Total Returns (Price + Dividend)

Latest dividend: 3.5 per share ex-dividend date: Nov-17-2025

Risk Adjusted Returns v/s

Returns Beta

News

Balrampur Chini Mills Ltd is Rated Sell

Balrampur Chini Mills Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 11 Nov 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 29 December 2025, providing investors with an up-to-date view of its fundamentals, returns, and technical outlook.

Read More

Balrampur Chini’s Evaluation Revised Amidst Challenging Market Conditions

Balrampur Chini’s recent assessment has been revised, reflecting changes in its underlying fundamentals and market dynamics. The sugar sector stock, classified as a small-cap, continues to navigate a difficult environment marked by subdued financial trends and bearish technical signals.

Read More

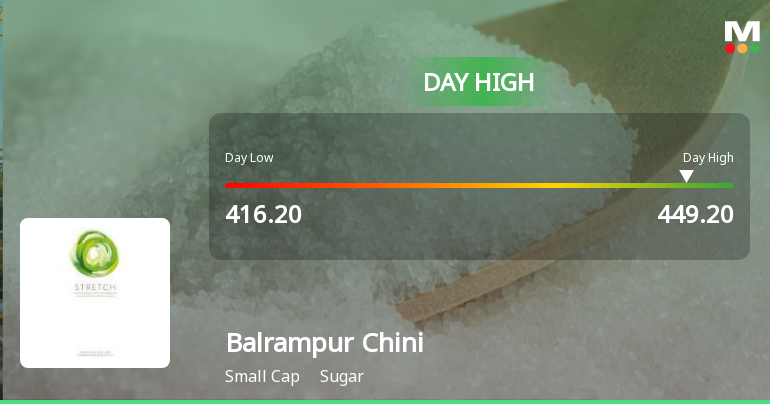

Balrampur Chini Mills Hits Intraday High with Strong 7.46% Surge

Balrampur Chini Mills recorded a robust intraday performance on 10 Dec 2025, touching a high of ₹447.2, marking a 7.46% rise from its previous close. This surge outpaced the broader sugar sector and the Sensex, reflecting notable trading momentum in the stock.

Read More Announcements

Closure of Trading Window

26-Dec-2025 | Source : BSEClosure of Trading Window on and from 1st January 2026 till the expiry of 48 hours after the declaration of Un-Audited Financial Results for the quarter and nine months ended 31st December 2025.

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

24-Dec-2025 | Source : BSECompanys Management will be participating an Analyst(s)/Investor(s) Meet hosted by B&K Securities India Private Limited (360 One)

Communication To The Shareholders

11-Dec-2025 | Source : BSECommunication to the shareholders regarding (1). Non-submission of KYC documents and/or insufficient bank details (2). Dividend payment -withheld vide SEBI Circulars

Corporate Actions

No Upcoming Board Meetings

Balrampur Chini Mills Ltd has declared 350% dividend, ex-date: 17 Nov 25

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Promoters

None

Held by 24 Schemes (25.4%)

Held by 138 FIIs (11.21%)

Saraogi Family Trust (vivek Saraogi-trustee) (25.97%)

Sbi Mutual Fund (6.61%)

14.71%

Quarterly Results Snapshot (Consolidated) - Sep'25 - YoY

YoY Growth in quarter ended Sep 2025 is 28.72% vs -15.69% in Sep 2024

YoY Growth in quarter ended Sep 2025 is -19.78% vs -59.59% in Sep 2024

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 18.15% vs -7.15% in Sep 2024

Growth in half year ended Sep 2025 is -23.21% vs -42.72% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is -5.96% vs 31.03% in Dec 2023

YoY Growth in nine months ended Dec 2024 is -37.24% vs 1,014.03% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is -3.19% vs 19.89% in Mar 2024

YoY Growth in year ended Mar 2025 is -18.25% vs 88.08% in Mar 2024