Dashboard

Strong Long Term Fundamental Strength with a 25.09% CAGR growth in Net Profits

Healthy long term growth as Net Interest Income (ex other income) has grown by an annual rate of 27.03% and Net profit at 25.09%

Positive results in Sep 25

With ROA of 0.4, it has a Expensive valuation with a 1.5 Price to Book Value

Market Beating Performance

Total Returns (Price + Dividend)

Latest dividend: 0.2 per share ex-dividend date: Jul-11-2025

Risk Adjusted Returns v/s

Returns Beta

News

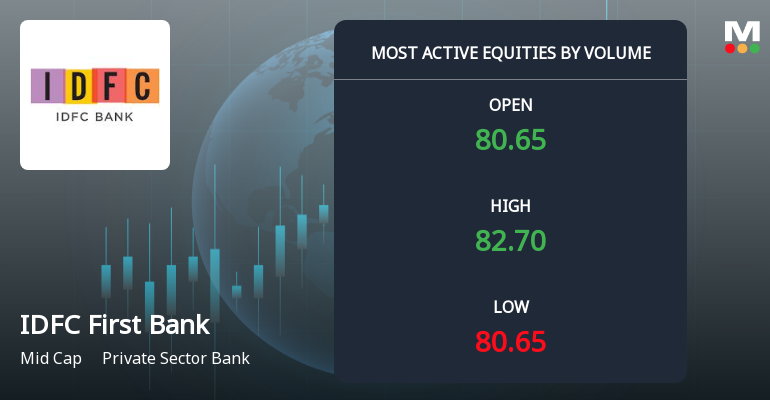

IDFC First Bank Sees Exceptional Trading Volume Amidst Positive Momentum

IDFC First Bank has emerged as one of the most actively traded stocks in the Indian equity market, registering a remarkable surge in trading volume and price momentum. The private sector bank’s shares witnessed a fresh 52-week high, supported by robust market participation and favourable technical indicators, signalling notable investor interest and potential accumulation.

Read More

IDFC First Bank Reaches New 52-Week High of Rs.82.7, Marking Strong Momentum

IDFC First Bank has attained a significant milestone by touching a new 52-week high of Rs.82.7, reflecting sustained momentum in its stock performance amid a broadly positive market environment.

Read More

IDFC First Bank Technical Momentum Shifts Signal Bullish Outlook Amid Market Fluctuations

IDFC First Bank has exhibited a notable shift in its technical momentum, moving from a mildly bullish stance to a more pronounced bullish trend. This change is underscored by a convergence of positive signals from key technical indicators including the MACD, Bollinger Bands, and moving averages, suggesting a strengthening price momentum despite mixed signals from broader market theories.

Read More Announcements

Announcement under Regulation 30 (LODR)-Credit Rating

10-Dec-2025 | Source : BSECredit Rating re-affirmed by India Ratings & Research

Announcement under Regulation 30 (LODR)-Allotment of ESOP / ESPS

10-Dec-2025 | Source : BSEAllotment of 571443 equity shares pursuant to exercise of ESOP

Schedule Of Analysts / Institutional Investors Meets - Intimation

10-Dec-2025 | Source : BSEKindly refer the enclosed Intimation regarding Schedule of Institutional Investor Meeting

Corporate Actions

No Upcoming Board Meetings

IDFC First Bank Ltd. has declared 2% dividend, ex-date: 11 Jul 25

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Oct 2025

Shareholding Compare (%holding)

Non Institution

None

Held by 32 Schemes (9.87%)

Held by 567 FIIs (35.6%)

None

President Of India (9.09%)

30.43%

Quarterly Results Snapshot (Standalone) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is 3.06% vs 2.43% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is -23.84% vs 52.12% in Jun 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is 10.33% vs 24.76% in Sep 2024

Growth in half year ended Sep 2025 is -7.54% vs -41.88% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'24

YoY Growth in nine months ended Dec 2024 is 22.55% vs 35.58% in Dec 2023

YoY Growth in nine months ended Dec 2024 is -45.31% vs 36.56% in Dec 2023

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is 20.38% vs 33.42% in Mar 2024

YoY Growth in year ended Mar 2025 is -48.42% vs 21.31% in Mar 2024