Dashboard

Company's ability to service its debt is weak with a poor EBIT to Interest (avg) ratio of 1.32

- Company's ability to service its debt is weak with a poor EBIT to Interest (avg) ratio of 1.32

- The company has been able to generate a Return on Equity (avg) of 2.84% signifying low profitability per unit of shareholders funds

Flat results in Sep 25

Consistent Underperformance against the benchmark over the last 3 years

Stock DNA

Transport Services

INR 3,276 Cr (Small Cap)

NA (Loss Making)

33

0.55%

0.38

-3.22%

2.84

Total Returns (Price + Dividend)

Latest dividend: 2.5 per share ex-dividend date: Jul-11-2025

Risk Adjusted Returns v/s

Returns Beta

News

Mahindra Logistics Ltd is Rated Sell

Mahindra Logistics Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 24 November 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 27 December 2025, providing investors with the most up-to-date view of the company’s fundamentals, returns, and market performance.

Read More

Mahindra Logis. Sees Revision in Market Assessment Amidst Challenging Financial Trends

Mahindra Logis., a smallcap player in the Transport Services sector, has experienced a revision in its market evaluation reflecting recent shifts in its financial and technical outlook. This adjustment follows a period marked by subdued profitability, flat financial trends, and a cautious technical stance, all contributing to a more conservative market perspective.

Read More

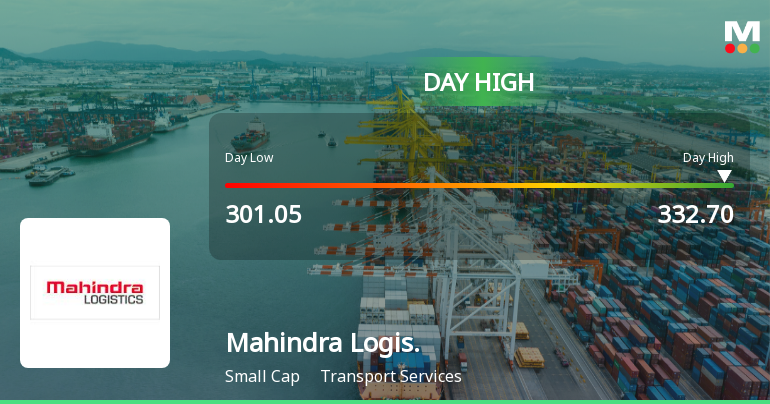

Mahindra Logistics Hits Intraday High with Strong 8.96% Surge

Mahindra Logistics recorded a robust intraday performance today, touching a high of Rs 332.7, reflecting an 8.96% rise from the previous close. This surge stands out amid a broadly negative market backdrop, with the Sensex trading 0.51% lower.

Read More Announcements

Board Meeting Intimation for Consideration And Approval Of The Unaudited Standalone And Consolidated Financial Results Of The Company For The Third Quarter And Nine Months Ended 31 December 2025.

26-Dec-2025 | Source : BSEMahindra Logistics Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 27/01/2026 inter alia to consider and approve the Unaudited Standalone and Consolidated Financial Results of the Company for the third quarter and nine months ended 31 December 2025 which shall be subject to limited review by the Statutory Auditor of the Company. Detailed disclosure is attached.

Closure of Trading Window

26-Dec-2025 | Source : BSEIn terms of Companys Code of Conduct for Prevention of Insider Trading in Securities of Mahindra Logistics Limited the Trading Window of the Company has been closed from Thursday 1 January 2026 to Thursday 29 January 2026(both days inclusive) for consideration of the Unaudited Standalone and Consolidated Financial Results of the Company for the third quarter and nine months ended 31 December 2025

Intimation Under Regulation 30 Of The Securities And Exchange Board Of India (Listing Obligations And Disclosure Requirements) Regulations 2015 - ESG Rating By NSE Sustainability Ratings & Analytics Ltd

12-Dec-2025 | Source : BSEDetailed intimation is attached.

Corporate Actions

No Upcoming Board Meetings

Mahindra Logistics Ltd has declared 25% dividend, ex-date: 11 Jul 25

No Splits history available

No Bonus history available

Mahindra Logistics Ltd has announced 3:8 rights issue, ex-date: 23 Jul 25

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Promoters

None

Held by 5 Schemes (12.1%)

Held by 44 FIIs (3.86%)

Mahindra & Mahindra Limited (59.6%)

Nippon Life India Trustee Ltd-a/c Nippon India Multi Cap Fund (5.45%)

18.6%

Quarterly Results Snapshot (Consolidated) - Sep'25 - YoY

YoY Growth in quarter ended Sep 2025 is 10.79% vs 11.46% in Sep 2024

YoY Growth in quarter ended Sep 2025 is 3.72% vs 32.52% in Sep 2024

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 12.54% vs 10.65% in Sep 2024

Growth in half year ended Sep 2025 is -5.38% vs 18.01% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is 11.84% vs 5.17% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 30.53% vs -254.58% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 10.88% vs 7.36% in Mar 2024

YoY Growth in year ended Mar 2025 is 34.51% vs -308.30% in Mar 2024