Dashboard

Company has a low Debt to Equity ratio (avg) at 0.02 times

Healthy long term growth as Operating profit has grown by an annual rate 61.07%

Positive results in Sep 25

With ROE of 13.7, it has a Attractive valuation with a 7 Price to Book Value

Majority shareholders : Promoters

Underperformed the market in the last 1 year

Stock DNA

Electronics & Appliances

INR 6,574 Cr (Small Cap)

51.00

46

0.00%

-0.18

13.74%

7.24

Total Returns (Price + Dividend)

IFB Industries for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

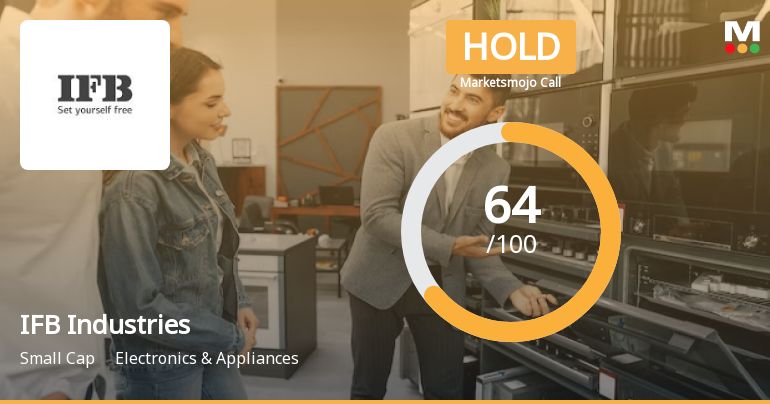

IFB Industries Ltd is Rated Hold by MarketsMOJO

IFB Industries Ltd is rated 'Hold' by MarketsMOJO, with this rating last updated on 20 Nov 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 25 December 2025, providing investors with the latest insights into the company’s performance and outlook.

Read More

IFB Industries Sees Revision in Market Evaluation Amid Mixed Financial Signals

IFB Industries has experienced a revision in its market evaluation, reflecting a nuanced shift in its financial and technical outlook. The adjustment comes amid a backdrop of solid operational performance but tempered by recent stock price trends and sector dynamics within Electronics & Appliances.

Read More

IFB Industries Technical Momentum Shifts Amid Mixed Indicator Signals

IFB Industries has exhibited a notable shift in its technical momentum, transitioning from a sideways trend to a mildly bullish stance. This development comes amid a complex interplay of technical indicators, including MACD, RSI, moving averages, and other momentum oscillators, which collectively paint a nuanced picture of the stock’s near-term trajectory.

Read More Announcements

Closure of Trading Window

26-Dec-2025 | Source : BSEPursuant to the Securities and Exchange Board of India (Prohibition and Insider Trading) Regulations 2015 the Trading Window for purchasing/selling or dealing in the shares of the Company will be closed from 1st January 2026 for Designated Employees and their Immediate Relatives. The Trading Window will open after 48 hours from the announcement of Unaudited Financial Results (Standalone and Consolidated) to the Stock Exchanges for the Quarter and Nine months ended 31st December 2025. Accordingly all the Designated Persons and their immediate relatives have been advised not to trade in the securities of the company during the aforementioned period of closure of Trading Window.

Announcement under Regulation 30 (LODR)-Newspaper Publication

15-Dec-2025 | Source : BSECopies of the newspaper advertisement published on 15th December 2025 in the newspapers namely -Business Standard - English and in Aajkal -Bengali informing the members about the opening of a one-time Special Window for re-lodgment of transfer requests of physical shares.

Announcement under Regulation 30 (LODR)-Acquisition

12-Dec-2025 | Source : BSEIncorporation of Step-Down Subsidiary

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Promoters

None

Held by 16 Schemes (5.83%)

Held by 38 FIIs (0.92%)

Ifb Automotive Private Limited (46.54%)

Dsp Small Cap Fund (4.66%)

12.61%

Quarterly Results Snapshot (Consolidated) - Sep'25 - YoY

YoY Growth in quarter ended Sep 2025 is 12.39% vs 10.76% in Sep 2024

YoY Growth in quarter ended Sep 2025 is 61.70% vs 45.89% in Sep 2024

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 8.85% vs 13.80% in Sep 2024

Growth in half year ended Sep 2025 is 11.60% vs 229.75% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is 12.26% vs 5.11% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 160.79% vs 54.18% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 14.73% vs 5.79% in Mar 2024

YoY Growth in year ended Mar 2025 is 136.12% vs 237.08% in Mar 2024