Dashboard

Negative results in Sep 25

- PAT(Q) At Rs 9.65 cr has Fallen at -30.5% (vs previous 4Q average)

- ROCE(HY) Lowest at 10.94%

- NET SALES(Q) Lowest at Rs 499.60 cr

Despite the size of the company, domestic mutual funds hold only 0% of the company

Below par performance in long term as well as near term

Stock DNA

Specialty Chemicals

INR 608 Cr (Micro Cap)

12.00

40

1.99%

0.31

8.74%

1.03

Total Returns (Price + Dividend)

Latest dividend: 2.5 per share ex-dividend date: Jun-27-2025

Risk Adjusted Returns v/s

Returns Beta

News

Jayant Agro Organics Ltd is Rated Strong Sell

Jayant Agro Organics Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 16 December 2025. However, the analysis and financial metrics presented here reflect the stock’s current position as of 28 December 2025, providing investors with the latest insights into the company’s performance and outlook.

Read More

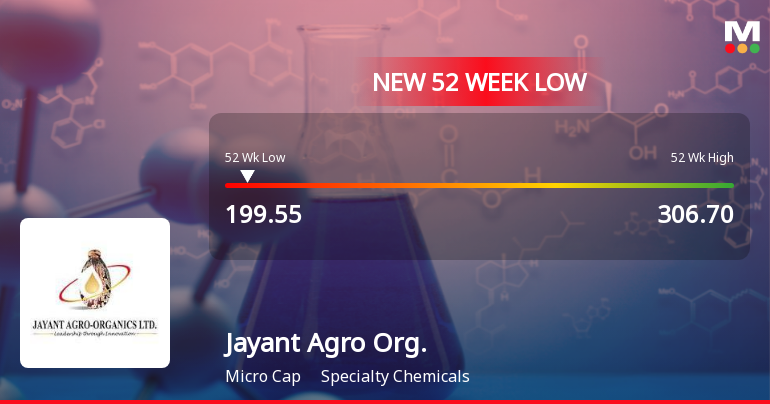

Jayant Agro Organics Falls to 52-Week Low of Rs.199.55 Amid Sector Pressure

Jayant Agro Organics has reached a new 52-week low of Rs.199.55, marking a significant price level for the specialty chemicals company. This decline comes amid a broader market environment where the Sensex is trading near its 52-week high, highlighting a divergence in performance between the stock and the benchmark index.

Read More

Jayant Agro Organics Falls to 52-Week Low of Rs.200 Amidst Prolonged Downtrend

Jayant Agro Organics has reached a new 52-week low of Rs.200, marking a significant decline amid a sustained period of price weakness. The stock has experienced a four-day consecutive fall, reflecting ongoing pressures within the specialty chemicals sector despite broader market gains.

Read More Announcements

Announcement under Regulation 30 (LODR)-Newspaper Publication

10-Nov-2025 | Source : BSENewspaper Advertisement

Board Meeting Outcome for Outcome Of Board Meeting

08-Nov-2025 | Source : BSEOutcome of Board Meeting

Unaudited Financial Results For The Quarter And Half Year Ended September 30 2025.

08-Nov-2025 | Source : BSEUnaudited Financial Reults for the quarter and half year ended September 30 2025.

Corporate Actions

No Upcoming Board Meetings

Jayant Agro Organics Ltd has declared 50% dividend, ex-date: 27 Jun 25

No Splits history available

Jayant Agro Organics Ltd has announced 1:1 bonus issue, ex-date: 01 Aug 17

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 3 FIIs (0.04%)

Hitesh Jayraj Udeshi (7.54%)

Itoh Oil Chemicals Co Ltd. (4%)

22.52%

Quarterly Results Snapshot (Consolidated) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is -25.67% vs 6.02% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is -40.25% vs 40.68% in Jun 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is -10.85% vs 20.02% in Sep 2024

Growth in half year ended Sep 2025 is -11.83% vs 10.71% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is 24.29% vs -29.61% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 20.91% vs 1.01% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 17.59% vs -22.43% in Mar 2024

YoY Growth in year ended Mar 2025 is 6.95% vs 4.03% in Mar 2024