Dashboard

Healthy long term growth as Net Sales has grown by an annual rate of 24.85% and Operating profit at 27.95%

The company has declared Positive results for the last 11 consecutive quarters

With ROCE of 14.2, it has a Very Expensive valuation with a 3.3 Enterprise value to Capital Employed

Rising Promoter Confidence

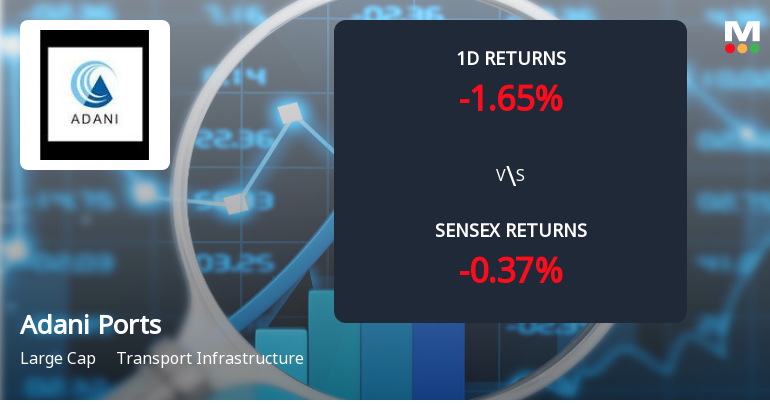

Consistent Returns over the last 3 years

Stock DNA

Transport Infrastructure

INR 335,030 Cr (Large Cap)

27.00

30

0.47%

0.68

17.89%

4.79

Total Returns (Price + Dividend)

Latest dividend: 7 per share ex-dividend date: Jun-13-2025

Risk Adjusted Returns v/s

Returns Beta

News

Adani Ports Sees Sharp Open Interest Surge Amid Mixed Market Signals

Adani Ports & Special Economic Zone Ltd has witnessed a notable 14.04% surge in open interest in its derivatives segment, signalling heightened market activity despite the stock’s recent underperformance. This spike in open interest, coupled with volume patterns and shifting market positioning, offers a nuanced view of investor sentiment and potential directional bets in the transport infrastructure sector.

Read More

Adani Ports Sees Sharp Open Interest Surge Amid Mixed Market Signals

Adani Ports & Special Economic Zone Ltd has witnessed a notable 13.11% increase in open interest in its derivatives segment, signalling heightened market activity despite the stock’s recent underperformance. This surge in open interest, coupled with volume patterns and shifting market positioning, offers a nuanced view of investor sentiment and potential directional bets in the transport infrastructure sector.

Read More

Adani Ports Sees Significant Open Interest Surge Amid Mixed Market Signals

Adani Ports & Special Economic Zone Ltd has witnessed a notable 11.8% increase in open interest in its derivatives segment, signalling heightened market activity despite the stock’s recent underperformance. This surge in open interest, coupled with volume patterns and shifting market positioning, offers valuable insights into investor sentiment and potential directional bets in the transport infrastructure sector.

Read More Announcements

Disclosures under Reg. 29(2) of SEBI (SAST) Regulations 2011

26-Dec-2025 | Source : BSEThe Exchange has received the disclosure under Regulation 29(2) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for 2023 Market Purchase

Allotment Of Equity Shares On Preferential Basis

23-Dec-2025 | Source : BSEAllotment of Equity Shares on Preferential Basis

Disclosures under Reg. 29(2) of SEBI (SAST) Regulations 2011

12-Dec-2025 | Source : BSEThe Exchange has received the disclosure under Regulation 29(2) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for Life Insurance Corporation of India

Corporate Actions

No Upcoming Board Meetings

Adani Ports & Special Economic Zone Ltd has declared 350% dividend, ex-date: 13 Jun 25

Adani Ports & Special Economic Zone Ltd has announced 2:10 stock split, ex-date: 23 Sep 10

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 40 Schemes (5.23%)

Held by 696 FIIs (12.76%)

Gautambhai Shantilal Adani & Rajeshbhai Shantilal Adani (on Behalf Of S. B. Adani Family Trust) (30.85%)

Life Insurance Corporation Of India (7.25%)

4.11%

Quarterly Results Snapshot (Consolidated) - Sep'25 - YoY

YoY Growth in quarter ended Sep 2025 is 29.72% vs 6.33% in Sep 2024

YoY Growth in quarter ended Sep 2025 is 27.16% vs 39.89% in Sep 2024

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 25.07% vs 13.44% in Sep 2024

Growth in half year ended Sep 2025 is 15.58% vs 43.89% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is 14.01% vs 31.61% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 33.06% vs 46.24% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 16.35% vs 28.10% in Mar 2024

YoY Growth in year ended Mar 2025 is 36.76% vs 52.78% in Mar 2024