Dashboard

Low ability to service debt as the company has a high Debt to EBITDA ratio of 4.00 times

- Low ability to service debt as the company has a high Debt to EBITDA ratio of 4.00 times

Negative results in Sep 25

With ROCE of 11, it has a Expensive valuation with a 4 Enterprise value to Capital Employed

Despite the size of the company, domestic mutual funds hold only 0.26% of the company

Underperformed the market in the last 1 year

Stock DNA

Auto Components & Equipments

INR 14,853 Cr (Small Cap)

71.00

40

0.13%

2.15

14.68%

10.68

Total Returns (Price + Dividend)

Latest dividend: 0.85 per share ex-dividend date: Aug-26-2025

Risk Adjusted Returns v/s

Returns Beta

News

JBM Auto Technical Momentum Shifts Amid Mixed Market Signals

JBM Auto has exhibited a notable shift in its technical momentum, reflecting a complex interplay of market indicators. Recent price movements and technical parameters suggest a transition from a predominantly bearish stance to a more nuanced mildly bearish outlook, underscoring the evolving dynamics within the auto components sector.

Read More

JBM Auto Sees Elevated Trading Activity Amidst Sector Outperformance

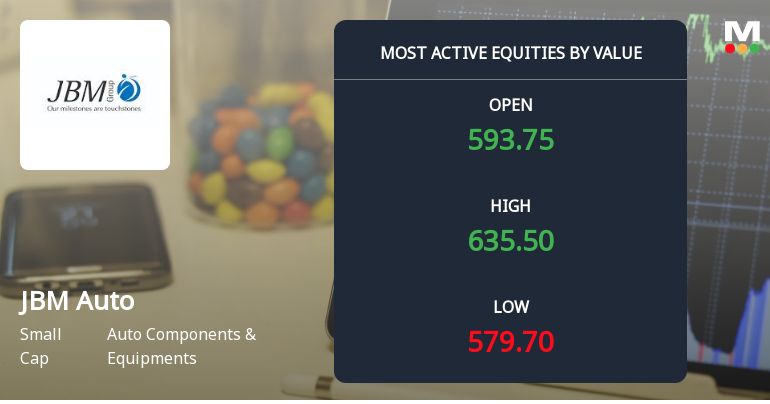

JBM Auto Ltd has emerged as one of the most actively traded stocks by value in the Auto Components & Equipments sector, registering significant market interest with a total traded value exceeding ₹242 crore on 24 December 2025. The stock's performance notably outpaced its sector peers, reflecting heightened investor focus and robust trading momentum.

Read More

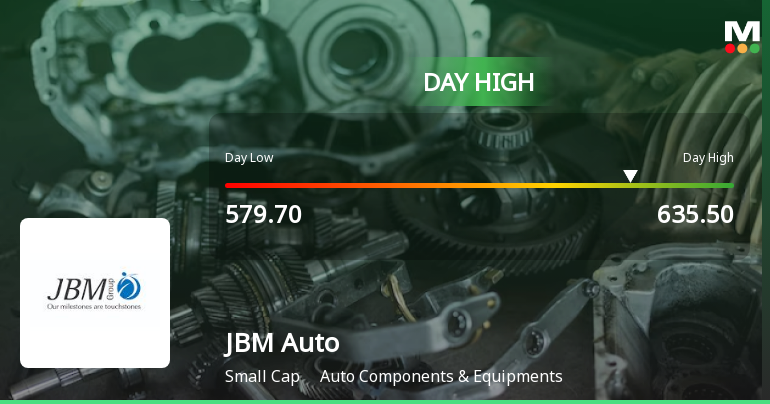

JBM Auto Hits Intraday High with Strong 9.88% Surge in Volatile Trading

JBM Auto recorded a robust intraday performance on 24 Dec 2025, touching a high of Rs 635, reflecting a 9.88% rise during volatile trading. The stock outpaced its sector and broader market indices, marking a notable session for the auto components company.

Read More Announcements

Clarification

22-Dec-2025 | Source : BSEClarification on volume movement

Clarification sought from JBM Auto Ltd

22-Dec-2025 | Source : BSEThe Exchange has sought clarification from JBM Auto Ltd on December 22 2025 with reference to Movement in Volume.

The reply is awaited.

Shareholder Meeting / Postal Ballot-Scrutinizers Report

12-Dec-2025 | Source : BSEJBM Auto Limited has informed the Exchange copy of scrutinizer report along with voting result for Postal Ballot.

Corporate Actions

No Upcoming Board Meetings

JBM Auto Ltd has declared 85% dividend, ex-date: 26 Aug 25

JBM Auto Ltd has announced 1:2 stock split, ex-date: 31 Jan 25

JBM Auto Ltd has announced 1:1 bonus issue, ex-date: 08 Oct 14

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Promoters

None

Held by 15 Schemes (0.08%)

Held by 84 FIIs (1.9%)

Smc Credits Limited (16.35%)

Zeal Impex And Traders Private Limited (7.72%)

12.92%

Quarterly Results Snapshot (Consolidated) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is 9.12% vs -23.81% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is 42.20% vs -44.53% in Jun 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 7.88% vs 11.63% in Sep 2024

Growth in half year ended Sep 2025 is 7.84% vs 11.44% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is 8.61% vs 23.74% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 10.15% vs 27.78% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 9.24% vs 29.86% in Mar 2024

YoY Growth in year ended Mar 2025 is 12.91% vs 43.77% in Mar 2024