Stock DNA

Construction

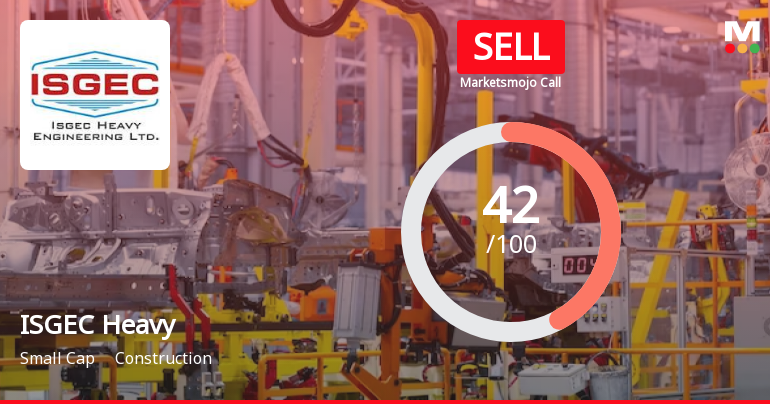

INR 6,786 Cr (Small Cap)

27.00

33

0.54%

0.24

8.65%

2.44

Total Returns (Price + Dividend)

Latest dividend: 5 per share ex-dividend date: Sep-08-2025

Risk Adjusted Returns v/s

Returns Beta

News

ISGEC Heavy Engineering Shows Mixed Technical Signals Amid Price Momentum Shift

ISGEC Heavy Engineering has experienced a notable shift in price momentum, reflected in a complex interplay of technical indicators that suggest a transition from a mildly bearish trend to a more sideways movement. This article analyses the recent technical signals, including MACD, RSI, moving averages, and volume-based indicators, to provide a comprehensive view of the stock’s current market stance.

Read More

ISGEC Heavy Engineering Hits Intraday High with Strong 9.38% Surge

ISGEC Heavy Engineering demonstrated robust intraday performance on 24 Dec 2025, surging 9.38% to touch a day’s high of Rs 971, marking a significant move within the construction sector amid a broadly subdued market environment.

Read More

ISGEC Heavy Sees Revision in Market Evaluation Amidst Challenging Sector Dynamics

ISGEC Heavy has experienced a revision in its market evaluation, reflecting shifts in key analytical parameters amid a subdued performance environment. The construction sector stock’s recent assessment changes highlight evolving perspectives on its quality, valuation, financial trends, and technical outlook.

Read More Announcements

Closure of Trading Window

23-Dec-2025 | Source : BSEClosure of Trading Window

Announcement under Regulation 30 (LODR)-Updates on Acquisition

17-Dec-2025 | Source : BSEUpdate on Completion of Acquisition of 26% equity of FPEL HR1 Energy Private Limited

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

16-Dec-2025 | Source : BSEIntimation of Investor Meeting fixed for Tuesday December 23 2025 - One to One - In-person

Corporate Actions

No Upcoming Board Meetings

ISGEC Heavy Engineering Ltd has declared 500% dividend, ex-date: 08 Sep 25

ISGEC Heavy Engineering Ltd has announced 1:10 stock split, ex-date: 28 Mar 19

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Promoters

None

Held by 12 Schemes (8.81%)

Held by 90 FIIs (3.48%)

The Yamuna Syndicate Ltd (45.0%)

Nippon Life India Trustee Ltd-a/c Nippon India Small Cap Fund (5.95%)

16.71%

Quarterly Results Snapshot (Consolidated) - Sep'25 - YoY

YoY Growth in quarter ended Sep 2025 is 2.87% vs 11.59% in Sep 2024

YoY Growth in quarter ended Sep 2025 is -7.45% vs 54.83% in Sep 2024

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is -4.76% vs 11.36% in Sep 2024

Growth in half year ended Sep 2025 is -9.36% vs 43.07% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is 7.56% vs -0.11% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 3.32% vs 56.19% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 3.26% vs -2.81% in Mar 2024

YoY Growth in year ended Mar 2025 is 39.93% vs 24.01% in Mar 2024