Dashboard

Strong Long Term Fundamental Strength with an average Return on Equity (ROE) of 18.15%

- Healthy long term growth as Operating profit has grown by an annual rate of 26.28%

- PAT(Latest six months) At Rs 9,574.97 cr has Grown at 21.02%

- NET SALES(Q) Highest at Rs 20,178.90 cr

- PBDIT(Q) Highest at Rs 13,872.31 cr.

High Institutional Holdings at 36.44%

Company is among the highest 1% of companies rated by MarketsMojo across all 4,000 stocks

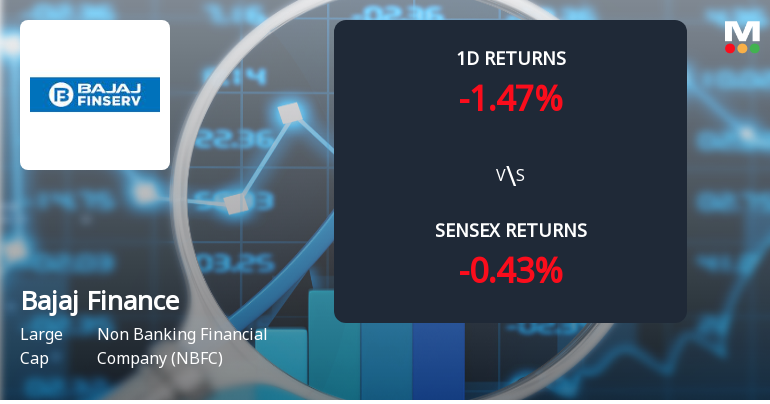

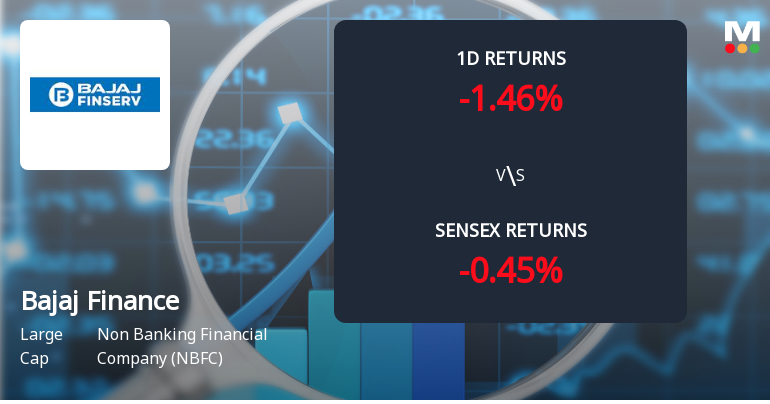

Market Beating Performance

With its market cap of Rs 6,31,489 cr, it is the biggest company in the sector and constitutes 11.12% of the entire sector

Stock DNA

Non Banking Financial Company (NBFC)

INR 625,111 Cr (Large Cap)

34.00

24

0.55%

3.85

17.73%

6.12

Total Returns (Price + Dividend)

Latest dividend: 44 per share ex-dividend date: May-30-2025

Risk Adjusted Returns v/s

Returns Beta

News

Bajaj Finance Ltd is Rated Buy

Bajaj Finance Ltd is rated 'Buy' by MarketsMOJO, with this rating last updated on 17 Mar 2025. While the rating was revised on that date, the analysis and financial metrics discussed here reflect the stock's current position as of 28 December 2025, providing investors with an up-to-date view of its fundamentals, returns, and market standing.

Read More

Bajaj Finance Sees Notable Surge in Open Interest Amid Market Volatility

Bajaj Finance Ltd has experienced a significant rise in open interest in its derivatives segment, signalling heightened market activity and evolving investor positioning. This development comes amid a backdrop of mixed price movements and shifting volume patterns, reflecting nuanced market sentiment towards the prominent Non Banking Financial Company (NBFC).

Read More

Bajaj Finance Sees Notable Surge in Derivatives Open Interest Amid Market Volatility

Bajaj Finance Ltd has witnessed a significant rise in open interest within its derivatives segment, signalling heightened market activity and evolving investor positioning. This development comes amid a backdrop of mixed price movements and shifting volume patterns, offering insights into potential directional bets on the large-cap Non Banking Financial Company (NBFC) stock.

Read More Announcements

Announcement under Regulation 30 (LODR)-Investor Presentation

05-Dec-2025 | Source : BSESubmission of investor / analyst Group Meet presentation

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Outcome

05-Dec-2025 | Source : BSEIntimation of Audio Recording of Analyst/Investor Group Meet

Intimation Under Regulation 30 Of SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015 -Sale Of Shares Of Subsidiary Company.

02-Dec-2025 | Source : BSEThe Company today sold 166600000 equity shares representing 1.9994% of Bajaj Housing Finance Limited paid-up equity share capital at Rs. 95.3074 per equity shares in open market by executing a bulk deal.

Corporate Actions

No Upcoming Board Meetings

Bajaj Finance Ltd has declared 2200% dividend, ex-date: 30 May 25

Bajaj Finance Ltd has announced 1:2 stock split, ex-date: 16 Jun 25

Bajaj Finance Ltd has announced 4:1 bonus issue, ex-date: 16 Jun 25

Bajaj Finance Ltd has announced 3:19 rights issue, ex-date: 23 Jan 13

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Promoters

None

Held by 48 Schemes (8.89%)

Held by 1334 FIIs (19.48%)

Bajaj Finserv Limited (51.32%)

Government Of Singapore - E (2.5%)

6.73%

Quarterly Results Snapshot (Consolidated) - Sep'25 - YoY

YoY Growth in quarter ended Sep 2025 is 18.06% vs 27.72% in Sep 2024

YoY Growth in quarter ended Sep 2025 is 21.89% vs 12.64% in Sep 2024

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 19.62% vs 28.25% in Sep 2024

Growth in half year ended Sep 2025 is 21.02% vs 13.22% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is 27.93% vs 33.31% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 14.41% vs 27.27% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 26.76% vs 32.75% in Mar 2024

YoY Growth in year ended Mar 2025 is 15.13% vs 25.58% in Mar 2024