Dashboard

With a Operating Losses, the company has a Weak Long Term Fundamental Strength

- High Debt Company with a Debt to Equity ratio (avg) at 5.03 times

- The company has been able to generate a Return on Capital Employed (avg) of 0.69% signifying low profitability per unit of total capital (equity and debt)

With ROE of 10.3, it has a Very Expensive valuation with a 3.7 Price to Book Value

Falling Participation by Institutional Investors

Stock DNA

Telecom - Equipment & Accessories

INR 264 Cr (Micro Cap)

36.00

16

0.00%

-0.07

10.32%

3.80

Total Returns (Price + Dividend)

Latest dividend: 1.5 per share ex-dividend date: Sep-18-2012

Risk Adjusted Returns v/s

Returns Beta

News

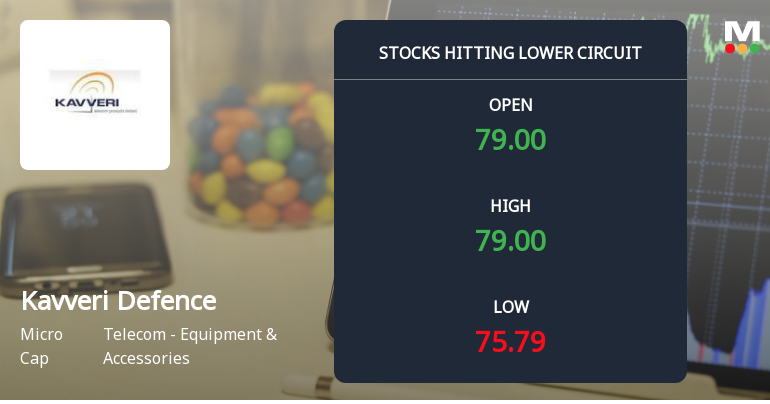

Kavveri Defence & Wireless Technologies Hits Lower Circuit Amid Heavy Selling Pressure

Shares of Kavveri Defence & Wireless Technologies Ltd faced intense selling pressure on 26 Dec 2025, hitting the lower circuit limit and closing near the day’s low. The stock recorded a maximum daily loss of 4.99%, underperforming its sector and broader market indices, as panic selling and unfilled supply weighed heavily on investor sentiment.

Read More

Kavveri Defence & Wireless Technologies Ltd is Rated Sell

Kavveri Defence & Wireless Technologies Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 18 Nov 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 25 December 2025, providing investors with an up-to-date view of the company’s fundamentals, valuation, financial trends, and technical outlook.

Read More

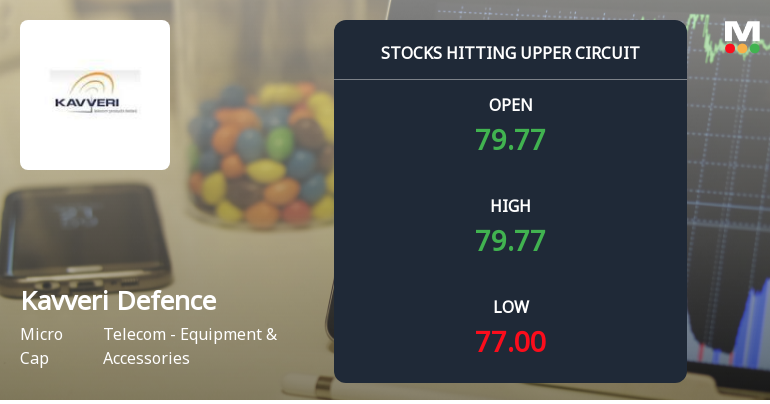

Kavveri Defence & Wireless Technologies Hits Upper Circuit Amid Strong Buying Pressure

Kavveri Defence & Wireless Technologies Ltd witnessed robust buying interest on 24 Dec 2025, hitting its upper circuit limit with a maximum daily gain of 4.99%. The stock outperformed its sector and the broader market, reflecting heightened investor enthusiasm and significant unfilled demand, leading to a regulatory freeze on further trading at the price band ceiling.

Read More Announcements

Kavveri Defence & Wireless Technologies Limited Has Informed The Exchange About General Updates.

04-Dec-2025 | Source : BSEKavveri Defence & Wireless Technologies Limited has informed the Exchange about General Updates.

Appointment of Company Secretary and Compliance Officer

29-Nov-2025 | Source : BSEAppointment of Company Secretary and Compliance Officer of the company.

Board Meeting Outcome for Outcome Of Board Meeting

29-Nov-2025 | Source : BSEMs. Renu Choudhary (Membership No. A60863) has been appointed as the Company Secretary and Compliance Officer of the Company with effect from 29th November 2025

Corporate Actions

No Upcoming Board Meetings

Kavveri Defence & Wireless Technologies Ltd has declared 15% dividend, ex-date: 18 Sep 12

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Non Institution

14.1618

Held by 0 Schemes

Held by 4 FIIs (4.71%)

C Sanketh Ram Reddy (6.55%)

Amrutlal G Thobhani (5.82%)

66.61%

Quarterly Results Snapshot (Consolidated) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is -46.29% vs -52.32% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is -56.48% vs -70.73% in Jun 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 213.02% vs 131.33% in Sep 2024

Growth in half year ended Sep 2025 is 203.92% vs 183.61% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is 468.79% vs -51.69% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 398.90% vs 40.91% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 976.73% vs -57.26% in Mar 2024

YoY Growth in year ended Mar 2025 is 578.36% vs -104.26% in Mar 2024