Dashboard

High Debt Company with a Debt to Equity ratio (avg) at 3.44 times

- Poor long term growth as Net Sales has grown by an annual rate of -11.52% over the last 5 years

- High Debt Company with a Debt to Equity ratio (avg) at 3.44 times

- The company has reported losses. Due to this company has reported negative ROE

Poor long term growth as Net Sales has grown by an annual rate of -11.52% over the last 5 years

78.89% of Promoter Shares are Pledged

Below par performance in long term as well as near term

Stock DNA

Construction

INR 4,985 Cr (Small Cap)

NA (Loss Making)

38

0.00%

0.87

-34.79%

4.46

Total Returns (Price + Dividend)

Latest dividend: 0.4 per share ex-dividend date: May-30-2011

Risk Adjusted Returns v/s

Returns Beta

News

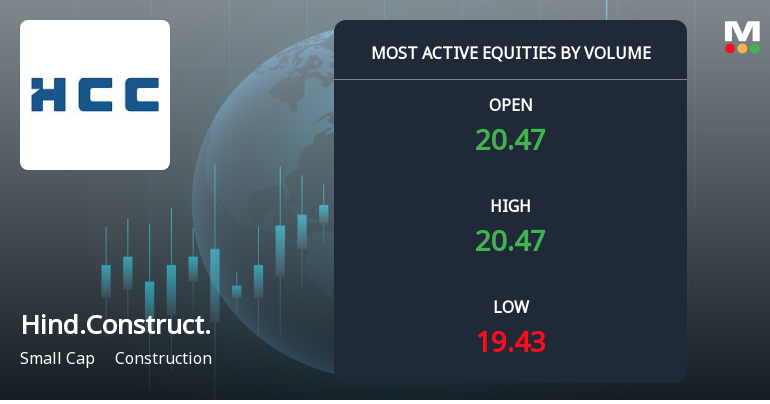

Hindustan Construction Company Sees Exceptional Trading Volume Amid Market Activity

Hindustan Construction Company (HCC) has emerged as one of the most actively traded stocks by volume on 26 December 2025, registering a total traded volume exceeding 2.25 crore shares. This surge in trading activity coincides with a positive price movement, as the stock outperformed its sector and broader market indices, signalling renewed investor interest in the construction sector amid prevailing market conditions.

Read More

Hindustan Construction Company Sees Exceptional Trading Volume Amid Market Volatility

Hindustan Construction Company (HCC) has emerged as one of the most actively traded stocks by volume on 24 December 2025, with over 2.5 crore shares exchanging hands. Despite a decline in price, the stock’s trading activity highlights significant market interest amid a broader construction sector that has shown mixed performance.

Read More

Hindustan Construction Company Sees Elevated Trading Volumes Amid Market Volatility

Hindustan Construction Company (HCC) has emerged as one of the most actively traded stocks today, registering a total traded volume exceeding 1.7 crore shares. Despite a slight decline in price, the stock’s heightened liquidity and trading activity underscore significant investor interest amid a fluctuating construction sector landscape.

Read More Announcements

Hindustan Construction Company Limited - Updates

15-Nov-2019 | Source : NSEHindustan Construction Company Limited has informed the Exchange regarding 'Publication of Unaudited Financial Results of the Company for second quarter ended and half year ended 30th September, 2019'.

Hindustan Construction Company Limited - Analysts/Institutional Investor Meet/Con. Call Updates

14-Nov-2019 | Source : NSEHindustan Construction Company Limited has informed the Exchange regarding Analysts/Institutional Investor Meet/Con. Call Updates

Hindustan Construction Company Limited - Cessation

31-Oct-2019 | Source : NSEHindustan Construction Company Limited has informed the Exchange regarding Cessation of Mr Samuel Joseph as Nominee Director of the company w.e.f. October 30, 2019.

Corporate Actions

No Upcoming Board Meetings

Hindustan Construction Company Ltd has declared 40% dividend, ex-date: 30 May 11

No Splits history available

Hindustan Construction Company Ltd has announced 1:1 bonus issue, ex-date: 10 Aug 10

Hindustan Construction Company Ltd has announced 277:630 rights issue, ex-date: 05 Dec 25

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Non Institution

78.8896

Held by 6 Schemes (0.66%)

Held by 83 FIIs (9.59%)

Hincon Holdings Ltd (11.89%)

Canara Bank-mumbai (1.61%)

55.65%

Quarterly Results Snapshot (Consolidated) - Sep'25 - YoY

YoY Growth in quarter ended Sep 2025 is -31.71% vs -23.23% in Sep 2024

YoY Growth in quarter ended Sep 2025 is -25.26% vs 2,383.21% in Sep 2024

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is -36.33% vs -14.27% in Sep 2024

Growth in half year ended Sep 2025 is 60.26% vs 23.09% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is -19.18% vs -19.74% in Dec 2023

YoY Growth in nine months ended Dec 2024 is -90.29% vs 206.69% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is -20.03% vs -28.91% in Mar 2024

YoY Growth in year ended Mar 2025 is -76.45% vs 1,817.53% in Mar 2024