Total Returns (Price + Dividend)

SC Agrotech for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

SC Agrotech Ltd is Rated Sell

SC Agrotech Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 08 Dec 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 26 December 2025, providing investors with the most up-to-date insight into the company’s performance and outlook.

Read More

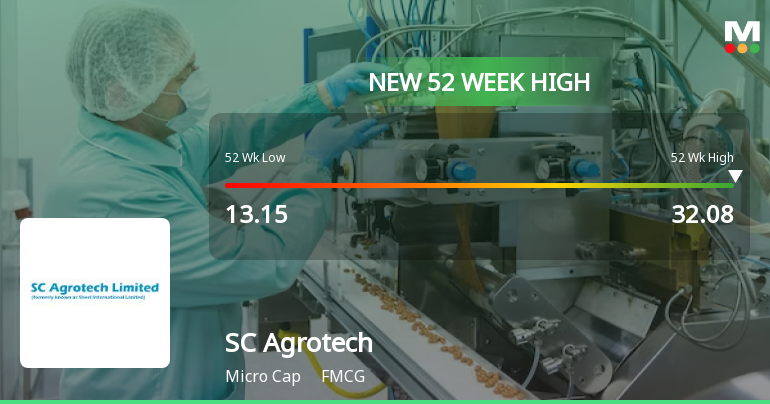

SC Agrotech Hits New 52-Week High of Rs.32.08, Marking Significant Rally

SC Agrotech, a key player in the FMCG sector, reached a new 52-week and all-time high of Rs.32.08 today, reflecting a sustained upward momentum that has captured market attention. The stock's performance over the past 15 trading sessions has been notably strong, with a cumulative return exceeding 106%, underscoring a remarkable rally in a challenging market environment.

Read More

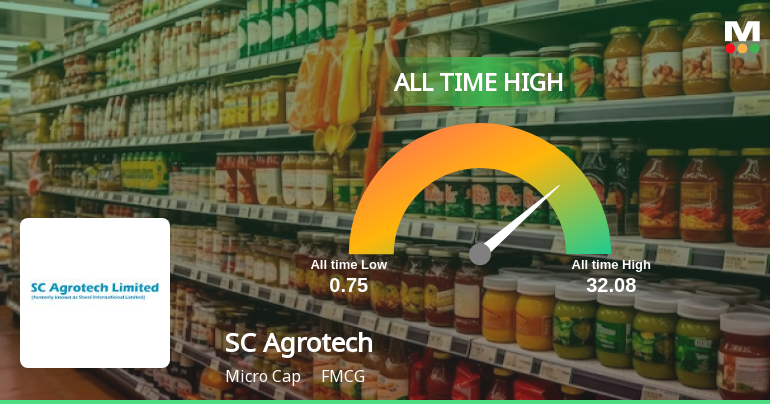

SC Agrotech Hits All-Time High at Rs.32.08, Marking a Significant Milestone

SC Agrotech, a prominent player in the FMCG sector, reached a new all-time high of Rs.32.08 today, reflecting a remarkable phase of sustained growth and market performance. This milestone underscores the company’s notable journey over recent months and years, highlighted by consistent gains and strong comparative returns against benchmark indices.

Read More Announcements

Announcement under Regulation 30 (LODR)-Allotment

03-Dec-2025 | Source : BSEAllotment of 70000000 Fully Convertible Equity warrants to allottees on December 03 2025

Board Meeting Outcome for Outcome Of The Board Meeting Held Today I.E. December 03 2025 For Allotment Of Warrants

03-Dec-2025 | Source : BSEAllotment of 70000000 (Seven Crore) Fully Convertible Equity Warrants convertible into Equity Shares to 19 allottees.

Announcement Under Regulation 30 (LODR) Regulations - Compliance With The BSE Notice 20221213-47 Dated 13/12/2022

26-Nov-2025 | Source : BSEAnnouncement under Regulation 30 (LODR) Regulation- Compliance with the BSE notice 20221213-47 dated 13/12/2022

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Non Institution

None

Held by 0 Schemes

Held by 0 FIIs

None

Jivaib Trading Private Limited (20.33%)

68.97%

Quarterly Results Snapshot (Standalone) - Sep'25 - YoY

YoY Growth in quarter ended Sep 2025 is 0.00% vs -100.00% in Sep 2024

YoY Growth in quarter ended Sep 2025 is 210.53% vs -2,000.00% in Sep 2024

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is 0.00% vs -100.00% in Sep 2024

Growth in half year ended Sep 2025 is 2,200.00% vs -66.67% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'24

YoY Growth in nine months ended Dec 2024 is -100.00% vs -22.22% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 578.57% vs -92.05% in Dec 2023

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is 263.24% vs 655.56% in Mar 2024

YoY Growth in year ended Mar 2025 is -20.83% vs -87.94% in Mar 2024