Dashboard

Strong Long Term Fundamental Strength with a 42.62% CAGR growth in Operating Profits

Healthy long term growth as Operating profit has grown by an annual rate of 42.62%

With a growth in Operating Profit of 95.03%, the company declared Outstanding results in Sep 25

With ROE of 9.9, it has a Very Expensive valuation with a 20.7 Price to Book Value

Increasing Participation by Institutional Investors

Stock DNA

Capital Markets

INR 4,182 Cr (Small Cap)

210.00

23

0.03%

0.02

9.86%

19.57

Total Returns (Price + Dividend)

Latest dividend: 0.1 per share ex-dividend date: Aug-08-2025

Risk Adjusted Returns v/s

Returns Beta

News

Indo Thai Securities Hits Upper Circuit Amid Strong Buying Pressure

Indo Thai Securities Ltd witnessed a significant surge in trading activity on 12 Dec 2025, hitting its upper circuit limit of 5% and closing at ₹368.15. The stock demonstrated robust buying interest despite opening with a gap down, reflecting a notable reversal after six consecutive days of decline.

Read More

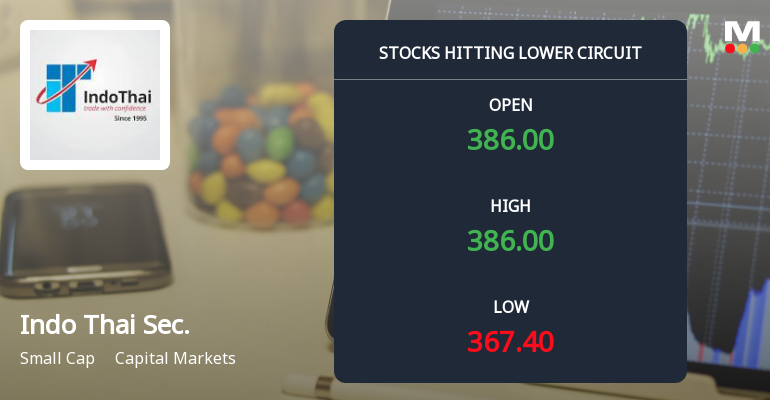

Indo Thai Securities Hits Lower Circuit Amid Heavy Selling Pressure

Indo Thai Securities Ltd witnessed a sharp decline on 9 December 2025, hitting its lower circuit limit as intense selling pressure gripped the stock. The capital markets company recorded a maximum daily loss, reflecting a wave of panic selling and a significant volume of unfilled supply, signalling cautious sentiment among investors.

Read More

Indo Thai Securities: Analytical Perspective Shifts Amid Mixed Technical and Fundamental Signals

Indo Thai Securities has experienced a revision in its market assessment following a detailed review of its quality, valuation, financial trends, and technical indicators. While the company continues to demonstrate robust long-term fundamentals and impressive financial results, recent technical signals and valuation metrics have prompted a more cautious analytical stance.

Read More Announcements

Announcement under Regulation 30 (LODR)-Monitoring Agency Report

14-Nov-2025 | Source : BSEPlease refer the attached document

Board Meeting Outcome for Board Meeting Outcome For Board Meeting Outcome For Indo Thai Securities Limited Has Informed The Exchange Regarding Board Meeting Held On November 14 2025

14-Nov-2025 | Source : BSEPlease refer the attached document.

Announcement under Regulation 30 (LODR)-Allotment

31-Oct-2025 | Source : BSEPlease refer the attached document

Corporate Actions

No Upcoming Board Meetings

Indo Thai Securities Ltd has declared 10% dividend, ex-date: 08 Aug 25

Indo Thai Securities Ltd has announced 1:10 stock split, ex-date: 18 Jul 25

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 2 FIIs (1.17%)

Varsha Doshi (12.13%)

None

34.73%

Quarterly Results Snapshot (Consolidated) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is 68.87% vs 140.00% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is 68.14% vs 432.17% in Jun 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 101.28% vs 21.66% in Sep 2024

Growth in half year ended Sep 2025 is 141.64% vs 27.99% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is -1.62% vs 75.68% in Dec 2023

YoY Growth in nine months ended Dec 2024 is -18.46% vs 2,234.55% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is -15.82% vs 313.76% in Mar 2024

YoY Growth in year ended Mar 2025 is -48.47% vs 315.63% in Mar 2024