Dashboard

Weak Long Term Fundamental Strength with a -211.39% CAGR growth in Operating Profits over the last 5 years

- Low ability to service debt as the company has a high Debt to EBITDA ratio of 23.51 times

- The company has been able to generate a Return on Equity (avg) of 1.77% signifying low profitability per unit of shareholders funds

- OPERATING CF(Y) Lowest at Rs 0.12 Cr

- DEBT-EQUITY RATIO(HY) Highest at 2.26 times

- DPS(Y) Lowest at Rs 0.00

Risky - Negative Operating Profits

Consistent Underperformance against the benchmark over the last 3 years

Stock DNA

Cement & Cement Products

INR 352 Cr (Micro Cap)

NA (Loss Making)

36

0.00%

2.25

-20.39%

1.69

Total Returns (Price + Dividend)

Latest dividend: 3 per share ex-dividend date: Sep-08-2022

Risk Adjusted Returns v/s

Returns Beta

News

Anjani Portland Sees Revision in Market Assessment Amid Challenging Fundamentals

Anjani Portland, a microcap player in the Cement & Cement Products sector, has experienced a revision in its market assessment reflecting a more cautious outlook. This shift is driven by a combination of fundamental and technical factors that highlight ongoing challenges in the company’s financial health and market performance.

Read More

Anjani Portland Sees Revision in Market Evaluation Amid Challenging Fundamentals

Anjani Portland’s market evaluation has undergone a notable revision reflecting shifts in its fundamental and technical outlook. The cement sector company’s recent assessment highlights a combination of financial challenges and market dynamics that have influenced investor sentiment and stock performance.

Read More

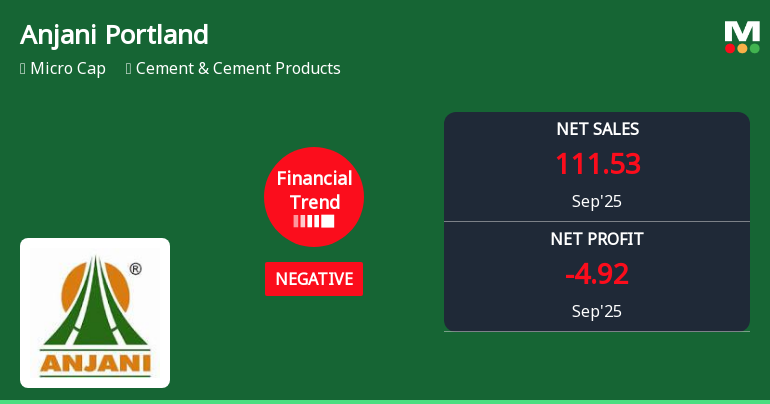

Anjani Portland Cement Reports Negative Financial Trend Amidst Revenue Growth

Anjani Portland Cement has exhibited a shift in its financial trajectory during the quarter ending September 2025, with recent data indicating a negative trend in key performance parameters despite notable revenue growth over the past six months. This development contrasts with the company’s historical performance and broader market benchmarks, signalling a complex outlook for investors in the cement sector.

Read More Announcements

Shareholder Meeting / Postal Ballot-Scrutinizers Report

26-Dec-2025 | Source : BSEVoting results with Scrutinizers report

Shareholder Meeting / Postal Ballot-Outcome of Postal_Ballot

26-Dec-2025 | Source : BSEVoting results with Scrutinizers report

Closure of Trading Window

22-Dec-2025 | Source : BSEIntimation of Closure of Trading Window

Corporate Actions

No Upcoming Board Meetings

Anjani Portland Cement Ltd has declared 30% dividend, ex-date: 08 Sep 22

No Splits history available

No Bonus history available

Anjani Portland Cement Ltd has announced 1:2 rights issue, ex-date: 16 Dec 22

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Promoters

None

Held by 1 Schemes (0.09%)

Held by 1 FIIs (0.01%)

Chettinad Cement Corporation Private Limited (75.0%)

None

18.32%

Quarterly Results Snapshot (Consolidated) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is -20.07% vs 0.48% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is -44.71% vs 73.83% in Jun 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 35.09% vs -37.85% in Sep 2024

Growth in half year ended Sep 2025 is 82.40% vs -64.42% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is -37.52% vs -11.83% in Dec 2023

YoY Growth in nine months ended Dec 2024 is -95.59% vs 16.13% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is -31.07% vs -5.68% in Mar 2024

YoY Growth in year ended Mar 2025 is -106.86% vs 32.80% in Mar 2024