Dashboard

Poor Management Efficiency with a low ROE of 9.80%

- The company has been able to generate a Return on Equity (avg) of 9.80% signifying low profitability per unit of shareholders funds

Company has a low Debt to Equity ratio (avg) at 0 times

Healthy long term growth as Net Sales has grown by an annual rate of 173.09%

With a growth in Net Sales of 13.74%, the company declared Outstanding results in Sep 25

With ROE of 6.3, it has a Very Expensive valuation with a 5.4 Price to Book Value

Despite the size of the company, domestic mutual funds hold only 0% of the company

Stock DNA

Aerospace & Defense

INR 2,571 Cr (Small Cap)

85.00

22

0.00%

-0.12

6.31%

5.38

Total Returns (Price + Dividend)

Jaykay Enter. for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

Jaykay Enterprises Ltd is Rated Hold by MarketsMOJO

Jaykay Enterprises Ltd is rated 'Hold' by MarketsMOJO, with this rating last updated on 21 November 2025. However, the analysis and financial metrics presented here reflect the stock's current position as of 26 December 2025, providing investors with an up-to-date view of the company’s fundamentals, returns, and market standing.

Read More

Jaykay Enter. Sees Revision in Market Evaluation Amid Mixed Financial Signals

Jaykay Enter., a small-cap player in the Aerospace & Defense sector, has experienced a revision in its market evaluation reflecting a nuanced shift in its financial and technical outlook. This adjustment follows a detailed reassessment of the company’s quality, valuation, financial trends, and technical indicators, providing investors with a clearer perspective on its current standing.

Read More

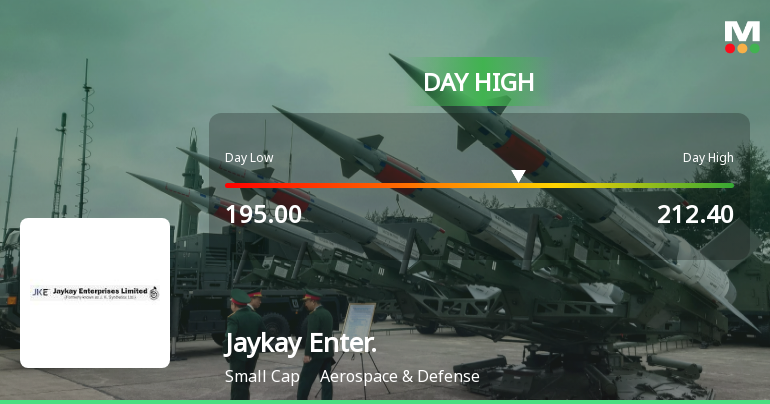

Jaykay Enterprises Hits Intraday High with Strong Trading Momentum

Jaykay Enterprises recorded a robust intraday performance today, touching a high of ₹212.4, marking a 9.18% rise during trading hours. The aerospace and defence company outpaced its sector and broader market indices, reflecting notable trading activity and a reversal after two days of decline.

Read More Announcements

Shareholder Meeting / Postal Ballot-Outcome of Postal_Ballot

26-Dec-2025 | Source : BSEOutcome of Postal Ballot of Jaykay Enterprises Limited

Shareholder Meeting / Postal Ballot-Scrutinizers Report

26-Dec-2025 | Source : BSEVoting Results and Scrutinizers Report of Jaykay Enterprises Limited

Closure of Trading Window

24-Dec-2025 | Source : BSEClosure of Trading Window

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

Jaykay Enterprises Ltd has announced 1:1 rights issue, ex-date: 19 Jul 24

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 2 Schemes (0.0%)

Held by 17 FIIs (0.13%)

Abhishek Singhania (33.71%)

None

25.26%

Quarterly Results Snapshot (Consolidated) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is 13.74% vs 405.93% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is -58.01% vs 632.11% in Jun 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 147.17% vs 217.76% in Sep 2024

Growth in half year ended Sep 2025 is 468.51% vs 70.03% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is 207.91% vs -38.20% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 192.84% vs -61.86% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 53.13% vs 12.14% in Mar 2024

YoY Growth in year ended Mar 2025 is -18.28% vs 21.33% in Mar 2024