Dashboard

With a fall in Net Sales of -15.22%, the company declared Very Negative results in Sep 25

- The company has declared negative results for the last 3 consecutive quarters

- The company has declared negative results in Mar 25 after 9 consecutive negative quarters

- OPERATING PROFIT TO INTEREST(Q) Lowest at 2.95 times

- PAT(Q) At Rs 151.89 cr has Fallen at -64.7% (vs previous 4Q average)

- DPR(Y) Lowest at 6.82%

Underperformed the market in the last 1 year

Stock DNA

Iron & Steel Products

INR 10,178 Cr (Small Cap)

8.00

27

1.25%

0.41

11.37%

0.85

Total Returns (Price + Dividend)

Latest dividend: 2 per share ex-dividend date: Jun-05-2025

Risk Adjusted Returns v/s

Returns Beta

News

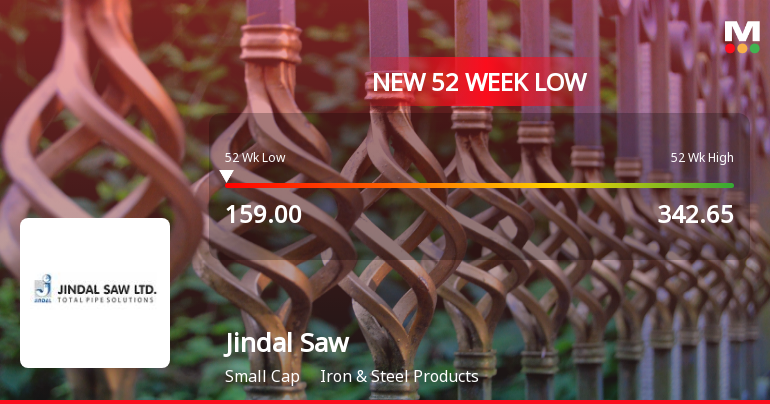

Jindal Saw Stock Falls to 52-Week Low of Rs.153.2 Amid Continued Downtrend

Shares of Jindal Saw, a key player in the Iron & Steel Products sector, touched a fresh 52-week low of Rs.153.2 today, marking a significant milestone in the stock’s ongoing decline. The stock has been under pressure for several sessions, reflecting a series of financial setbacks and market headwinds.

Read More

Jindal Saw Stock Falls to 52-Week Low of Rs.159.75 Amidst Continued Downtrend

Jindal Saw’s share price reached a fresh 52-week low of Rs.159.75 today, marking a significant decline amid a sustained downward trend. The stock has been trading below all key moving averages and has recorded losses over the past three consecutive sessions, reflecting ongoing pressures within the Iron & Steel Products sector.

Read More Announcements

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

20-Nov-2025 | Source : BSEas attached

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

29-Oct-2025 | Source : BSEas attached

Announcement under Regulation 30 (LODR)-Earnings Call Transcript

29-Oct-2025 | Source : BSEas attached

Corporate Actions

No Upcoming Board Meetings

Jindal Saw Ltd has declared 200% dividend, ex-date: 05 Jun 25

Jindal Saw Ltd has announced 1:2 stock split, ex-date: 09 Oct 24

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Promoters

21.5253

Held by 49 Schemes (4.02%)

Held by 256 FIIs (15.35%)

Nalwa Sons Investments Limited (16.75%)

Hsbc Elss Tax Saver Fund (2.27%)

14.06%

Quarterly Results Snapshot (Consolidated) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is 3.65% vs -19.06% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is -64.18% vs 45.58% in Jun 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is -20.86% vs 6.42% in Sep 2024

Growth in half year ended Sep 2025 is -38.77% vs 46.60% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is 1.61% vs 22.50% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 23.17% vs 321.53% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is -0.61% vs 17.29% in Mar 2024

YoY Growth in year ended Mar 2025 is 3.66% vs 160.43% in Mar 2024