Dashboard

Poor Management Efficiency with a low ROE of 9.53%

- The company has been able to generate a Return on Equity (avg) of 9.53% signifying low profitability per unit of shareholders funds

Poor long term growth as Net Sales has grown by an annual rate of 13.27% over the last 5 years

The company has declared Negative results for the last 3 consecutive quarters

With ROE of 1.6, it has a Very Expensive valuation with a 1.5 Price to Book Value

Below par performance in long term as well as near term

Stock DNA

Computers - Software & Consulting

INR 228 Cr (Micro Cap)

98.00

28

0.00%

-0.24

1.57%

1.53

Total Returns (Price + Dividend)

Airan for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

Airan Ltd is Rated Strong Sell

Airan Ltd is rated Strong Sell by MarketsMOJO. This rating was last updated on 27 Oct 2025, reflecting a reassessment of the stock’s outlook. However, all fundamentals, returns, and financial metrics discussed here are current as of 24 December 2025, providing investors with the latest perspective on the company’s position.

Read More

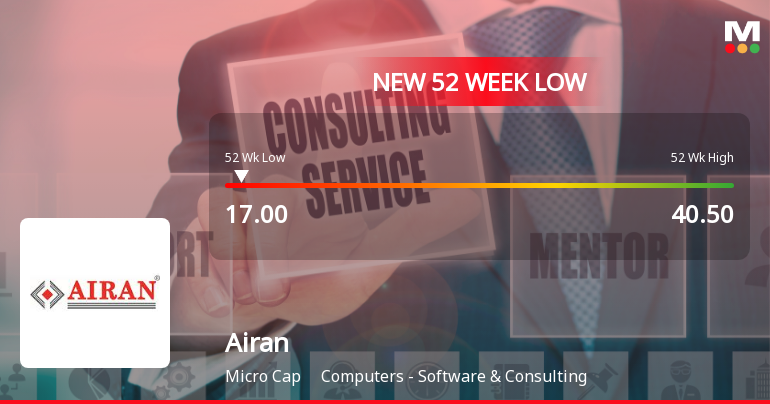

Airan Stock Falls to 52-Week Low Amidst Prolonged Underperformance

Shares of Airan, a company operating in the Computers - Software & Consulting sector, have reached a 52-week low, reflecting a significant decline in market value over the past year. The stock's latest low price marks a notable point in its ongoing performance trajectory.

Read More

Airan Stock Falls to 52-Week Low of Rs.17 Amidst Prolonged Downtrend

Shares of Airan, a company operating in the Computers - Software & Consulting sector, reached a new 52-week low of Rs.17 today, marking a significant milestone in a sustained period of decline. The stock has been on a downward trajectory for nine consecutive trading sessions, reflecting a cumulative return of -11.58% during this stretch.

Read More Announcements

Closure of Trading Window

27-Dec-2025 | Source : BSEClosure of Trading Window

Board Meeting Outcome for Outcome Of Board Meeting Held Today I.E. On Friday November 14 2025 In Terms Of Second Proviso To Regulation 30(6) Of SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015.

14-Nov-2025 | Source : BSEOutcome of Board Meeting held today i.e. on Friday November 14 2025 in terms of second proviso to Regulation 30(6) of SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015.

Submission Of Unaudited Standalone & Consolidated Financial Result Of The Company For The Quarter And Half Year Ended On September 30 2025 Along With Limited Review Report

14-Nov-2025 | Source : BSESubmission of Unaudited Standalone & Consolidated Financials Results of the Company for the quarter and half year ended on September 30 2025 along with Limited Review Report.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

Airan Ltd has announced 2:2 stock split, ex-date: 14 Aug 18

Airan Ltd has announced 1:1 bonus issue, ex-date: 22 Apr 19

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 1 FIIs (0.0%)

Airan Network Private Limited (33.59%)

None

24.13%

Quarterly Results Snapshot (Consolidated) - Sep'25 - YoY

YoY Growth in quarter ended Sep 2025 is 0.15% vs -1.54% in Sep 2024

YoY Growth in quarter ended Sep 2025 is 145.18% vs -154.25% in Sep 2024

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is -0.80% vs 3.72% in Sep 2024

Growth in half year ended Sep 2025 is -80.57% vs 311.27% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is 4.53% vs 5.68% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 177.02% vs 5.18% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 0.95% vs 8.33% in Mar 2024

YoY Growth in year ended Mar 2025 is 46.69% vs 21.14% in Mar 2024