Stock DNA

Specialty Chemicals

INR 16,946 Cr (Small Cap)

44.00

31

0.51%

-0.01

10.02%

4.44

Total Returns (Price + Dividend)

Latest dividend: 20 per share ex-dividend date: Jul-30-2025

Risk Adjusted Returns v/s

Returns Beta

News

BASF India Sees Revision in Market Assessment Amidst Challenging Trends

BASF India has experienced a revision in its market evaluation, reflecting shifts in key analytical parameters that influence investor sentiment. The specialty chemicals company’s recent assessment highlights a complex interplay of strengths and weaknesses across quality, valuation, financial trends, and technical outlook, set against a backdrop of subdued stock performance and sector dynamics.

Read More

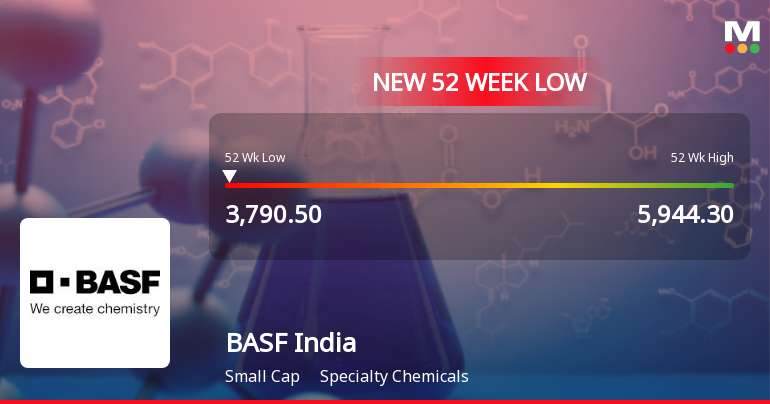

BASF India Stock Falls to 52-Week Low of Rs.3802.65 Amidst Sector Pressure

BASF India has reached a new 52-week low of Rs.3802.65, marking a significant price level for the specialty chemicals company as it continues to trade below key moving averages amid a subdued market environment.

Read More

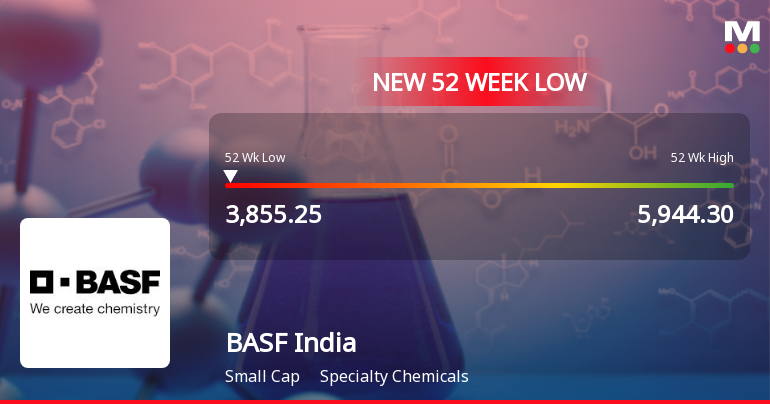

BASF India Stock Falls to 52-Week Low of Rs.3855.25 Amidst Sector Pressure

BASF India’s share price touched a fresh 52-week low of Rs.3855.25 today, marking a significant decline amid a broader sectoral downturn. The stock has been trading below all major moving averages and has recorded a consecutive two-day fall, reflecting ongoing pressures within the specialty chemicals industry.

Read More Announcements

Closure of Trading Window

23-Dec-2025 | Source : BSEIntimation of closure of Trading Window for the purpose of unaudited standalone and consolidated financial results of the Company for the quarter ending 31st December 2025

Board Meeting Intimation for Unaudited Standalone And Consolidated Financial Results Of The Company For The Quarter Ending 31St December 2025

23-Dec-2025 | Source : BSEBASF India Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 13/02/2026 inter alia to consider and approve Unaudited Standalone and Consolidated Financial Results of the Company for the Quarter ending 31st December 2025

Announcement under Regulation 30 (LODR)-Newspaper Publication

27-Nov-2025 | Source : BSENewspaper Advertisement for Notice of Postal Ballot and Remote E - Voting facility to the members

Corporate Actions

13 Feb 2026

BASF India Ltd has declared 200% dividend, ex-date: 30 Jul 25

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Promoters

None

Held by 21 Schemes (3.41%)

Held by 119 FIIs (4.14%)

Basf Societas Europaea (52.75%)

Tata Mutual Fund - Tata Small Cap Fund (2.37%)

11.47%

Quarterly Results Snapshot (Standalone) - Sep'25 - YoY

YoY Growth in quarter ended Sep 2025 is -8.09% vs 14.65% in Sep 2024

YoY Growth in quarter ended Sep 2025 is -21.02% vs -14.19% in Sep 2024

Half Yearly Results Snapshot (Consolidated) - Sep'25

Not Applicable: The company has declared_date for only one period

Not Applicable: The company has declared_date for only one period

Nine Monthly Results Snapshot (Consolidated) - Dec'24

Not Applicable: The company has declared_date for only one period

Not Applicable: The company has declared_date for only one period

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 10.84% vs 81.28% in Mar 2024

YoY Growth in year ended Mar 2025 is -14.95% vs 2,364.00% in Mar 2024