish Trend Amid Mixed Market Returns

MMTC, a key player in the Trading & Distributors sector, has exhibited a notable shift in its technical momentum, with recent evaluation adjustments indicating a transition from a sideways to a bearish trend. This development comes amid a backdrop of mixed returns relative to the broader Sensex index, underscoring the complex dynamics influencing the stock’s performance.

Read More Announcements

Closure of Trading Window

24-Dec-2025 | Source : BSEMMTC Limited has informed the exchange regarding the closure of trading window under the provisions of SEBI (PIT) Regulations 2015. The trading window shall remain closed from 1st January 2026 till 48 hours after the declaration of Unaudited Financial Results for the quarter ending on 31st December 2025.

Announcement under Regulation 30 (LODR)-Change in Management

16-Dec-2025 | Source : BSEMMTC Limited informs the exchange regarding the appointment of Shri AKM Kashyap as a Non- official Government Nominee Director of the company w.e.f 16.12.2025.

Clarification sought from MMTC Ltd

11-Dec-2025 | Source : BSEThe Exchange has sought clarification from MMTC Ltd on December 11 2025 with reference to Movement in Volume.

The reply is awaited.

Corporate Actions

No Upcoming Board Meetings

MMTC Ltd has declared 30% dividend, ex-date: 19 Sep 19

MMTC Ltd has announced 1:10 stock split, ex-date: 29 Jul 10

MMTC Ltd has announced 1:2 bonus issue, ex-date: 03 May 18

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Promoters

None

Held by 14 Schemes (0.05%)

Held by 6 FIIs (0.09%)

President Of India (89.93%)

Life Insurance Corporation Of India (1.66%)

7.56%

Quarterly Results Snapshot (Consolidated) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is -19.12% vs 491.30% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is 285.92% vs 1,884.75% in Jun 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 11.31% vs -44.33% in Sep 2024

Growth in half year ended Sep 2025 is 166.37% vs 21.05% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is -47.66% vs -99.83% in Dec 2023

YoY Growth in nine months ended Dec 2024 is -31.05% vs -92.11% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is -49.63% vs -99.85% in Mar 2024

YoY Growth in year ended Mar 2025 is -54.92% vs -87.70% in Mar 2024