Dashboard

With HIgh Debt (Debt-Equity Ratio at 10.74 times)- the company has a Weak Long Term Fundamental Strength

- Poor long term growth as Net Sales has grown by an annual rate of -2.05% and Operating profit at -219.75% over the last 5 years

- High Debt Company with a Debt to Equity ratio (avg) at 3.75 times

Risky - Negative EBITDA

Despite the size of the company, domestic mutual funds hold only 0% of the company

Stock DNA

Aerospace & Defense

INR 7,316 Cr (Small Cap)

NA (Loss Making)

194

0.00%

10.74

-52.01%

30.44

Total Returns (Price + Dividend)

Swan Defence for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

Swan Defence and Heavy Industries Sees Shift in Price Momentum Amid Technical Indicator Changes

Swan Defence and Heavy Industries has experienced a notable shift in its price momentum, reflecting changes in key technical indicators that suggest evolving market dynamics for the aerospace and defence company. Recent data points to a transition from a mildly bullish trend to a more pronounced bullish stance, supported by mixed signals across weekly and monthly technical parameters.

Read More

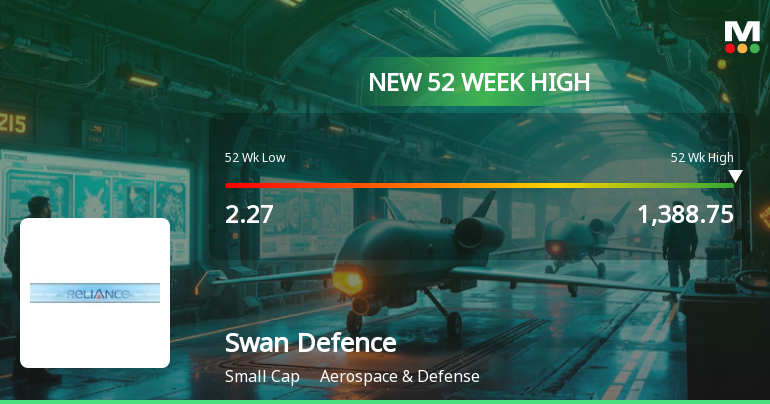

Swan Defence and Heavy Industries Hits New 52-Week High at Rs.1388.75

Swan Defence and Heavy Industries has reached a significant milestone by touching a new 52-week and all-time high of Rs.1388.75, marking a notable moment in the Aerospace & Defense sector. This achievement reflects the stock’s strong momentum amid a broadly positive market environment.

Read More

Swan Defence and Heavy Industries Stock Hits All-Time High at Rs.1388.75

Swan Defence and Heavy Industries, a key player in the Aerospace & Defense sector, reached a new all-time high of Rs.1388.75 today, marking a significant milestone in its market journey. The stock demonstrated robust performance across multiple time frames, outpacing sector and benchmark indices with notable gains.

Read More Announcements

Closure of Trading Window

24-Dec-2025 | Source : BSEIntimation for closure of Trading Window

Availing Of Financial Assistance.

17-Dec-2025 | Source : BSEAvailing of financial assistance upto Rs. 800 Crores (Rupees Eight Hundred Crores Only) from Hazel Infra Limited Holding Company.

Board Meeting Outcome for Outcome Of Board Meeting Held On December 17 2025.

17-Dec-2025 | Source : BSEOutcome of Board Meeting held on December 17 2025.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 6 FIIs (0.02%)

Hazel Infra Limited (94.91%)

Vistra Itcl India Limited (1%)

3.2%

Quarterly Results Snapshot (Standalone) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is 9,321.43% vs -91.45% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is 34.81% vs -36.17% in Jun 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Not Applicable: The company has declared_date for only one period

Not Applicable: The company has declared_date for only one period

Nine Monthly Results Snapshot (Consolidated) - Dec'24

Not Applicable: The company has declared_date for only one period

Not Applicable: The company has declared_date for only one period

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 0.00% vs -100.00% in Mar 2024

YoY Growth in year ended Mar 2025 is -49.18% vs 94.18% in Mar 2024