Dashboard

Low ability to service debt as the company has a high Debt to EBITDA ratio of 3.54 times

- Low ability to service debt as the company has a high Debt to EBITDA ratio of 3.54 times

- The company has been able to generate a Return on Equity (avg) of 9.61% signifying low profitability per unit of shareholders funds

Underperformed the market in the last 1 year

Stock DNA

Construction

INR 19,737 Cr (Small Cap)

29.00

37

0.72%

0.87

12.11%

3.49

Total Returns (Price + Dividend)

Latest dividend: 5.5 per share ex-dividend date: Jul-25-2025

Risk Adjusted Returns v/s

Returns Beta

News

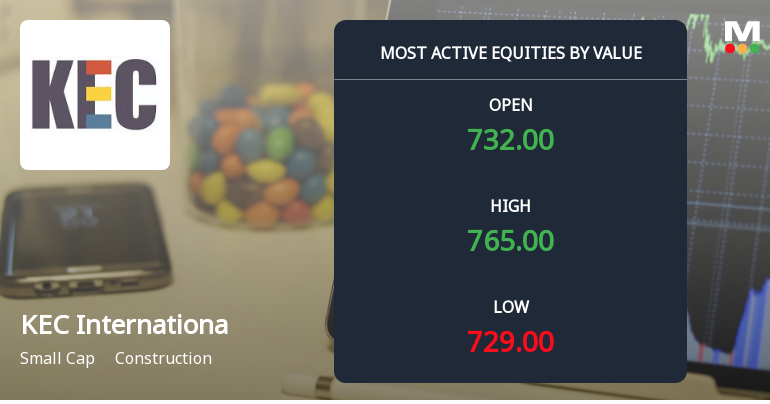

KEC International Sees Robust Trading Activity Amid Construction Sector Gains

KEC International Ltd emerged as one of the most actively traded stocks by value on 22 December 2025, reflecting significant investor interest within the construction sector. The stock demonstrated notable price movement and trading volumes, outperforming its sector peers and the broader market indices during the session.

Read More

KEC Internationa’s Evaluation Revised Amidst Challenging Market Conditions

KEC Internationa has experienced a revision in its market evaluation reflecting shifts in key analytical parameters. The construction sector stock’s recent assessment highlights a complex interplay of financial trends, valuation appeal, technical outlook, and overall quality metrics, providing investors with a nuanced perspective on its current standing.

Read More

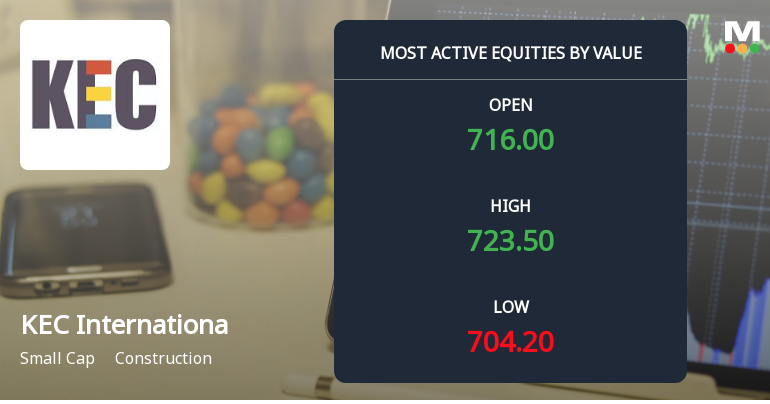

KEC International Sees Robust Trading Activity Amid Construction Sector Movements

KEC International Ltd has emerged as one of the most actively traded stocks by value on 15 Dec 2025, reflecting significant investor interest within the construction sector. The stock’s performance today highlights notable trading volumes and price movements that outpace sector averages, underscoring its prominence in the current market landscape.

Read More Announcements

Closure of Trading Window

26-Dec-2025 | Source : BSEThe intimation of closure of trading window for dealing in Securities of the Company by Designated Persons and their immediate relatives with effect from January 01 2026 is enclosed.

Disclosures under Reg. 29(2) of SEBI (SAST) Regulations 2011

24-Dec-2025 | Source : BSEThe Exchange has received the disclosure under Regulation 29(2) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for HDFC Mutual Fund

Disclosure Under Regulation 30 Of The SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015

23-Dec-2025 | Source : BSEPursuant to Regulation 30 of the SEBI (Listing Obligations and Disclosure Requirements ) Regulations 2015 and SEBI master circular dated November 11 2024 details of Order received from GST Authority Rajasthan are enclosed.

Corporate Actions

No Upcoming Board Meetings

KEC International Ltd has declared 275% dividend, ex-date: 25 Jul 25

KEC International Ltd has announced 2:10 stock split, ex-date: 30 Dec 10

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Promoters

None

Held by 27 Schemes (20.21%)

Held by 222 FIIs (15.92%)

Swallow Associates Llp (25.45%)

Hdfc Mutual Fund - Hdfc Mid-cap Fund (7.34%)

8.94%

Quarterly Results Snapshot (Consolidated) - Sep'25 - YoY

YoY Growth in quarter ended Sep 2025 is 19.13% vs 13.65% in Sep 2024

YoY Growth in quarter ended Sep 2025 is 88.21% vs 52.98% in Sep 2024

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 15.47% vs 10.10% in Sep 2024

Growth in half year ended Sep 2025 is 64.96% vs 76.22% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is 8.91% vs 16.95% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 55.12% vs 87.78% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 9.70% vs 15.23% in Mar 2024

YoY Growth in year ended Mar 2025 is 64.58% vs 97.00% in Mar 2024