Dashboard

Flat results in Sep 25

- CASH AND CASH EQUIVALENTS(HY) Lowest at Rs 34.22 cr

- DEBTORS TURNOVER RATIO(HY) Lowest at 11.70 times

- PAT(Q) At Rs 90.05 cr has Fallen at -5.0%

With ROE of 23.5, it has a Expensive valuation with a 6.4 Price to Book Value

Falling Participation by Institutional Investors

Underperformed the market in the last 1 year

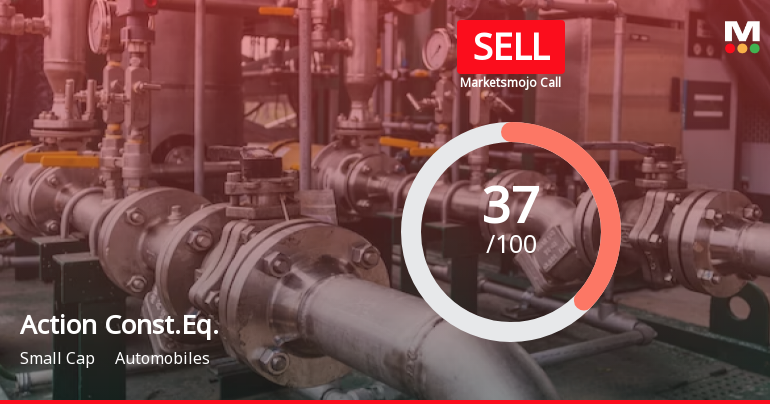

Stock DNA

Automobiles

INR 11,372 Cr (Small Cap)

27.00

33

0.21%

-0.20

23.45%

6.43

Total Returns (Price + Dividend)

Latest dividend: 2 per share ex-dividend date: Aug-14-2025

Risk Adjusted Returns v/s

Returns Beta

News

Action Construction Equipment Faces Bearish Momentum Amid Technical Shifts

Action Construction Equipment’s stock price has exhibited a notable shift in momentum, reflecting a transition towards a bearish technical outlook. Recent market data and technical indicators suggest a cautious stance for investors as the stock navigates through a challenging phase within the automobile sector.

Read More

Action Const.Eq. Sees Revision in Market Evaluation Amid Mixed Financial Signals

Action Const.Eq., a small-cap player in the automobile sector, has experienced a revision in its market evaluation reflecting nuanced shifts across key financial and technical parameters. This adjustment comes amid a backdrop of subdued stock performance and evolving investor sentiment.

Read More

Action Construction Equipment Technical Momentum Shifts Amid Mixed Market Signals

Action Construction Equipment has experienced a nuanced shift in its technical momentum, reflecting a complex interplay of bearish and bullish indicators across multiple timeframes. The stock’s recent price movements and technical signals suggest a cautious market stance amid broader sector dynamics.

Read More Announcements

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

17-Dec-2025 | Source : BSESchedule of Analyst/Investor meet is attached herewith.

Announcement under Regulation 30 (LODR)-Press Release / Media Release

11-Dec-2025 | Source : BSEACE & Sanghvi Movers Limited Sign Strategic MOU of Indigenously Manufactured Heavy Cranes.

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

21-Nov-2025 | Source : BSESchedule of Analyst/Investor are attached herewith.

Corporate Actions

No Upcoming Board Meetings

Action Construction Equipment Ltd has declared 100% dividend, ex-date: 14 Aug 25

Action Construction Equipment Ltd has announced 2:10 stock split, ex-date: 13 Mar 08

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Promoters

None

Held by 17 Schemes (0.5%)

Held by 138 FIIs (10.37%)

Vijay Agarwal (28.76%)

Polar Capital Funds Plc-emerging Market Star Fund (2.08%)

18.2%

Quarterly Results Snapshot (Consolidated) - Sep'25 - YoY

YoY Growth in quarter ended Sep 2025 is -1.65% vs 12.40% in Sep 2024

YoY Growth in quarter ended Sep 2025 is -5.01% vs 28.25% in Sep 2024

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is -6.35% vs 12.54% in Sep 2024

Growth in half year ended Sep 2025 is 4.91% vs 26.51% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is 13.86% vs 34.42% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 26.53% vs 85.33% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 14.18% vs 34.92% in Mar 2024

YoY Growth in year ended Mar 2025 is 24.70% vs 91.22% in Mar 2024