Dashboard

Strong lending practices with low Gross NPA ratio of 2.16%

Strong Long Term Fundamental Strength with a 195.58% CAGR growth in Net Profits

Healthy long term growth as Net profit has grown by an annual rate of 195.58%

With ROA of 1.1, it has a Attractive valuation with a 1 Price to Book Value

Total Returns (Price + Dividend)

Latest dividend: 8.34 per share ex-dividend date: Jun-06-2025

Risk Adjusted Returns v/s

Returns Beta

News

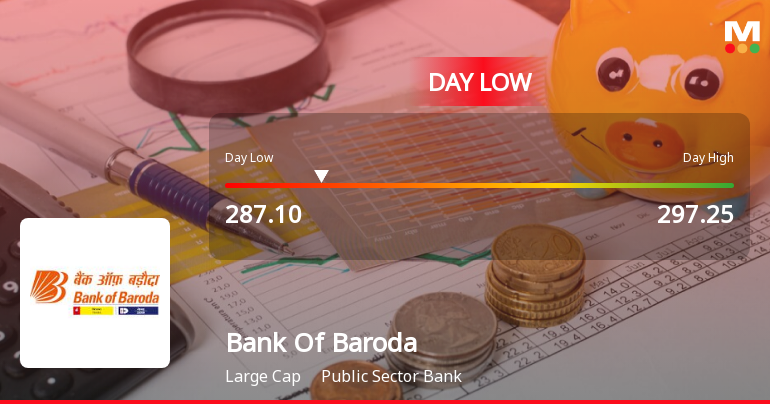

Bank Of Baroda Hits Intraday Low Amid Price Pressure and Sector Weakness

Bank Of Baroda experienced a notable intraday decline on 8 December 2025, touching a low of ₹283.7 as the stock faced downward pressure amid broader sectoral weakness and a retreat in benchmark indices.

Read More

Bank Of Baroda Hits Intraday Low Amid Price Pressure and Sector Weakness

Bank Of Baroda experienced a notable intraday decline on 3 December 2025, touching a low of Rs 287.1 as it faced downward pressure amid a broader sector downturn and subdued market sentiment.

Read More

Bank Of Baroda Hits New 52-Week High of Rs.303.9 Marking Significant Milestone

Bank Of Baroda has reached a new 52-week high of Rs.303.9, reflecting a notable milestone in its market performance. This achievement underscores the stock’s sustained momentum amid a mixed broader market environment.

Read More Announcements

Subscription Of Shares Of Indian Digital Payment Intelligence Corporation

11-Dec-2025 | Source : BSESubscription of Shares of Indian Digital Payment Intelligence Corporation (IDPIC)

Group Investor Conference Intimation

11-Dec-2025 | Source : BSEGroup Investor Conference Intimation

Disclosure Under Regulation 30 Of The SEBI (LODR) Regulations 2015

10-Dec-2025 | Source : BSEDisclosure under Regulation 30 of the SEBI (LODR) Regulations 2015

Corporate Actions

No Upcoming Board Meetings

Bank Of Baroda has declared 417% dividend, ex-date: 06 Jun 25

Bank Of Baroda has announced 2:10 stock split, ex-date: 22 Jan 15

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Promoters

None

Held by 40 Schemes (10.04%)

Held by 661 FIIs (8.71%)

President Of India (63.97%)

Lic Ulip Growth Fund (6.64%)

6.87%

Quarterly Results Snapshot (Standalone) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is 1.35% vs -0.08% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is 5.90% vs -10.03% in Jun 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is 4.5% vs 10.09% in Sep 2024

Growth in half year ended Sep 2025 is -3.56% vs 16.50% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'24

YoY Growth in nine months ended Dec 2024 is 9.39% vs 30.27% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 12.64% vs 38.22% in Dec 2023

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is 8.61% vs 25.69% in Mar 2024

YoY Growth in year ended Mar 2025 is 10.08% vs 26.08% in Mar 2024