Dashboard

Strong Long Term Fundamental Strength with an average Return on Capital Employed (ROCE) of 30.45%

- Healthy long term growth as Net Sales has grown by an annual rate of 64.62% and Operating profit at 54.63%

- Strong ability to service debt as the company has a low Debt to EBITDA ratio of 0.31 times

With a growth in Operating Profit of 151.3%, the company declared Very Positive results in Sep 25

With ROCE of 31.8, it has a Expensive valuation with a 15.7 Enterprise value to Capital Employed

High Institutional Holdings at 49.63%

Stock DNA

Electronics & Appliances

INR 75,857 Cr (Mid Cap)

59.00

59

0.06%

0.18

31.12%

18.86

Total Returns (Price + Dividend)

Latest dividend: 8 per share ex-dividend date: Sep-16-2025

Risk Adjusted Returns v/s

Returns Beta

News

Dixon Technologies (India) Ltd is Rated Hold

Dixon Technologies (India) Ltd is rated 'Hold' by MarketsMOJO, with this rating last updated on 03 Nov 2025. While the rating change occurred on that date, the analysis and financial metrics discussed here reflect the stock's current position as of 28 December 2025, providing investors with an up-to-date perspective on the company’s fundamentals, valuation, financial trends, and technical outlook.

Read More

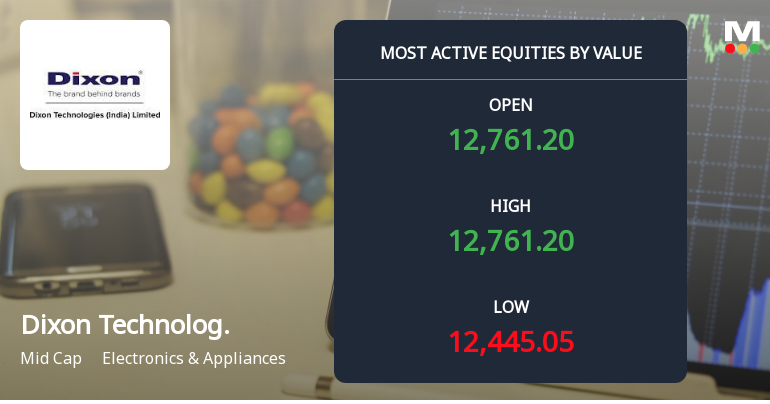

Dixon Technologies (India) Sees High Value Trading Amid Market Volatility

Dixon Technologies (India) Ltd has emerged as one of the most actively traded stocks by value in recent sessions, reflecting significant investor interest despite a series of price declines. The company’s shares have experienced notable trading volumes and value turnover, underscoring its prominence within the Electronics & Appliances sector amid a broader market downturn.

Read More

Dixon Technologies Sees Heavy Put Option Activity Ahead of December Expiry

Dixon Technologies (India) Ltd has emerged as one of the most actively traded stocks in the put options segment as the 30 December 2025 expiry approaches, signalling notable bearish positioning and hedging activity among market participants. The stock’s recent price performance and option market data suggest a cautious outlook from investors amid a broader sector underperformance.

Read More Announcements

Dixon Technologies (India) Limited - Analysts/Institutional Investor Meet/Con. Call Updates

09-Dec-2019 | Source : NSEDixon Technologies (India) Limited has informed the Exchange regarding Analysts/Institutional Investor Meet/Con. Call Updates

Dixon Technologies (India) Limited - Analysts/Institutional Investor Meet/Con. Call Updates

27-Nov-2019 | Source : NSEDixon Technologies (India) Limited has informed the Exchange regarding Analysts/Institutional Investor Meet/Con. Call Updates

Dixon Technologies (India) Limited - Analysts/Institutional Investor Meet/Con. Call Updates

26-Nov-2019 | Source : NSEDixon Technologies (India) Limited has informed the Exchange regarding Analysts/Institutional Investor Meet/Con. Call Updates

Corporate Actions

No Upcoming Board Meetings

Dixon Technologies (India) Ltd has declared 400% dividend, ex-date: 16 Sep 25

Dixon Technologies (India) Ltd has announced 2:10 stock split, ex-date: 18 Mar 21

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Promoters

None

Held by 40 Schemes (22.66%)

Held by 813 FIIs (20.69%)

Psv Family Trust Under The Trustees Mr. Sunil Vachani And Mrs. Gayatri Vachani (15.62%)

Kamla Vachani (6.28%)

10.35%

Quarterly Results Snapshot (Consolidated) - Sep'25 - YoY

YoY Growth in quarter ended Sep 2025 is 28.79% vs 133.33% in Sep 2024

YoY Growth in quarter ended Sep 2025 is 71.86% vs 263.26% in Sep 2024

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 52.87% vs 120.51% in Sep 2024

Growth in half year ended Sep 2025 is 70.95% vs 197.22% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is 119.20% vs 42.80% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 154.87% vs 55.88% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 119.66% vs 45.10% in Mar 2024

YoY Growth in year ended Mar 2025 is 197.90% vs 43.92% in Mar 2024