Dashboard

Weak Long Term Fundamental Strength with a -1.86% CAGR growth in Operating Profits over the last 5 years

- NET SALES(Q) At Rs 228.29 cr has Fallen at -31.4% (vs previous 4Q average)

- PAT(Q) At Rs 0.07 cr has Fallen at -96.8% (vs previous 4Q average)

- OPERATING PROFIT TO INTEREST (Q) Lowest at 0.30 times

38.28% of Promoter Shares are Pledged

Below par performance in long term as well as near term

Total Returns (Price + Dividend)

Anmol India for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

Anmol India Ltd is Rated Strong Sell

Anmol India Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 14 Nov 2025. However, the analysis and financial metrics discussed below reflect the stock's current position as of 25 December 2025, providing investors with the latest insights into the company’s performance and outlook.

Read More

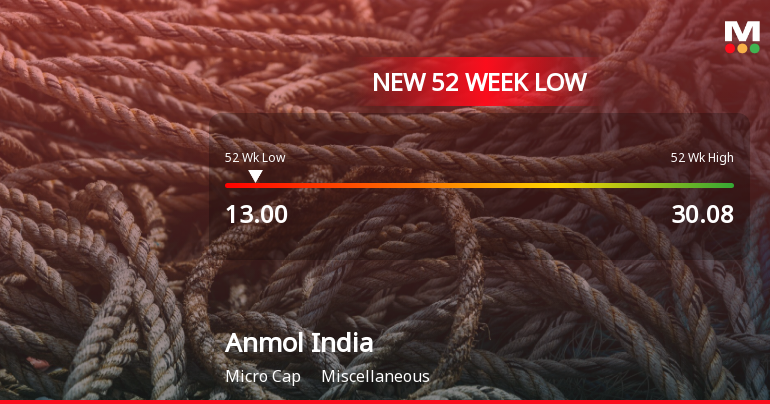

Anmol India Stock Falls to 52-Week Low of Rs.13 Amidst Market Pressure

Anmol India’s share price reached a fresh 52-week low of Rs.13 today, marking a significant decline amid broader market fluctuations and sectoral underperformance. The stock’s fall comes after a brief two-day rally, reflecting ongoing pressures within the company’s financial performance and market sentiment.

Read More

Anmol India Sees Revision in Market Assessment Amidst Challenging Fundamentals

Anmol India has undergone a revision in its market evaluation reflecting a more cautious outlook due to persistent weaknesses in its financial and technical parameters. The stock’s recent assessment highlights ongoing challenges in profitability and market momentum, underscoring the need for investors to carefully consider the company’s current position within the miscellaneous sector.

Read More Announcements

Submission Of Voting Results Of The Extra- Ordinary General Meeting Of Anmol India Limited Held On 26Th December 2025

27-Dec-2025 | Source : BSEWe hereby inform that the Extra- Ordinary General Meeting of the Company was held on 26th December 2025 at the Registered Office of the Company. In this regard we hereby submit the Voting Results and the scrutinizers report.

Shareholder Meeting / Postal Ballot-Outcome of EGM

26-Dec-2025 | Source : BSEAs per Regulation 30 of SEBI (LODR) 2015 we hereby inform you that the Extra- Ordinary General Meeting of the Company was held on Friday the 26th December 2025 at the Registered Office of the Company through physical mode.

Shareholder Meeting / Postal Ballot-Outcome of EGM

26-Dec-2025 | Source : BSERevised Outcome of Extra- Ordinary General Meeting held today i.e. 26th December 2025

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

Anmol India Ltd has announced 4:1 bonus issue, ex-date: 18 Jul 23

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Promoters

38.2763

Held by 0 Schemes

Held by 0 FIIs

Chakshu Goyal (18.76%)

Kapil (6.88%)

39.41%

Quarterly Results Snapshot (Standalone) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is -60.46% vs 83.74% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is -98.78% vs 257.50% in Jun 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is 14.00% vs 1.78% in Sep 2024

Growth in half year ended Sep 2025 is 16.77% vs -60.02% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'24

YoY Growth in nine months ended Dec 2024 is -12.59% vs 5.60% in Dec 2023

YoY Growth in nine months ended Dec 2024 is -68.26% vs 19.41% in Dec 2023

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is -15.12% vs 6.45% in Mar 2024

YoY Growth in year ended Mar 2025 is -66.56% vs 12.00% in Mar 2024