Dashboard

Strong Long Term Fundamental Strength with an average Return on Equity (ROE) of 20.46%

- Healthy long term growth as Operating profit has grown by an annual rate 47.75%

- Strong ability to service debt as the company has a low Debt to EBITDA ratio of 0.40 times

The company has declared Positive results for the last 3 consecutive quarters

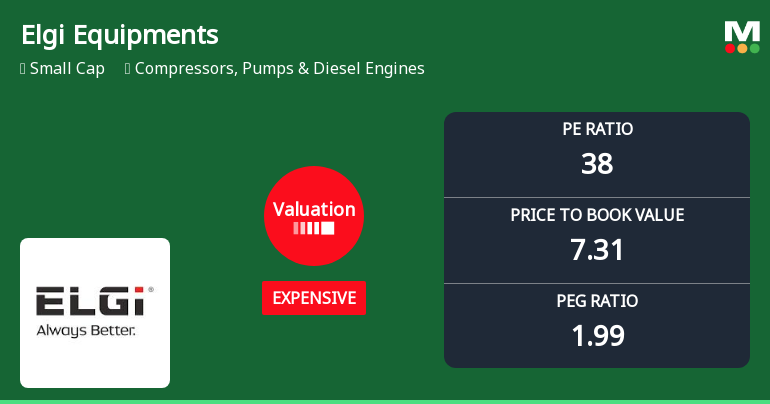

With ROE of 19.4, it has a Expensive valuation with a 7.3 Price to Book Value

High Institutional Holdings at 32.36%

Below par performance in long term as well as near term

Stock DNA

Compressors, Pumps & Diesel Engines

INR 14,548 Cr (Small Cap)

38.00

34

0.48%

-0.17

19.40%

7.31

Total Returns (Price + Dividend)

Latest dividend: 2.2 per share ex-dividend date: Jul-18-2025

Risk Adjusted Returns v/s

Returns Beta

News

Elgi Equipments Valuation Shift Highlights Price Attractiveness Amid Sector Peers

Elgi Equipments, a key player in the Compressors, Pumps & Diesel Engines sector, has experienced a notable revision in its valuation parameters, reflecting a shift in market assessment. This article analyses the recent changes in its price-to-earnings and price-to-book value ratios, comparing them with historical trends and peer companies to provide a comprehensive view of its current price attractiveness.

Read More

Elgi Equipments Ltd is Rated Hold by MarketsMOJO

Elgi Equipments Ltd is rated 'Hold' by MarketsMOJO, with this rating last updated on 17 Nov 2025. While the rating change occurred then, the analysis and financial metrics discussed here reflect the stock's current position as of 25 December 2025, providing investors with an up-to-date perspective on the company’s performance and outlook.

Read More

Elgi Equipments Technical Momentum Shifts Amid Market Volatility

Elgi Equipments, a key player in the Compressors, Pumps & Diesel Engines sector, has experienced notable shifts in its technical momentum, reflecting a complex interplay of bearish and mildly bullish signals across multiple timeframes. This article analyses the recent changes in technical indicators and price movements, placing them in the context of broader market trends and historical performance.

Read More Announcements

Disclosures under Reg. 29(2) of SEBI (SAST) Regulations 2011

15-Dec-2025 | Source : BSEThe Exchange has received the disclosure under Regulation 29(2) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for Wasatch Advisors LP

Disclosures under Reg. 29(2) of SEBI (SAST) Regulations 2011

28-Nov-2025 | Source : BSEThe Exchange has received the disclosure under Regulation 29(2) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for Mitsubishi UFJ Financial Group (MUFG) & PACs

Disclosures under Reg. 29(2) of SEBI (SAST) Regulations 2011

28-Nov-2025 | Source : BSEThe Exchange has received the disclosure under Regulation 29(2) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for SBI Mutual Fund

Corporate Actions

No Upcoming Board Meetings

Elgi Equipments Ltd has declared 220% dividend, ex-date: 18 Jul 25

No Splits history available

Elgi Equipments Ltd has announced 1:1 bonus issue, ex-date: 24 Sep 20

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Non Institution

0.6719

Held by 17 Schemes (4.71%)

Held by 161 FIIs (26.12%)

Dark Horse Portfolio Investment Private Limited (20.1%)

Pari Washington India Master Fund Ltd. (5.09%)

21.88%

Quarterly Results Snapshot (Consolidated) - Sep'25 - YoY

YoY Growth in quarter ended Sep 2025 is 11.41% vs 7.78% in Sep 2024

YoY Growth in quarter ended Sep 2025 is 28.17% vs 3.76% in Sep 2024

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 9.87% vs 9.15% in Sep 2024

Growth in half year ended Sep 2025 is 23.53% vs 10.41% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is 7.05% vs 6.66% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 5.30% vs 17.41% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 9.10% vs 5.82% in Mar 2024

YoY Growth in year ended Mar 2025 is 12.25% vs -15.89% in Mar 2024