Dashboard

High Management Efficiency with a high ROCE of 31.42%

Strong ability to service debt as the company has a low Debt to EBITDA ratio of 1.20 times

Healthy long term growth as Net Sales has grown by an annual rate of 15.00% and Operating profit at 19.45%

The company has declared Positive results for the last 6 consecutive quarters

With ROCE of 31.5, it has a Very Attractive valuation with a 2.9 Enterprise value to Capital Employed

Company is among the highest 1% of companies rated by MarketsMojo across all 4,000 stocks

Stock DNA

Non - Ferrous Metals

INR 236,031 Cr (Large Cap)

17.00

23

3.85%

1.57

33.55%

5.83

Total Returns (Price + Dividend)

Latest dividend: 16 per share ex-dividend date: Aug-26-2025

Risk Adjusted Returns v/s

Returns Beta

News

Vedanta Ltd Sees Notable Surge in Open Interest Amidst Market Momentum

Vedanta Ltd, a key player in the Non-Ferrous Metals sector, has experienced a significant rise in open interest in its derivatives segment, reflecting evolving market positioning and investor interest. This development coincides with the stock reaching a new 52-week and all-time high, underscoring a period of sustained momentum despite mixed sector and market performance.

Read More

Vedanta Ltd Sees Notable Surge in Open Interest Amidst Market Momentum

Vedanta Ltd, a key player in the Non-Ferrous Metals sector, has witnessed a significant rise in open interest in its derivatives segment, signalling heightened market activity and evolving investor positioning. This development coincides with the stock reaching a new 52-week high, reflecting a complex interplay of volume dynamics and market sentiment.

Read More

Vedanta Ltd Sees Robust Trading Activity Amidst Sector Gains

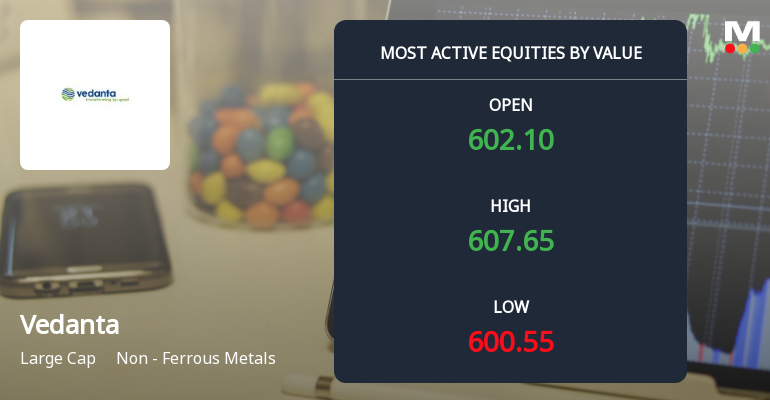

Vedanta Ltd, a prominent player in the Non-Ferrous Metals sector, recorded significant trading volumes and value turnover on 26 December 2025, reflecting sustained investor interest despite a modest underperformance relative to its sector peers. The stock's recent price movements and trading metrics highlight its continued liquidity and market relevance within the large-cap space.

Read More Announcements

Announcement under Regulation 30 (LODR)-Credit Rating

24-Dec-2025 | Source : BSEPlease refer the enclosed file.

Intimation Under Regulation 30 Of The Securities And Exchange Board Of India (Listing Obligations And Disclosure Requirements) Regulations 2015

17-Dec-2025 | Source : BSEPlease refer enclosed file.

Announcement under Regulation 30 (LODR)-Credit Rating

16-Dec-2025 | Source : BSEPlease refer the enclosed file.

Corporate Actions

No Upcoming Board Meetings

Vedanta Ltd. has declared 1600% dividend, ex-date: 26 Aug 25

Vedanta Ltd. has announced 1:10 stock split, ex-date: 08 Aug 08

Vedanta Ltd. has announced 1:1 bonus issue, ex-date: 08 Aug 08

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Promoters

99.9935

Held by 40 Schemes (8.83%)

Held by 710 FIIs (11.08%)

Twin Star Holdings Ltd (40.02%)

Life Insurance Corporation Of India (5.7%)

11.84%

Quarterly Results Snapshot (Consolidated) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is 5.40% vs -6.50% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is -43.55% vs -8.56% in Jun 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 5.85% vs 0.99% in Sep 2024

Growth in half year ended Sep 2025 is -37.38% vs 828.59% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is 3.97% vs -1.06% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 300.87% vs -66.98% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 6.43% vs -2.43% in Mar 2024

YoY Growth in year ended Mar 2025 is 253.57% vs -59.91% in Mar 2024