Dashboard

Poor long term growth as Net Sales has grown by an annual rate of 10.51% and Operating profit at 10.90% over the last 5 years

Negative results in Sep 25

With ROE of 15.7, it has a Very Expensive valuation with a 5.2 Price to Book Value

Below par performance in long term as well as near term

Stock DNA

Garments & Apparels

INR 6,943 Cr (Small Cap)

33.00

22

1.40%

-0.20

15.71%

5.20

Total Returns (Price + Dividend)

Latest dividend: 8 per share ex-dividend date: Nov-14-2025

Risk Adjusted Returns v/s

Returns Beta

News

Garware Tech Sees Revision in Market Evaluation Amid Challenging Financial Trends

Garware Tech, a small-cap player in the Garments & Apparels sector, has experienced a revision in its market evaluation reflecting recent shifts in its financial and technical outlook. This adjustment follows a period marked by subdued profitability and valuation concerns, impacting investor sentiment and stock performance.

Read More

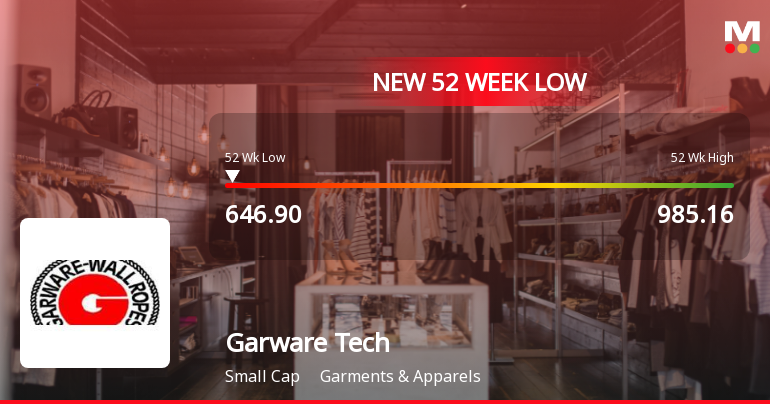

Garware Technical Fibres Falls to 52-Week Low of Rs.646.9 Amidst Continued Downtrend

Garware Technical Fibres has reached a new 52-week low of Rs.646.9, marking a significant decline in its stock price amid a sustained downward trend over recent sessions. The stock’s performance contrasts sharply with broader market indices, reflecting ongoing pressures within the company’s financial metrics and valuation.

Read More

Garware Technical Fibres Falls to 52-Week Low of Rs.646.9 Amidst Prolonged Downtrend

Garware Technical Fibres has reached a new 52-week low of Rs.646.9, marking a significant decline amid a sustained downward trend over recent sessions. The stock’s performance contrasts sharply with broader market indices, reflecting ongoing pressures within the company’s financial metrics and valuation.

Read More Announcements

Announcement under Regulation 30 (LODR)-Newspaper Publication

19-Dec-2025 | Source : BSEPlease find enclosed herewith the copy of newspaper advertisment published in Business Standard (All India) and Loksatta (Pune) editions under signature of Mr. Sunil Agarwal Company Secretary on Friday 19th December 2025.

Shareholder Meeting / Postal Ballot-Notice of Postal Ballot

18-Dec-2025 | Source : BSEPursuant to Regulation 30 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015 please find enclosed herewith a copy of the Postal Ballot Notice dated 25th November 2025

Announcement under Regulation 30 (LODR)-Newspaper Publication

09-Dec-2025 | Source : BSEPlease find enclosed herewith copy of the Notice published in Business Standard (All India) and Loksatta (Pune) editions on Tuesday 09th December 2025 under the signature of Mr. Sunil Agarwal Company Secretary for intimation of re-lodgement of physical shares transfer requests to the Members of the Company.

Corporate Actions

No Upcoming Board Meetings

Garware Technical Fibres Ltd has declared 80% dividend, ex-date: 14 Nov 25

No Splits history available

Garware Technical Fibres Ltd has announced 4:1 bonus issue, ex-date: 03 Jan 25

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Promoters

None

Held by 12 Schemes (10.33%)

Held by 106 FIIs (10.05%)

Garware Capital Markets Limited (17.97%)

Kotak Small Cap Fund (5.35%)

19.41%

Quarterly Results Snapshot (Consolidated) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is -5.26% vs -15.10% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is -39.74% vs -25.29% in Jun 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is -5.51% vs 15.73% in Sep 2024

Growth in half year ended Sep 2025 is -24.52% vs 18.11% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is 17.41% vs 0.89% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 15.70% vs 23.26% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 16.18% vs 1.54% in Mar 2024

YoY Growth in year ended Mar 2025 is 10.12% vs 22.11% in Mar 2024