Dashboard

Weak Long Term Fundamental Strength as the company has not declared results in the last 6 months

- Low ability to service debt as the company has a high Debt to EBITDA ratio of 8.73 times

- The company has been able to generate a Return on Equity (avg) of 0.50% signifying low profitability per unit of shareholders funds

Risky - No result in last 6 months

Stock DNA

Diversified Retail

INR 22 Cr (Micro Cap)

NA (Loss Making)

83

0.00%

-28.35

562.56%

-0.08

Total Returns (Price + Dividend)

Latest dividend: 0.20000000000000004 per share ex-dividend date: Aug-21-2017

Risk Adjusted Returns v/s

Returns Beta

News

Future Enterprises Ltd is Rated Strong Sell

Future Enterprises Ltd is rated Strong Sell by MarketsMOJO. This rating was last updated on 09 December 2024. However, the analysis and financial metrics discussed below reflect the stock’s current position as of 26 December 2025, providing investors with an up-to-date view of the company’s fundamentals, returns, and market standing.

Read More

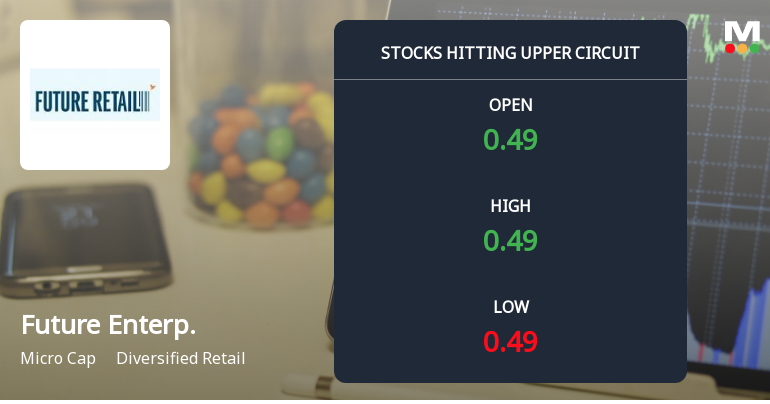

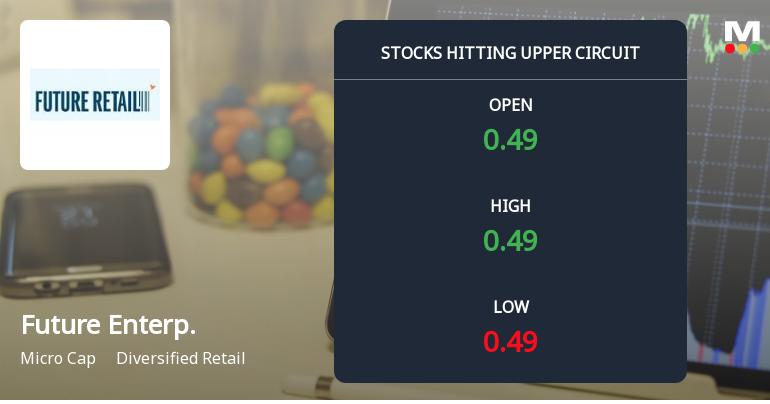

Future Enterprises Hits Upper Circuit Amid Strong Buying Pressure

Shares of Future Enterprises Ltd surged to hit the upper circuit limit on 26 Dec 2025, reflecting robust buying interest and a maximum permissible daily gain of 2.13%. The stock outperformed its sector and benchmark indices despite subdued delivery volumes, signalling a concentrated demand that led to a regulatory trading freeze.

Read More

Future Enterprises Hits Upper Circuit Amid Strong Buying Pressure

Shares of Future Enterprises Ltd surged to hit the upper circuit limit on 24 Dec 2025, reflecting robust demand and intense buying interest in the micro-cap stock within the diversified retail sector. The stock’s price movement was accompanied by a regulatory freeze on further trading, underscoring the significant unfilled demand and market enthusiasm despite a modest turnover.

Read More Announcements

Corporate Insolvency Resolution Process (CIRP)-Intimation of meeting of Committee of Creditors

11-Nov-2025 | Source : BSEWe wish to inform you that Thirty-Ninth Meeting of the Committee of Creditors is Proposed to be held on Thursday 13 November 2025 at 11.00 AM

Corporate Insolvency Resolution Process (CIRP)-Intimation of meeting of Committee of Creditors

11-Nov-2025 | Source : BSEWe wish to inform you that Thirty-Ninth meeting of Committee of Creditors is Proposed to be held on Thursday 13 November 2025 at 11.00 AM

Corporate Insolvency Resolution Process (CIRP)-Intimation of meeting of Committee of Creditors

29-Aug-2025 | Source : BSEWe wish to inform You Thirty-Eighth Meeting of Commitee of Creditors is Proposed to be held on Friday29th August 2025 at 11 A.M.

Corporate Actions

No Upcoming Board Meetings

Future Enterprises Ltd has declared 10% dividend, ex-date: 21 Aug 17

Future Enterprises Ltd has announced 2:10 stock split, ex-date: 12 Dec 06

Future Enterprises Ltd has announced 1:10 bonus issue, ex-date: 05 Nov 08

Future Enterprises Ltd has announced 5:8 rights issue, ex-date: 18 Nov 14

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Mar 2023

Shareholding Compare (%holding)

Non Institution

61.4359

Held by 1 Schemes (0.0%)

Held by 2 FIIs (0.02%)

Central Departmental Stores Private Limited (*) (10.24%)

Bennett, Coleman And Company Limited (18.44%)

57.54%

Quarterly Results Snapshot (Standalone) - Mar'23 - QoQ

QoQ Growth in quarter ended Mar 2023 is -27.35% vs -54.64% in Dec 2022

QoQ Growth in quarter ended Mar 2023 is -1,418.86% vs 4.21% in Dec 2022

Half Yearly Results Snapshot (Standalone) - Sep'22

Growth in half year ended Sep 2022 is -89.33% vs 336.22% in Sep 2021

Growth in half year ended Sep 2022 is 256.62% vs 0.42% in Sep 2021

Nine Monthly Results Snapshot (Standalone) - Dec'22

YoY Growth in nine months ended Dec 2022 is -91.89% vs 134.55% in Dec 2021

YoY Growth in nine months ended Dec 2022 is 191.36% vs 0.31% in Dec 2021

Annual Results Snapshot (Standalone) - Mar'23

YoY Growth in year ended Mar 2023 is -93.09% vs 70.66% in Mar 2022

YoY Growth in year ended Mar 2023 is 70.84% vs -121.41% in Mar 2022